- United States

- /

- Media

- /

- NasdaqCM:THRY

Revenues Not Telling The Story For Thryv Holdings, Inc. (NASDAQ:THRY)

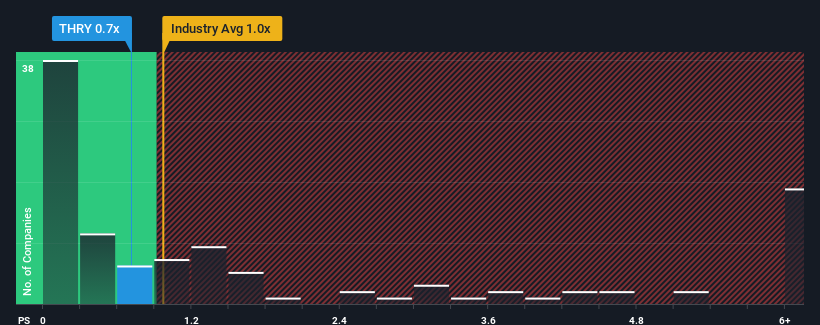

It's not a stretch to say that Thryv Holdings, Inc.'s (NASDAQ:THRY) price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" for companies in the Media industry in the United States, where the median P/S ratio is around 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Thryv Holdings

How Thryv Holdings Has Been Performing

Thryv Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Thryv Holdings will help you uncover what's on the horizon.How Is Thryv Holdings' Revenue Growth Trending?

Thryv Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. The last three years don't look nice either as the company has shrunk revenue by 17% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 11% as estimated by the five analysts watching the company. With the industry predicted to deliver 4.8% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Thryv Holdings' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Thryv Holdings' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While Thryv Holdings' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you take the next step, you should know about the 1 warning sign for Thryv Holdings that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Thryv Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:THRY

Thryv Holdings

Provides digital marketing solutions and cloud-based tools to the small-to-medium sized businesses in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives