- United States

- /

- Media

- /

- NasdaqGS:SATS

EchoStar (SATS) Valuation Check After SpaceX IPO Hype and Analyst Upgrades Fuel Sharp Share Price Rally

Reviewed by Simply Wall St

EchoStar (SATS) has suddenly become the go to proxy for SpaceX after reports of a potential SpaceX IPO at a sky high valuation sparked heavy buying and a rush into the stock.

See our latest analysis for EchoStar.

The latest SpaceX IPO chatter has simply poured fuel on a rally that was already building, with EchoStar’s share price return up 59.3% over 30 days and 371.96% year to date, while its 1 year total shareholder return of 360.03% shows this is no overnight story but a powerful, sustained re-rating.

If this kind of momentum has you wondering what else could be setting up for a big move, it is worth exploring fast growing stocks with high insider ownership as a next stop on your research list.

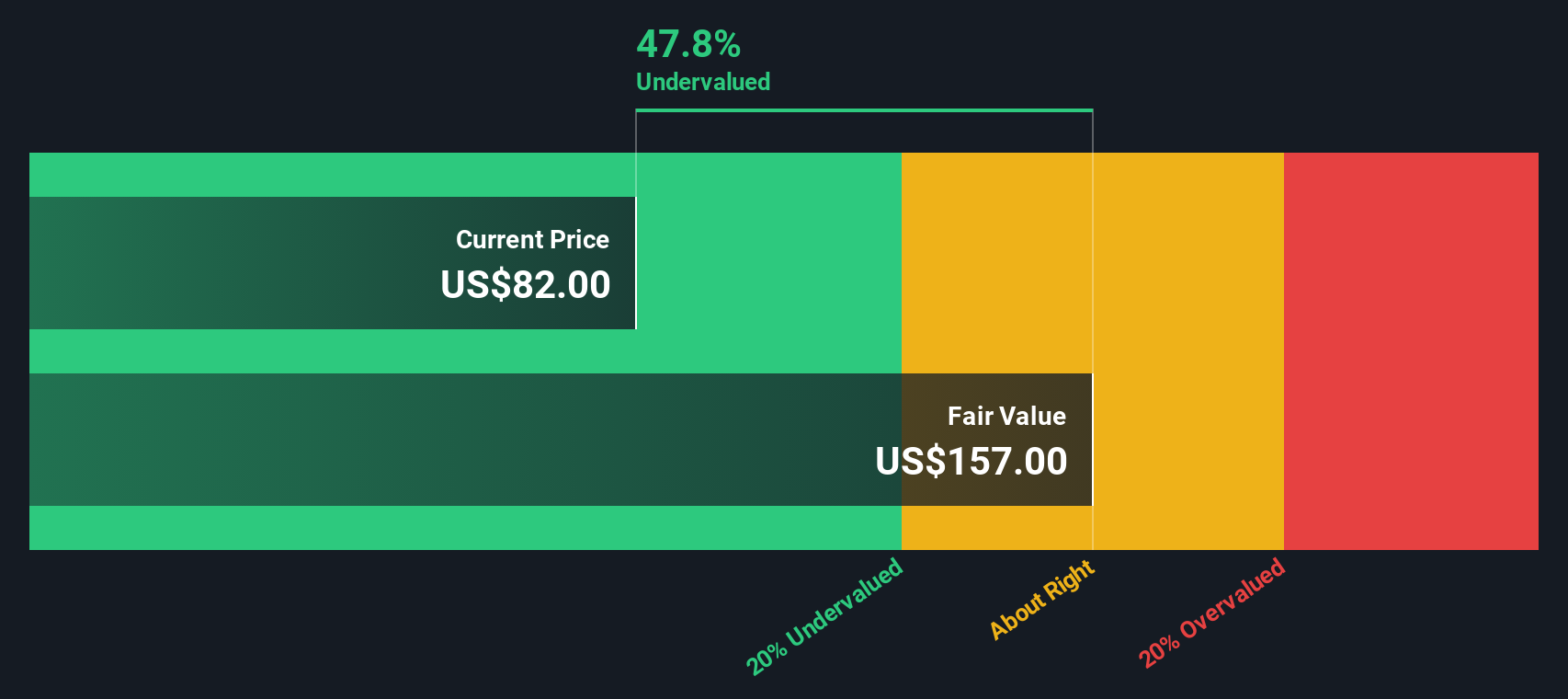

With shares now trading above the average Wall Street price target but still showing a sizable intrinsic value discount, investors face a key question: is EchoStar undervalued on fundamentals or already pricing in years of SpaceX fueled growth?

Most Popular Narrative: 18.9% Overvalued

EchoStar last closed at $107.37, notably above the most popular narrative fair value of about $90.29, setting up a clear valuation tension.

Analysts are assuming EchoStar's revenue will grow by 1.3% annually over the next 3 years.

Analysts are not forecasting that EchoStar will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate EchoStar's profit margin will increase from -2.0% to the average US Media industry of 10.2% in 3 years.

Curious how a loss making company still earns a premium tag? The narrative leans on a dramatic swing in margins and a re rated future earnings multiple. Want to see exactly how those moving parts stack up?

Result: Fair Value of $90.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent FCC uncertainty over key spectrum licenses, along with EchoStar’s heavy near term debt obligations, could quickly challenge this upbeat margin improvement narrative.

Find out about the key risks to this EchoStar narrative.

Another View: DCF Points to Deep Undervaluation

While the popular narrative flags EchoStar as 18.9% overvalued, our DCF model offers a very different view. It suggests the shares are trading about 37.5% below fair value at roughly $171.80. If the cash flows play out, is today’s price a mispricing or a value trap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EchoStar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EchoStar Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your EchoStar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by lining up fresh opportunities from our most powerful screeners so you are not reacting after the move.

- Capture potential turnaround plays early by scanning these 3612 penny stocks with strong financials that already show stronger balance sheets and improving fundamentals.

- Position ahead of the next tech growth wave by targeting these 26 AI penny stocks building real businesses around artificial intelligence innovation.

- Lock in quality at attractive prices by focusing on these 13 dividend stocks with yields > 3% that combine solid payouts with sustainable underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EchoStar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Fair value with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)