- United States

- /

- Capital Markets

- /

- NasdaqGS:TIGR

3 Top US Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As U.S. stock indexes experience significant declines, led by a sharp drop in tech and chip stocks, investors are increasingly looking for stable growth opportunities amidst market volatility. In such turbulent times, companies with high insider ownership often stand out as promising investments due to the alignment of interests between company leaders and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 78.8% |

| BBB Foods (NYSE:TBBB) | 22.9% | 66.5% |

Here we highlight a subset of our preferred stocks from the screener.

Roku (NasdaqGS:ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform in the United States and internationally, with a market cap of approximately $9.81 billion.

Operations: Roku generates revenue primarily from two segments: Devices, which contributed $551.17 million, and Platform, which brought in $3.19 billion.

Insider Ownership: 12.4%

Earnings Growth Forecast: 70.9% p.a.

Roku's high insider ownership aligns with its growth trajectory, evidenced by a forecasted 70.9% annual earnings increase and expected profitability within three years. Despite recent shareholder dilution and low projected Return on Equity (0.7%), Roku's revenue is set to grow at 10.7% per year, outpacing the US market average of 8.7%. Recent expansions include a new innovation hub in Bengaluru and enhanced advertising partnerships, further solidifying its market position amidst ongoing legal challenges over patent infringements.

- Navigate through the intricacies of Roku with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Roku is priced higher than what may be justified by its financials.

UP Fintech Holding (NasdaqGS:TIGR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: UP Fintech Holding Limited, with a market cap of $572.63 million, offers online brokerage services primarily targeting Chinese investors.

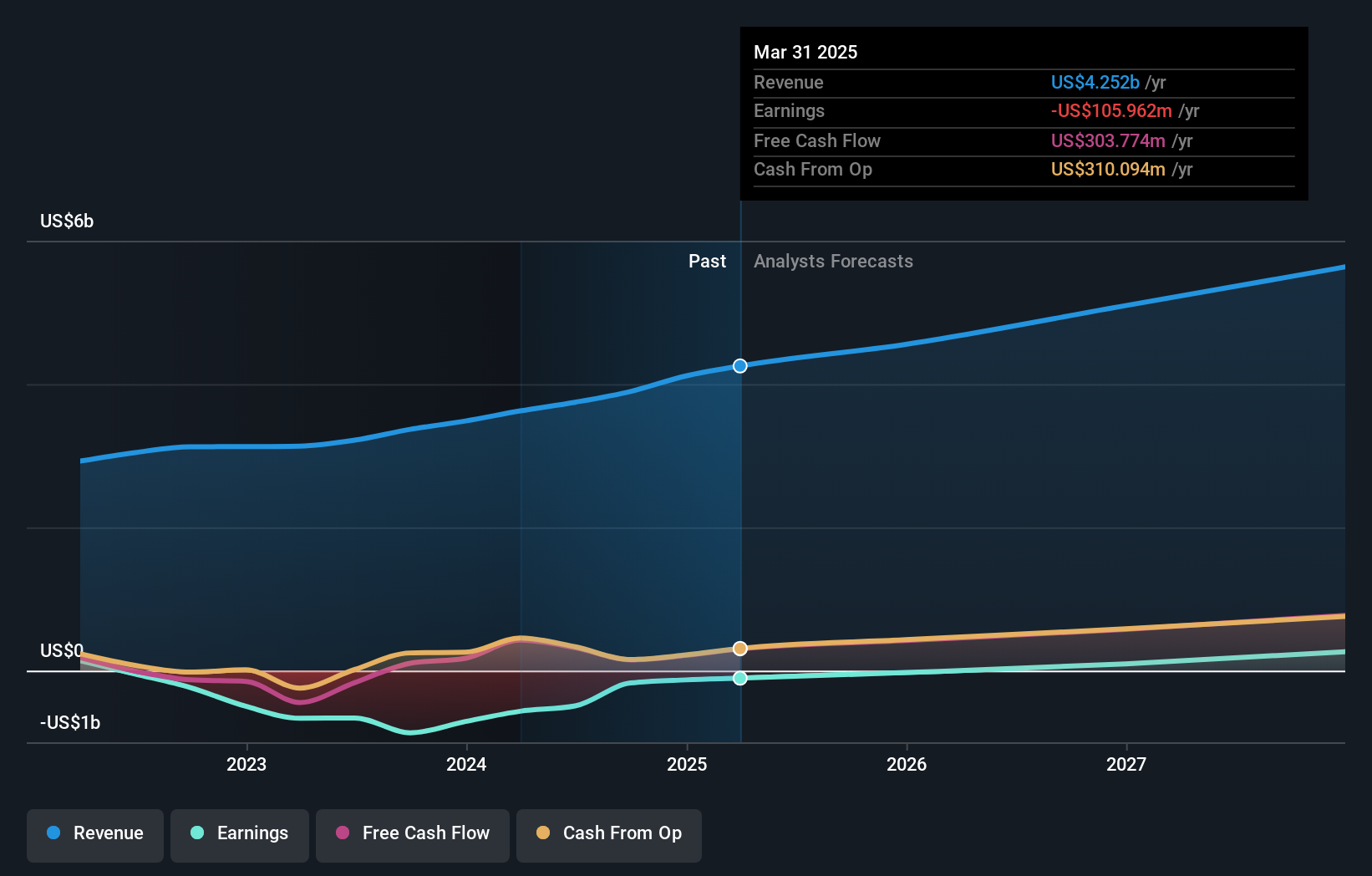

Operations: UP Fintech Holding Limited generates $250.01 million in revenue from its brokerage services.

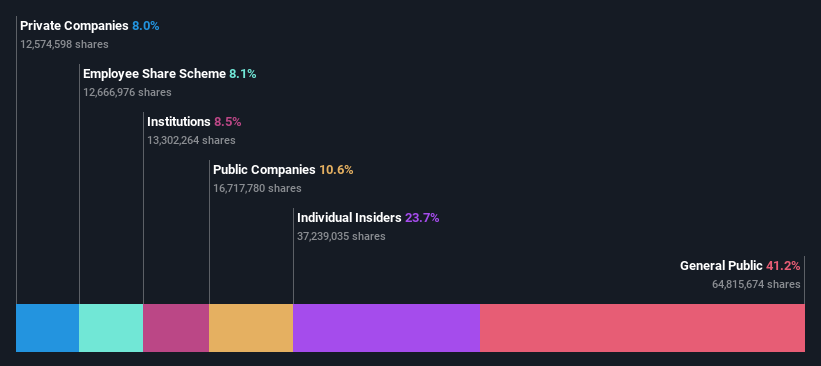

Insider Ownership: 23.7%

Earnings Growth Forecast: 22.8% p.a.

UP Fintech Holding's high insider ownership aligns with its strong growth prospects, as earnings are forecast to grow 22.8% annually over the next three years, outpacing the US market average of 15%. Despite a recent dip in net income to US$2.59 million for Q2 2024 from US$13.19 million a year ago, revenue has increased significantly to US$87.44 million from US$66.05 million, indicating robust operational performance and potential for long-term growth.

- Click here to discover the nuances of UP Fintech Holding with our detailed analytical future growth report.

- According our valuation report, there's an indication that UP Fintech Holding's share price might be on the expensive side.

Block (NYSE:SQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Block, Inc. (NYSE:SQ) operates ecosystems centered on commerce and financial products and services both in the United States and internationally, with a market cap of approximately $40.68 billion.

Operations: The company's revenue segments include $7.38 billion from Square and $15.93 billion from Cash App.

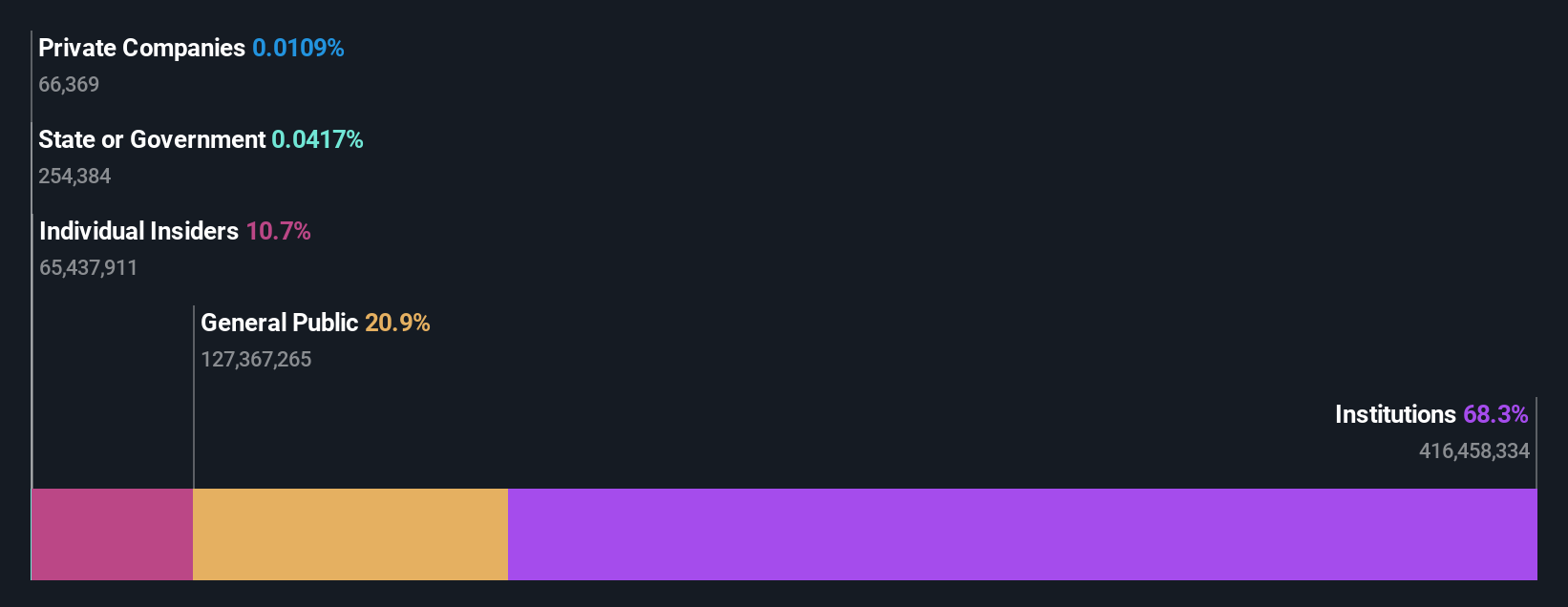

Insider Ownership: 10.3%

Earnings Growth Forecast: 32.6% p.a.

Block, Inc. shows strong growth potential with earnings forecast to grow 32.6% annually, significantly outpacing the US market average of 15%. Despite recent substantial insider selling, the company has been profitable this year and trades at 12.6% below its estimated fair value. Recent earnings reports highlight robust performance with Q2 revenue of US$6.16 billion and net income of US$195.27 million compared to a net loss last year, reflecting improved profitability and operational efficiency.

- Click to explore a detailed breakdown of our findings in Block's earnings growth report.

- In light of our recent valuation report, it seems possible that Block is trading beyond its estimated value.

Next Steps

- Dive into all 181 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TIGR

UP Fintech Holding

Provides online brokerage services focusing on Chinese investors.

Reasonable growth potential with mediocre balance sheet.