- United States

- /

- Media

- /

- NasdaqGS:SIRI

Sirius XM (SIRI): Evaluating the Stock’s Value After Bringing Airbnb Vet Dave Stephenson to the Board

Reviewed by Simply Wall St

If you’re wondering what’s next for Sirius XM Holdings (SIRI) after this week’s announcement, you’re not alone. The company just welcomed Dave Stephenson, a veteran executive from Airbnb and Amazon, to its Board of Directors and the compensation committee. This kind of move often signals more than just a résumé boost. It can hint at shifts in corporate strategy and leadership direction, both of which investors quickly notice.

It comes as Sirius XM Holdings’ shares have delivered a moderate 5% gain over the past year, with momentum picking up in recent months. Despite negative returns over the longer term, the past quarter has seen renewed investor interest, possibly in anticipation of management changes and shifting priorities. Against a backdrop of flat revenue but a sharp rise in reported net income, the company’s trajectory now feels less predictable and potentially more interesting than it did a year ago.

So with a fresh face bringing tech industry pedigree to the boardroom, is Sirius XM Holdings quietly positioning itself for a turnaround that markets haven’t yet priced in, or has the stock already run ahead of any fundamental improvement?

Most Popular Narrative: 53% Undervalued

According to ValueMan, the most widely followed narrative sees Sirius XM Holdings as significantly undervalued, presenting a potential opportunity far beyond current market prices.

This is a negative equity company. Its debt load is not a burden, but it's an investment vehicle. You CAN argue if a catastrophic event happens SIRI is underwater, like covid. However, looking forward SIRI's revenue has maintained steady even in the advent of streaming services. Communication companies always have high debt loads, but also incredible moats.

There is a hidden formula powering this eye-catching valuation. The real shock comes from aggressive predictions about profit growth and the company’s ability to keep cash flowing straight to shareholders. Want to discover the bold financial levers and deeper logic behind these numbers? The key to this narrative’s upside may be far from what most investors assume.

Result: Fair Value of $50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant debt levels and unpredictable industry shocks could quickly upend the outlook. These factors serve as strong reminders for cautious optimism.

Find out about the key risks to this Sirius XM Holdings narrative.Another View: What Does Our DCF Say?

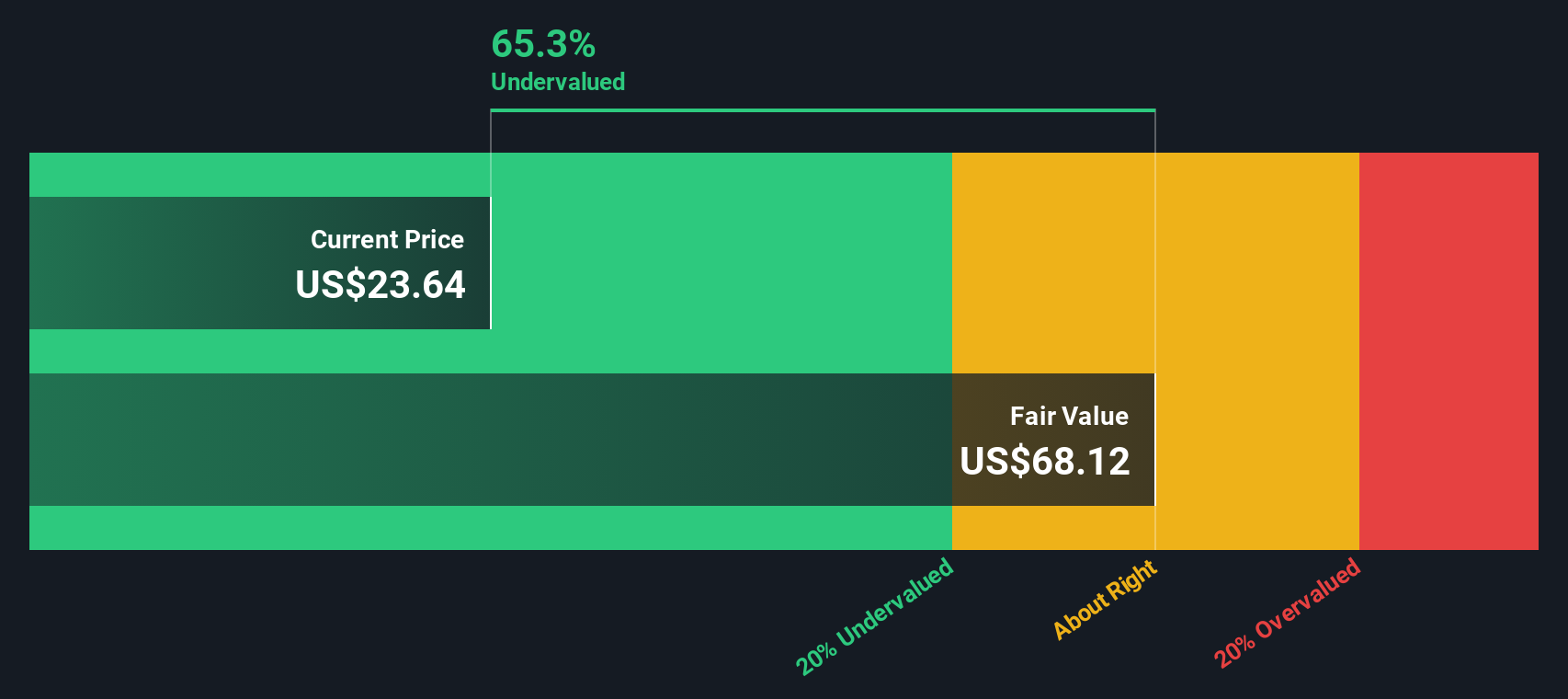

Taking a step back from market multiples, the SWS DCF model suggests a much higher intrinsic value than what the market currently reflects. This may also indicate the stock could be undervalued. Does this consistent outcome mean the opportunity is real, or are both methods missing risks that numbers do not show?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sirius XM Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sirius XM Holdings Narrative

If you feel there’s more to the story or prefer your own research approach, it takes just a few minutes to build a personal valuation view. Do it your way.

A great starting point for your Sirius XM Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors take action before opportunity passes them by. Don’t limit your potential to just one stock. There’s a world of exceptional companies waiting to transform your portfolio. Use the screener to find your next great pick before the crowd catches on.

- Spot companies paying out healthy yields and watch your passive income grow with dividend stocks with yields > 3%.

- Capture tomorrow’s technology trendsetters by seeing which breakthrough innovators are shaking up the market with AI penny stocks.

- Capitalize on seriously undervalued stocks and give your investments a value-driven edge through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives