- United States

- /

- Media

- /

- NasdaqCM:QMMM

QMMM Holdings (QMMM): Assessing Valuation After Bold Crypto and AI Expansion

Reviewed by Kshitija Bhandaru

If you’ve been watching QMMM Holdings (QMMM) recently, the company’s leap into the cryptocurrency sector is hard to ignore. Earlier this week, QMMM announced a sweeping expansion into crypto, pairing artificial intelligence with blockchain to build new analytics tools and launch a decentralized marketplace for data. The announcement also included plans for a $100 million crypto treasury, initially focused on Bitcoin, Ethereum, and Solana. This suggests a bold commitment to digital finance and innovation beyond its traditional scope.

This move has definitely caught the market’s attention. Over the past month, QMMM stock has surged 20%, with gains accelerating to more than 68% in the past three months. Year to date, returns are up 60%, though the one-year figure stands at a more modest 14%. It is clear that investors are reassessing risk and reward, as excitement about next-generation tech meets real financial stakes for the company and its shareholders.

The big question for those on the sidelines is whether QMMM is now trading at a discount to future growth, or if the market has already priced in its crypto ambitions completely.

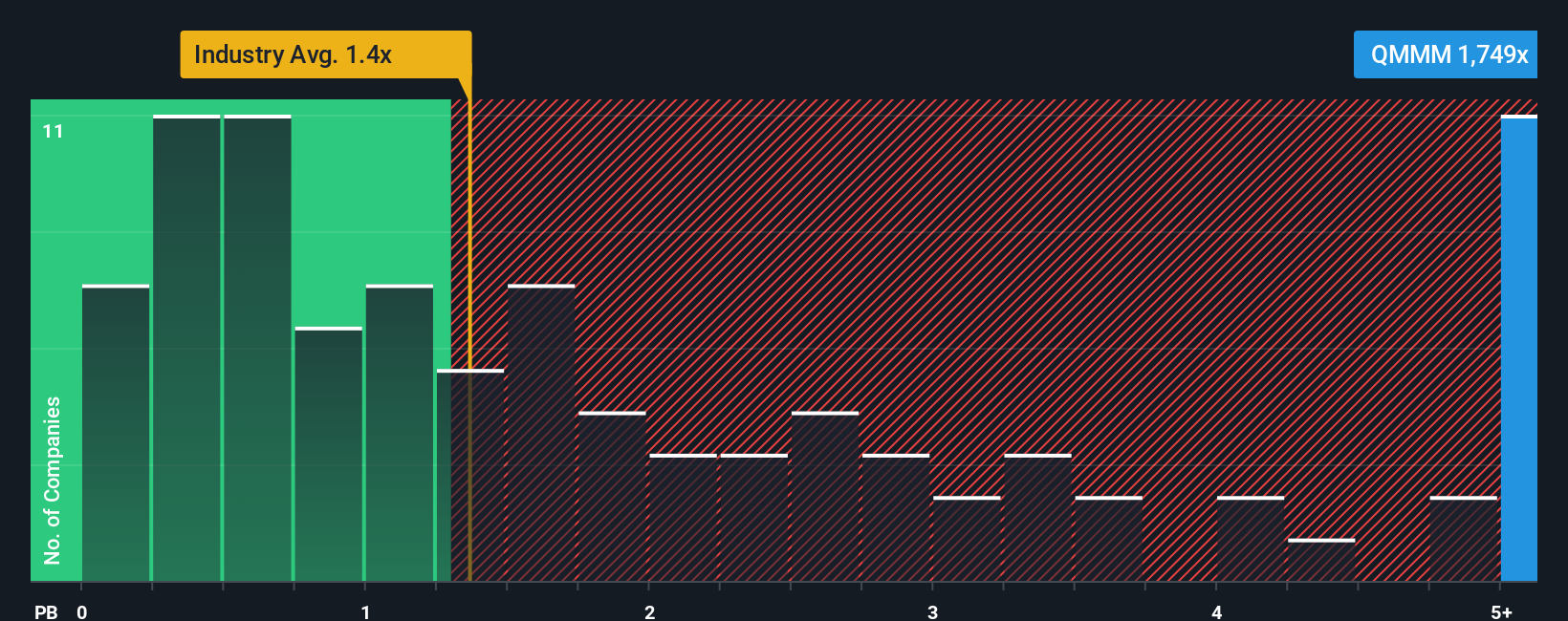

Price-to-Book of 1213.5x: Is it justified?

Based on its price-to-book ratio, QMMM Holdings appears significantly overvalued relative to its peers and the broader US media industry. The company trades at a hefty 1213.5 times its book value, while the peer average stands at 9.8 and the industry average is just 1.5.

The price-to-book ratio measures the market price of a company relative to its net asset value. For media companies and startups aiming for high growth, a premium may be warranted. However, such an extreme multiple usually reflects future profit expectations or speculative enthusiasm rather than current fundamentals.

Given QMMM's lack of consistent profitability and minimal revenues, it appears the market is pricing in aggressive future growth or transformative potential. Without evidence of a sharp turnaround in earnings or substantial revenue expansion, this premium may be difficult to defend in the near term.

Result: Fair Value of $2M (OVERVALUED)

See our latest analysis for QMMM Holdings.However, limited revenue growth and ongoing net losses could quickly erode bullish sentiment if QMMM fails to deliver on its ambitious crypto roadmap.

Find out about the key risks to this QMMM Holdings narrative.Another View: Book Value in Context

Looking at another common measure, QMMM's price alongside its net asset value is still extremely high compared to the industry. This alternative check also signals that the stock could be aggressively valued. But does the market know something we don’t?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QMMM Holdings Narrative

If you want to dig into the numbers firsthand and draw your own conclusions, it’s quick and easy to put together your own view on QMMM. Do it your way

A great starting point for your QMMM Holdings research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next headline to move the markets. Take charge of your portfolio and spot tomorrow’s winners today with these curated investment angles:

- Tap into growth potential by checking out undervalued stocks based on cash flows to find stocks that are trading below their true worth.

- Benefit from breakthrough healthcare by browsing healthcare AI stocks for innovative companies transforming medicine with artificial intelligence.

- Harness the power of digital assets by exploring cryptocurrency and blockchain stocks and see which businesses are reshaping global finance through crypto and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QMMM Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QMMM

QMMM Holdings

Through its subsidiaries, provides digital media advertising and marketing production services primarily in Hong Kong.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)