- United States

- /

- Media

- /

- NasdaqGS:SSP

Investors Give The E.W. Scripps Company (NASDAQ:SSP) Shares A 30% Hiding

The E.W. Scripps Company (NASDAQ:SSP) shares have had a horrible month, losing 30% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 63% share price decline.

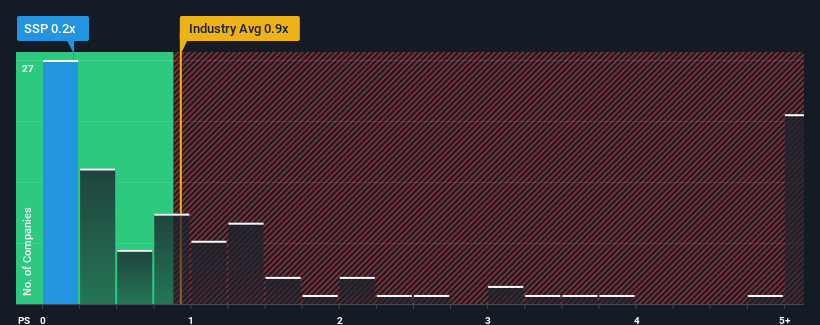

Following the heavy fall in price, when close to half the companies operating in the United States' Media industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider E.W. Scripps as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for E.W. Scripps

What Does E.W. Scripps' P/S Mean For Shareholders?

E.W. Scripps hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on E.W. Scripps will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For E.W. Scripps?

In order to justify its P/S ratio, E.W. Scripps would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.5%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 40% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 3.9% each year over the next three years. With the industry predicted to deliver 4.1% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that E.W. Scripps' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does E.W. Scripps' P/S Mean For Investors?

The southerly movements of E.W. Scripps' shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of E.W. Scripps' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for E.W. Scripps (1 can't be ignored) you should be aware of.

If you're unsure about the strength of E.W. Scripps' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if E.W. Scripps might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SSP

E.W. Scripps

Operates as a media enterprise through a portfolio of local television stations, national news, and entertainment networks in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success