- United States

- /

- Biotech

- /

- NasdaqCM:RCEL

Top High Growth Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

The market is up 1.6% over the last week, with the Information Technology sector up 4.2%. In the last year, the market has climbed 22%, and earnings are forecast to grow by 15% annually. In this thriving environment, identifying high-growth tech stocks that align with these optimistic trends can be crucial for investors looking to capitalize on future opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.49% | 27.13% | ★★★★★★ |

| Sarepta Therapeutics | 24.13% | 44.72% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.44% | 65.92% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.81% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 251 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

AVITA Medical (NasdaqCM:RCEL)

Simply Wall St Growth Rating: ★★★★★☆

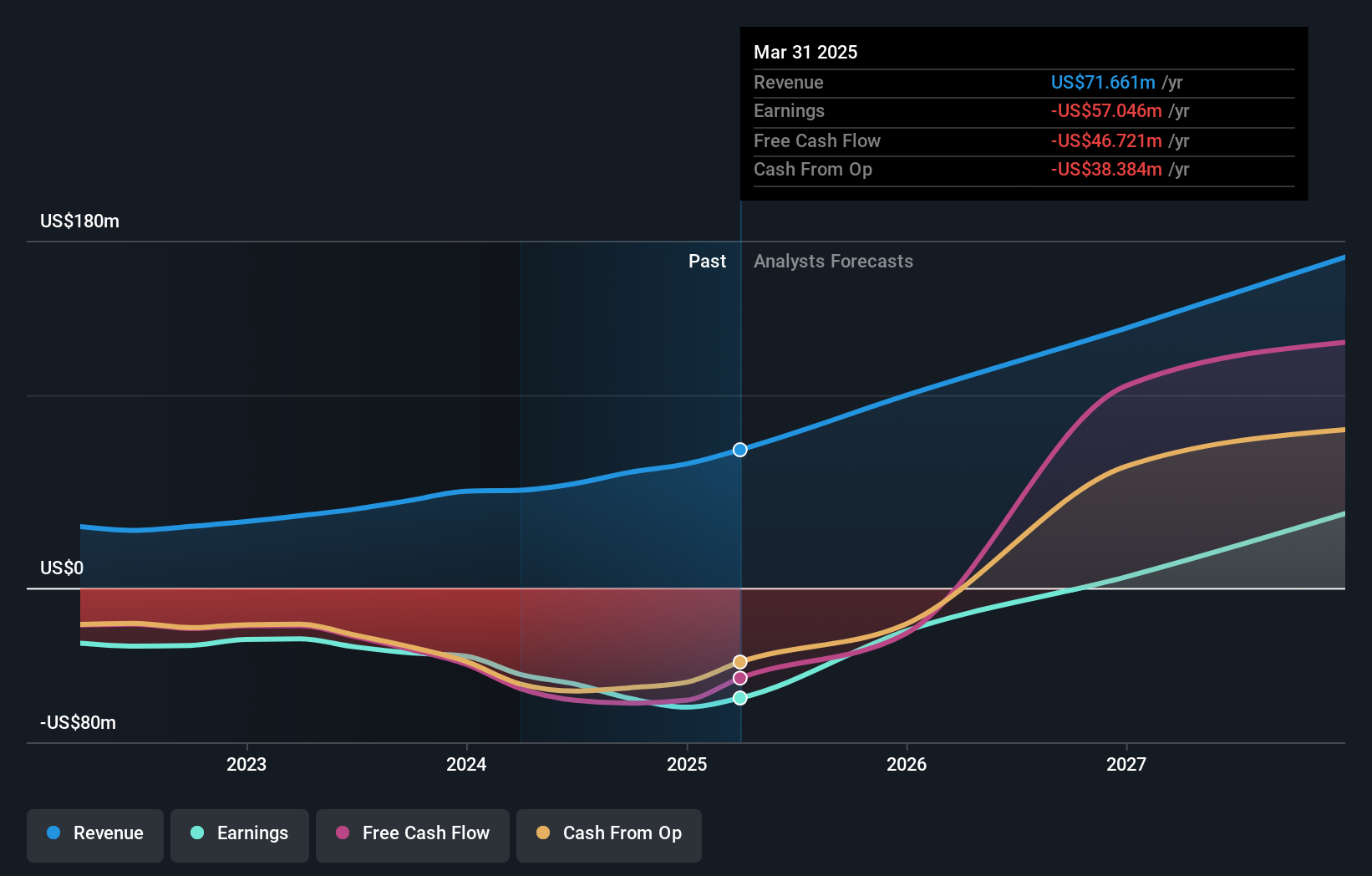

Overview: AVITA Medical, Inc., along with its subsidiaries, operates as a regenerative medicine company in the United States and internationally, with a market cap of $250.89 million.

Operations: The company generates revenue primarily through the sale of Recell Devices, amounting to $54.14 million. Operating in the regenerative medicine sector, it focuses on innovative medical solutions across various markets.

AVITA Medical's recent developments highlight its dynamic growth potential in the tech and healthcare sectors. The company reported a 29.79% increase in second-quarter revenue to $15.2 million, despite a net loss of $15.39 million, reflecting significant investment in R&D and market expansion efforts. With an expected annual revenue growth rate of 26.7%, AVITA is poised for substantial advancement, further bolstered by their exclusive partnership with Regenity Biosciences to develop innovative regenerative products.

- Take a closer look at AVITA Medical's potential here in our health report.

Evaluate AVITA Medical's historical performance by accessing our past performance report.

Verra Mobility (NasdaqCM:VRRM)

Simply Wall St Growth Rating: ★★★★☆☆

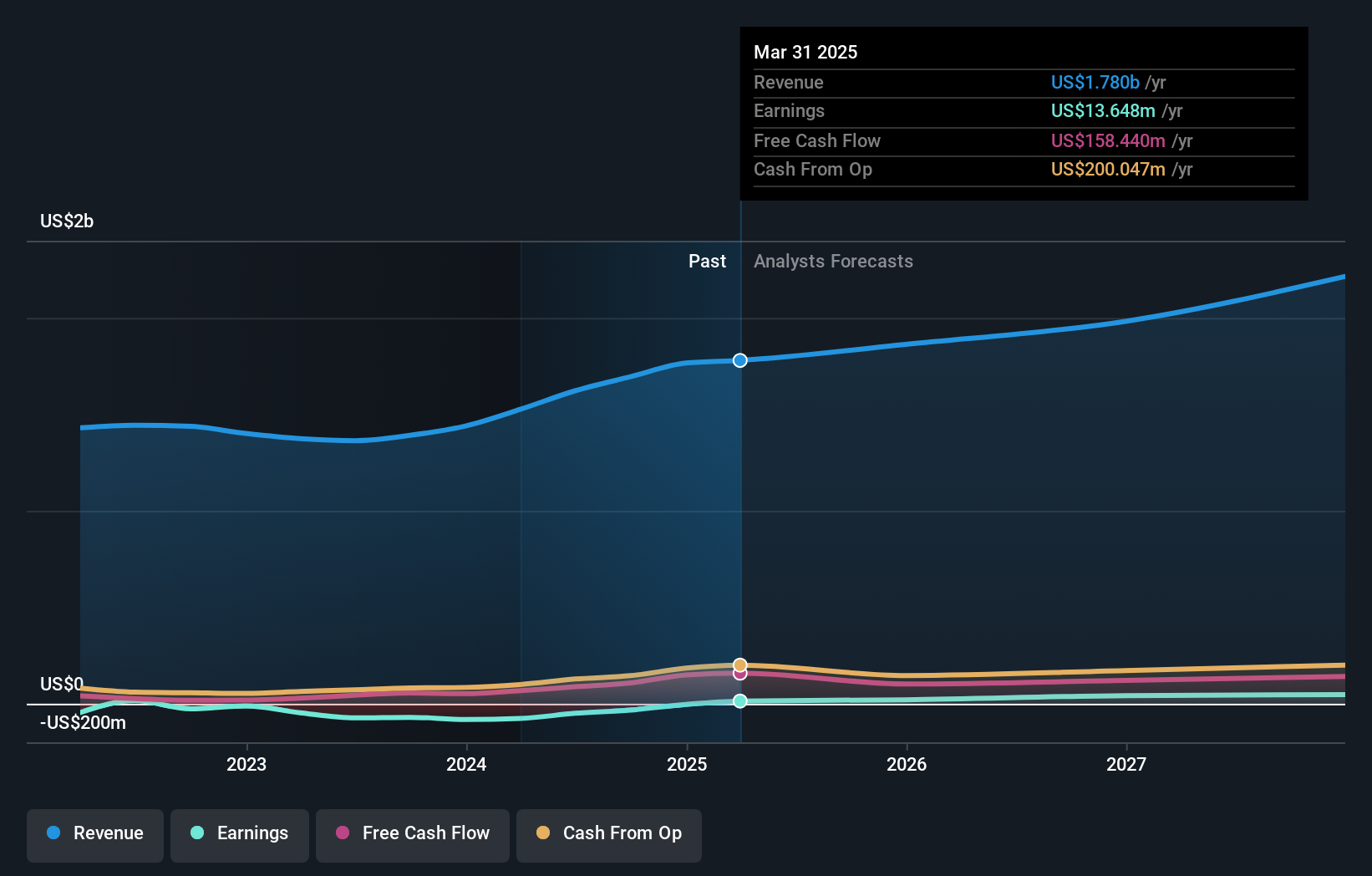

Overview: Verra Mobility Corporation offers smart mobility technology solutions and services across the United States, Australia, Canada, and Europe, with a market cap of $4.45 billion.

Operations: Verra Mobility generates revenue primarily from three segments: Parking Solutions ($84.39 million), Commercial Services ($392.57 million), and Government Solutions ($376.14 million). The company's offerings span multiple regions, including the United States, Australia, Canada, and Europe.

Verra Mobility's recent earnings reveal a robust performance, with Q2 revenue rising to $222.43 million from $204.46 million last year and net income jumping to $34.22 million, reflecting a 26.3% growth in earnings over the past year. The company has invested significantly in R&D, spending approximately 7.4% of its revenue on innovation and technology advancements to enhance fleet management services for major clients globally. Additionally, Verra Mobility repurchased 2 million shares for $51.5 million this quarter, indicating strong confidence in its financial health and future prospects within the tech sector.

- Get an in-depth perspective on Verra Mobility's performance by reading our health report here.

Gain insights into Verra Mobility's historical performance by reviewing our past performance report.

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across Israel, the United States, the United Kingdom, Germany, and internationally, with a market cap of $1.08 billion.

Operations: Taboola.com Ltd. generates revenue primarily through its advertising segment, which brought in $1.62 billion. The company leverages an artificial intelligence-based algorithmic engine to drive its platform operations across multiple international markets.

Taboola's recent innovations, such as the AI-powered Maximize Conversions, have significantly impacted its performance advertising segment, driving a 100% increase in campaign launches in Q2 2024. The company reported Q2 revenue of $428.16 million, up from $332 million last year, and reduced its net loss to $4.29 million from $31.31 million a year ago. With R&D expenses accounting for approximately 14.3% of revenue and expected annual earnings growth at 59.22%, Taboola is positioning itself strongly within the tech sector through continuous innovation and strategic investments.

- Unlock comprehensive insights into our analysis of Taboola.com stock in this health report.

Assess Taboola.com's past performance with our detailed historical performance reports.

Where To Now?

- Investigate our full lineup of 251 US High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RCEL

AVITA Medical

Operates as a therapeutic acute wound care company in the United States, Japan, the European Union, Australia, and the United Kingdom.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives