- United States

- /

- Biotech

- /

- NasdaqGS:EXEL

Exploring 3 High Growth Tech Stocks in the US Market

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn led by declines in tech shares, with major indices like the Nasdaq and S&P 500 retreating from recent highs, investors are paying close attention to Federal Reserve Chair Jerome Powell's remarks on interest rates and economic stability. In this context, identifying high-growth tech stocks involves evaluating companies that demonstrate resilience and potential for innovation amidst fluctuating market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.94% | 26.66% | ★★★★★☆ |

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.11% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Workday | 11.29% | 31.90% | ★★★★★☆ |

| Circle Internet Group | 28.59% | 82.71% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Exelixis (EXEL)

Simply Wall St Growth Rating: ★★★★☆☆

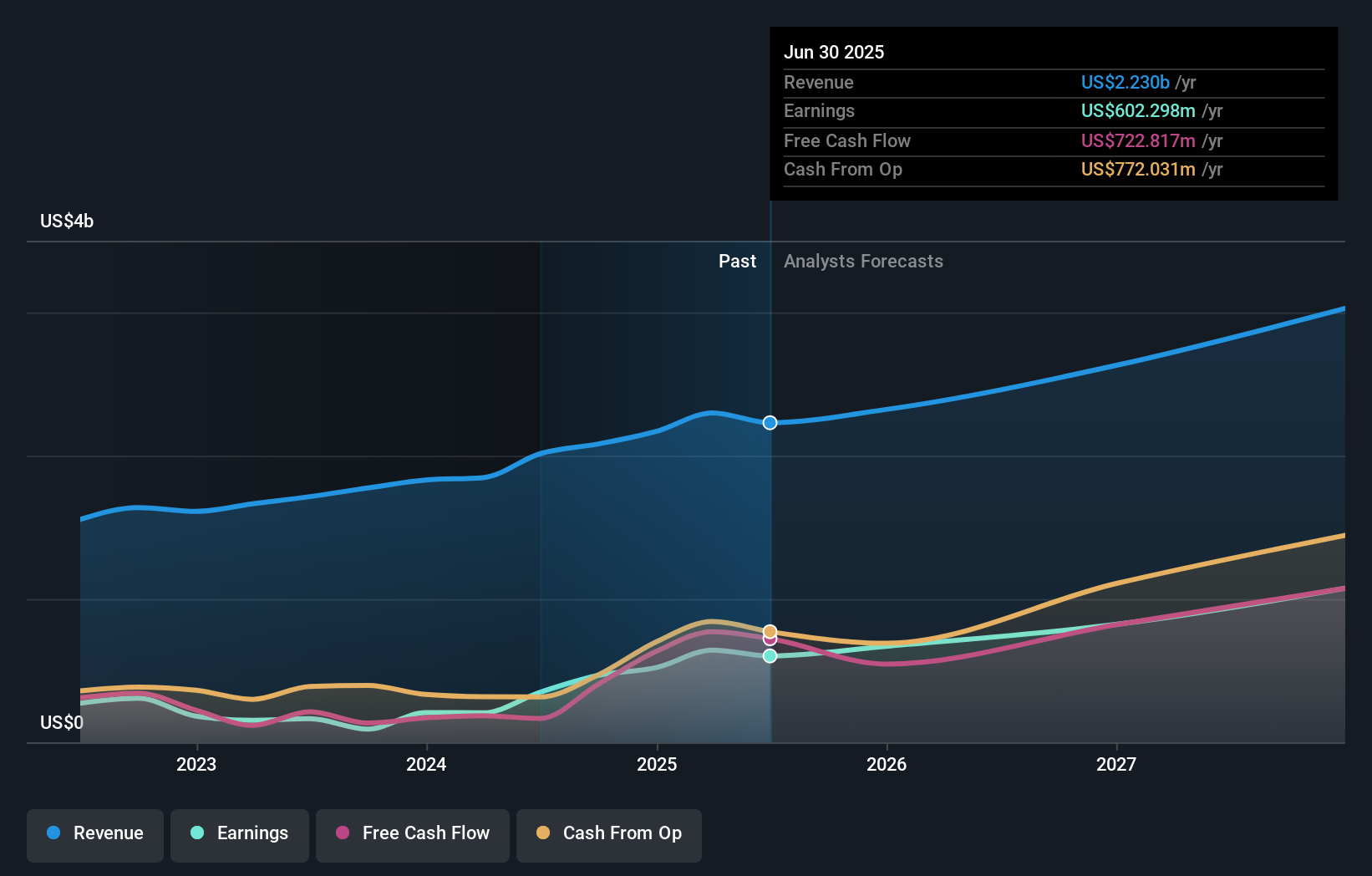

Overview: Exelixis, Inc. is an oncology-focused company dedicated to discovering, developing, and commercializing new medicines for challenging-to-treat cancers in the United States, with a market cap of approximately $10.66 billion.

Operations: Exelixis generates revenue primarily from its biotechnology segment, amounting to $2.23 billion. The company is engaged in the discovery, development, and commercialization of oncology medicines targeting difficult-to-treat cancers in the U.S.

Exelixis, with its recent amendment to the collaboration agreement with Adagene, is leveraging innovative SAFEbody technology for developing new cancer treatments, highlighting its commitment to advancing oncology care. This strategic move aligns with Exelixis's robust R&D focus, as evidenced by the appointment of Dana T. Aftab as EVP of R&D, ensuring continued innovation in drug discovery and development. Financially, Exelixis has demonstrated significant growth with a 72.1% increase in earnings over the past year outpacing the industry's 65.2%, and forecasts suggest a strong future with expected annual earnings growth of 19.9% and revenue growth surpassing the US market average at 10.6%. These developments underscore Exelixis’s potential in a competitive biotech landscape while enhancing its capabilities to meet evolving healthcare challenges.

- Delve into the full analysis health report here for a deeper understanding of Exelixis.

Assess Exelixis' past performance with our detailed historical performance reports.

trivago (TRVG)

Simply Wall St Growth Rating: ★★★★☆☆

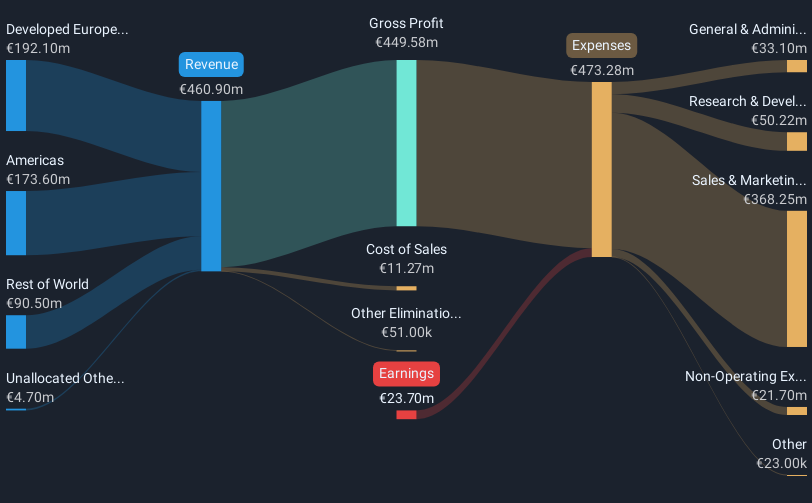

Overview: trivago N.V. operates a hotel and accommodation search platform across various international markets, including the United States, Germany, and Japan, with a market cap of $251.54 million.

Operations: The company generates revenue primarily from its hotel and accommodation search platform, with significant contributions from Developed Europe (€209.72 million) and the Americas (€185.37 million). The Rest of World segment adds €105.61 million to the total revenue stream.

Despite its current unprofitability, trivago is making strides in the competitive online travel and media industry. With a revenue growth forecast of 10.1% annually, it outpaces the U.S. market prediction of 9.7%. The company's commitment to innovation and market expansion was evident at the recent TestMu Conference, where new automation technologies were showcased. Additionally, trivago's forward-looking guidance anticipates profitability within three years, supported by consistent double-digit revenue growth as confirmed in their latest earnings guidance for 2025. This trajectory suggests a robust potential for turnaround despite a challenging past performance marked by net losses in recent quarters.

- Take a closer look at trivago's potential here in our health report.

Gain insights into trivago's historical performance by reviewing our past performance report.

Phreesia (PHR)

Simply Wall St Growth Rating: ★★★★☆☆

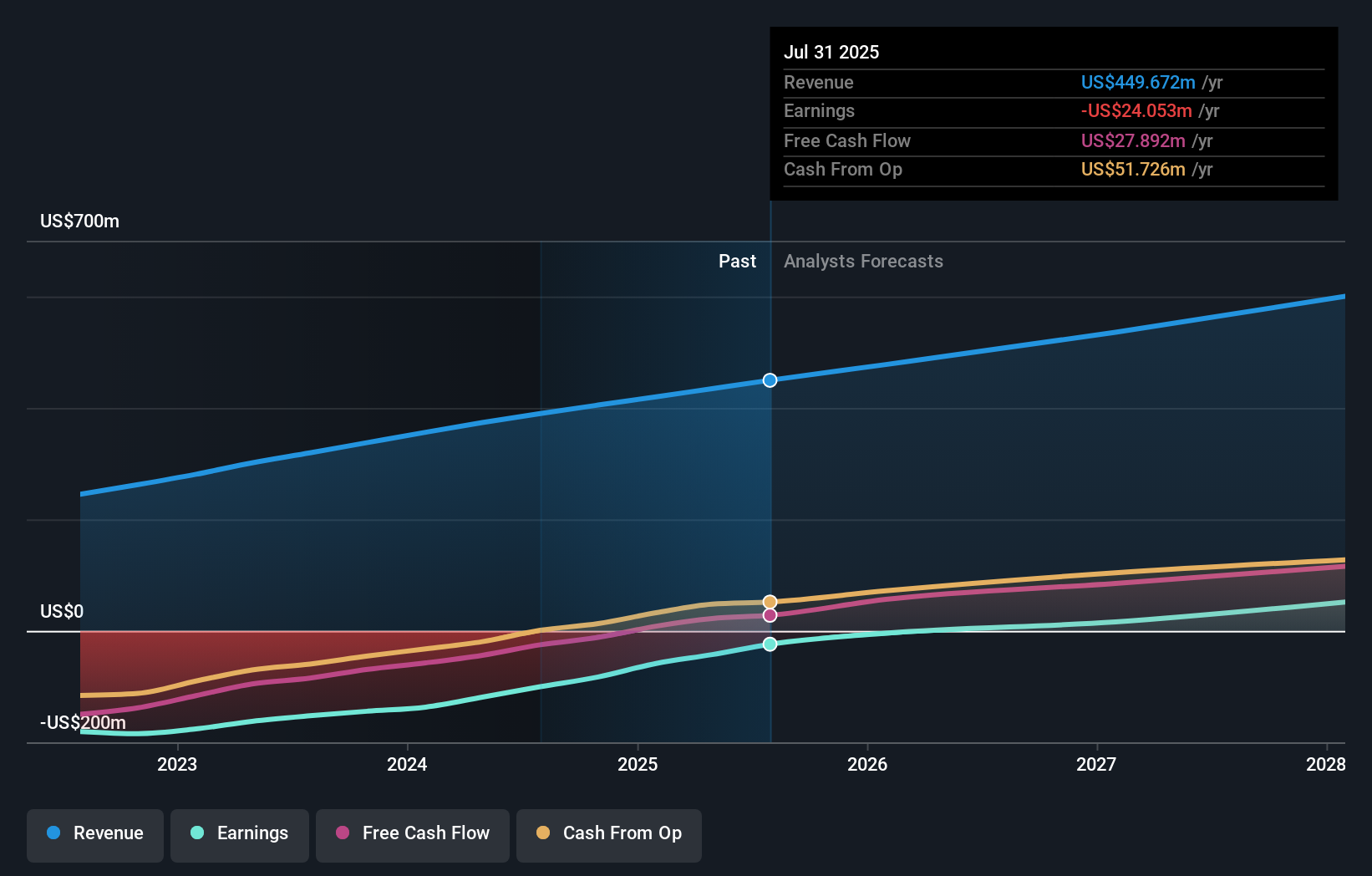

Overview: Phreesia, Inc. offers an integrated SaaS-based software and payment platform tailored for the healthcare industry across the United States and Canada, with a market capitalization of $1.48 billion.

Operations: The company's revenue primarily stems from its Technology Solutions segment, generating $449.67 million.

Phreesia's recent pivot towards profitability is underscored by a substantial increase in Q2 revenue to $117.26 million, up from $102.12 million year-over-year, complemented by a swing to net income of $0.654 million from a significant loss previously. This performance is bolstered by an innovative launch, Phreesia VoiceAI, enhancing patient interaction through AI-driven natural language processing—showcasing the company's commitment to integrating cutting-edge technology in healthcare services. Moreover, the collaboration with Sesame Workshop leverages iconic characters for patient education at check-ins, potentially increasing engagement and promoting preventive care—a strategic move that could enhance long-term user retention and brand loyalty within their digital intake platform.

- Get an in-depth perspective on Phreesia's performance by reading our health report here.

Review our historical performance report to gain insights into Phreesia's's past performance.

Key Takeaways

- Click through to start exploring the rest of the 64 US High Growth Tech and AI Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXEL

Exelixis

An oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026