- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRVG

High Growth Tech Stocks To Watch In The US May 2025

Reviewed by Simply Wall St

The U.S. stock market is experiencing a notable upswing, with the S&P 500 on track for its longest winning streak since 2004, buoyed by strong employment data and potential trade talks between the U.S. and China. In this environment of optimism and recovery, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience in volatile conditions, adaptability to policy changes, and robust financial health amidst evolving economic landscapes.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.35% | 34.10% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.69% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.29% | 67.39% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alkami Technology | 20.59% | 90.79% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Ascendis Pharma | 32.75% | 59.64% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Mirum Pharmaceuticals (NasdaqGM:MIRM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mirum Pharmaceuticals, Inc. is a biopharmaceutical company dedicated to developing and commercializing novel therapies for debilitating rare and orphan diseases, with a market cap of $2.15 billion.

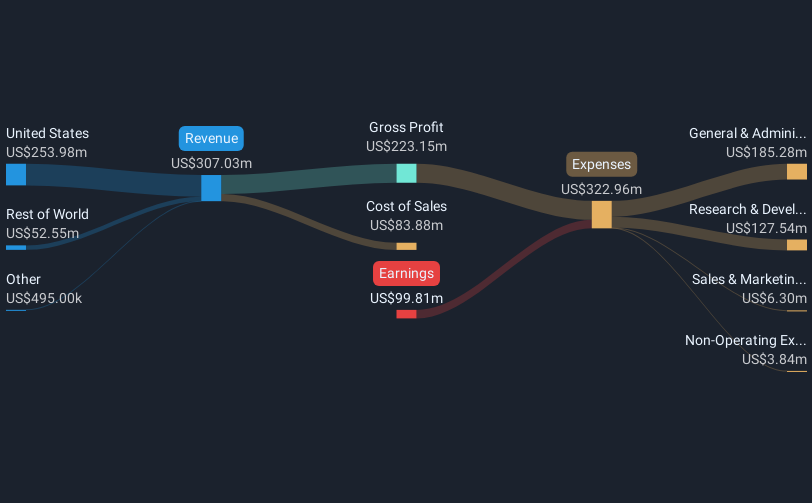

Operations: Mirum Pharmaceuticals focuses on developing and commercializing therapies for rare and orphan diseases, generating revenue of $336.89 million from its pharmaceuticals segment.

Mirum Pharmaceuticals, a key player in the biotech industry, is navigating its path toward profitability with significant advancements and strategic presentations. Recently, the company announced its participation in the EASL Symposium to present promising data from its VANTAGE study on May 9, 2025. This follows a robust year where Mirum reported a notable revenue increase to $336.89 million, up from $186.37 million the previous year, reflecting an annualized growth rate of 20.9%. Despite current unprofitability with a net loss reduction to $87.94 million from $163.42 million last year, these developments are pivotal as Mirum aims for profitability within three years amidst high expectations of earnings growth at an annual rate of 61.75%. This trajectory is supported by recent FDA approvals and continuous R&D efforts that underscore its commitment to addressing rare diseases through innovative treatments.

BioCryst Pharmaceuticals (NasdaqGS:BCRX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BioCryst Pharmaceuticals, Inc. is a biotechnology company focused on developing oral small-molecule and injectable protein therapeutics for rare diseases, with a market cap of $1.85 billion.

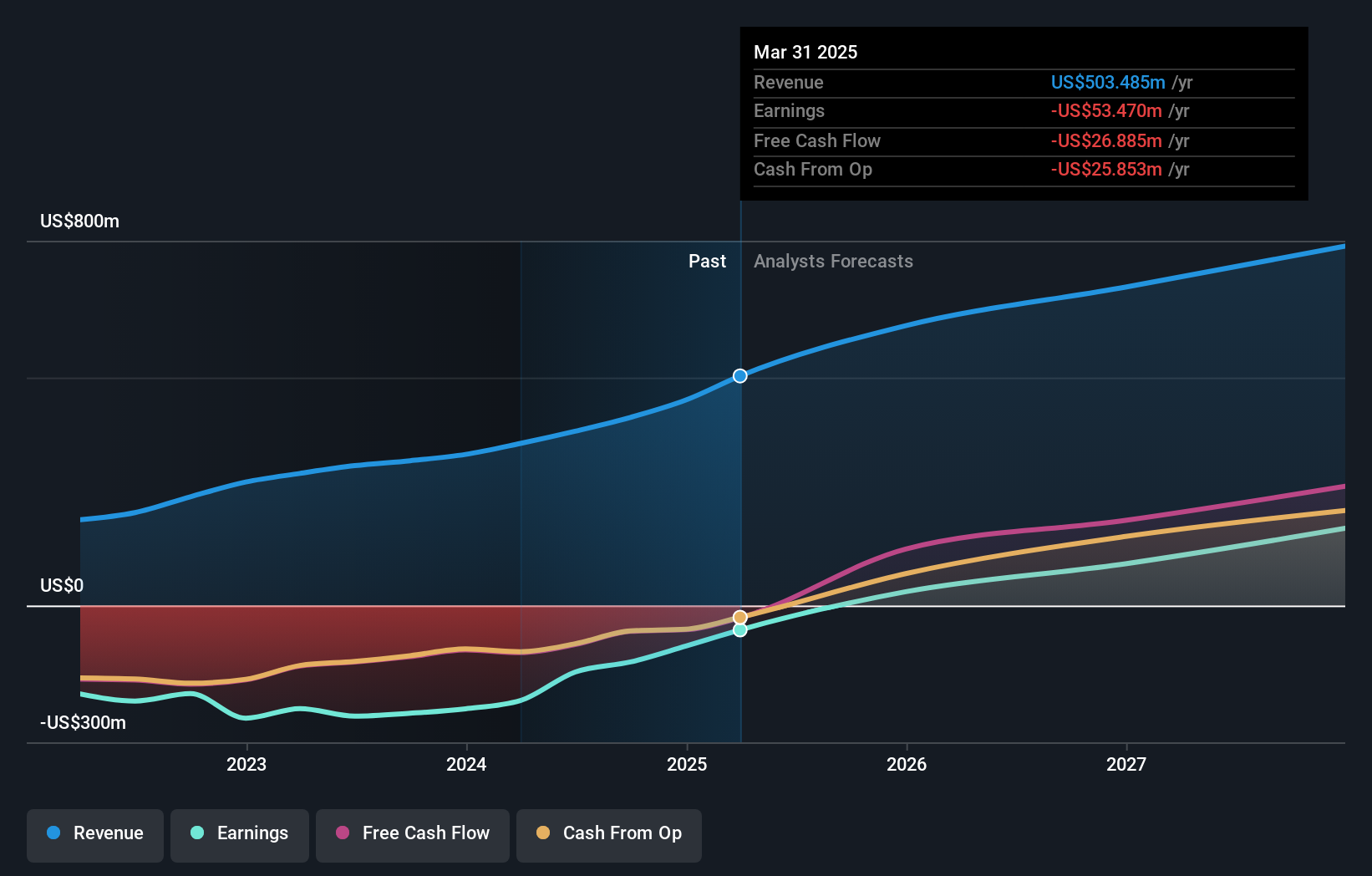

Operations: BioCryst focuses on developing therapeutics for rare diseases, generating revenue primarily from its biotechnology segment, which reported $450.71 million. The company operates within the biotechnology sector and targets niche markets with its specialized products.

BioCryst Pharmaceuticals, amid a transformative phase, is steering towards profitability with an expected annual profit growth of 56.3%, outpacing the industry average. The company's R&D commitment is evident from its expenditure trends, which are integral to its strategy in developing treatments for rare diseases—a sector marked by high entry barriers and significant patient need. Recent leadership enhancements, including the appointment of a seasoned investment banker to its board, align with BioCryst's aim to fortify its financial and strategic acumen as it anticipates revenue growth of 13.4% annually. This trajectory is supported by increased revenue guidance for 2025, projecting sales between $560 million and $575 million due to robust performance of their flagship product ORLADEYO® in clinical trials.

trivago (NasdaqGS:TRVG)

Simply Wall St Growth Rating: ★★★★☆☆

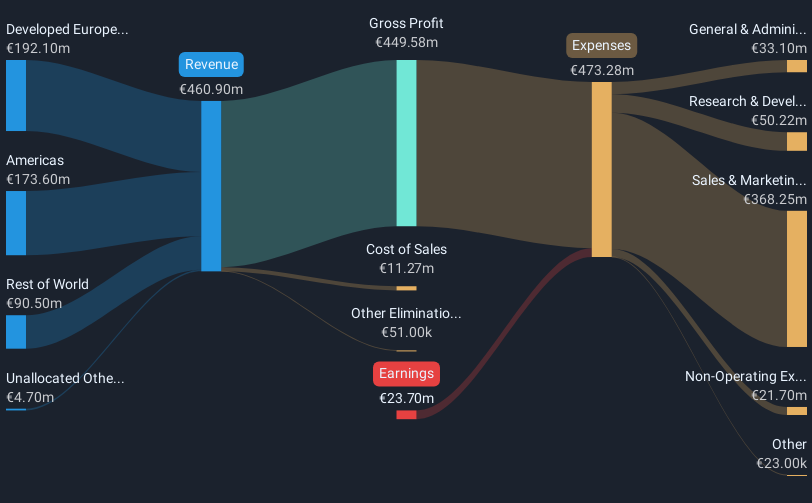

Overview: trivago N.V. operates a hotel and accommodation search platform across various international markets, with a market cap of approximately $292.77 million.

Operations: The company generates revenue primarily through advertising services on its hotel and accommodation search platform, leveraging a cost-per-click model. Operating in key markets like the United States, Germany, and the United Kingdom, it focuses on connecting users with online travel agencies and hotel chains. The business has shown variability in its net profit margin over recent periods.

Trivago N.V. is navigating a transformative landscape with a recent uptick in revenue, marking a 9.3% annual growth, surpassing the U.S. market average of 8.3%. This surge is underscored by their Q1 2025 earnings where sales rose to EUR 124.11 million from EUR 101.43 million year-over-year, despite a net loss reduction to EUR 7.8 million from EUR 8.38 million previously reported in the same period last year. The appointment of Dr. Wolf Schmuhl as CFO hints at strategic shifts aimed at reinforcing governance and financial oversight amidst these challenging yet promising times for the company, which has historically struggled with profitability but is now on a path forecasted to achieve profit growth of approximately 70.8% annually over the next three years.

- Take a closer look at trivago's potential here in our health report.

Examine trivago's past performance report to understand how it has performed in the past.

Make It Happen

- Embark on your investment journey to our 236 US High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade trivago, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRVG

trivago

Operates a hotel and accommodation search platform in the United States, Germany, the United Kingdom, Canada, Japan, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives