- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:QNST

QuinStreet (NASDAQ:QNST) ascends 6.4% this week, taking five-year gains to 62%

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the QuinStreet, Inc. (NASDAQ:QNST) share price is up 62% in the last five years, that's less than the market return. The last year hasn't been great either, with the stock up just 1.3%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

We know that QuinStreet has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. So it might be better to look at other metrics to try to understand the share price.

In contrast revenue growth of 10% per year is probably viewed as evidence that QuinStreet is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

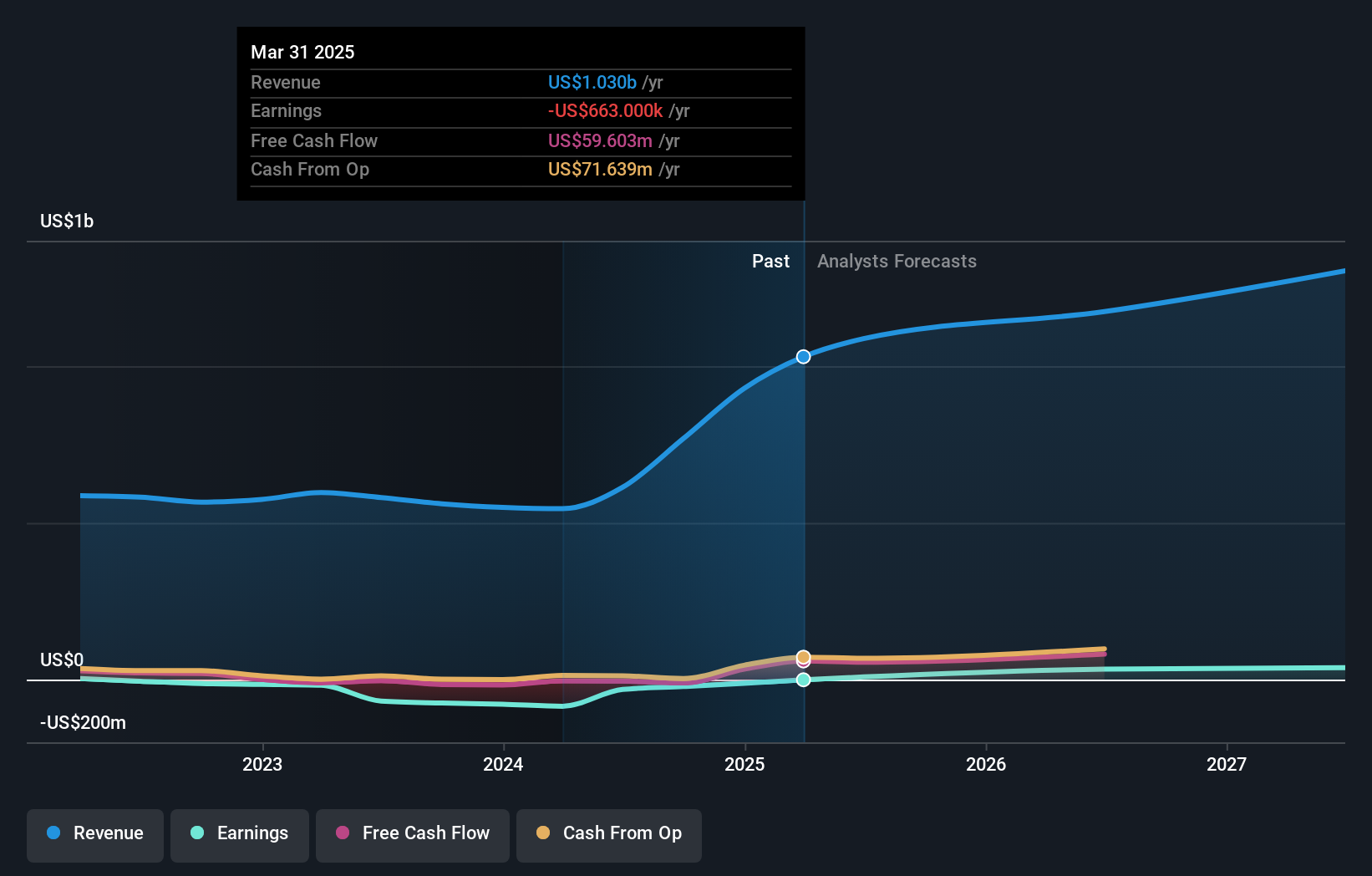

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling QuinStreet stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

QuinStreet shareholders are up 1.3% for the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 10% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. Before spending more time on QuinStreet it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if QuinStreet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:QNST

QuinStreet

An online performance marketing company, provides customer acquisition services for its clients in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives