- United States

- /

- Media

- /

- NasdaqGS:PERI

Investors Aren't Entirely Convinced By Perion Network Ltd.'s (NASDAQ:PERI) Revenues

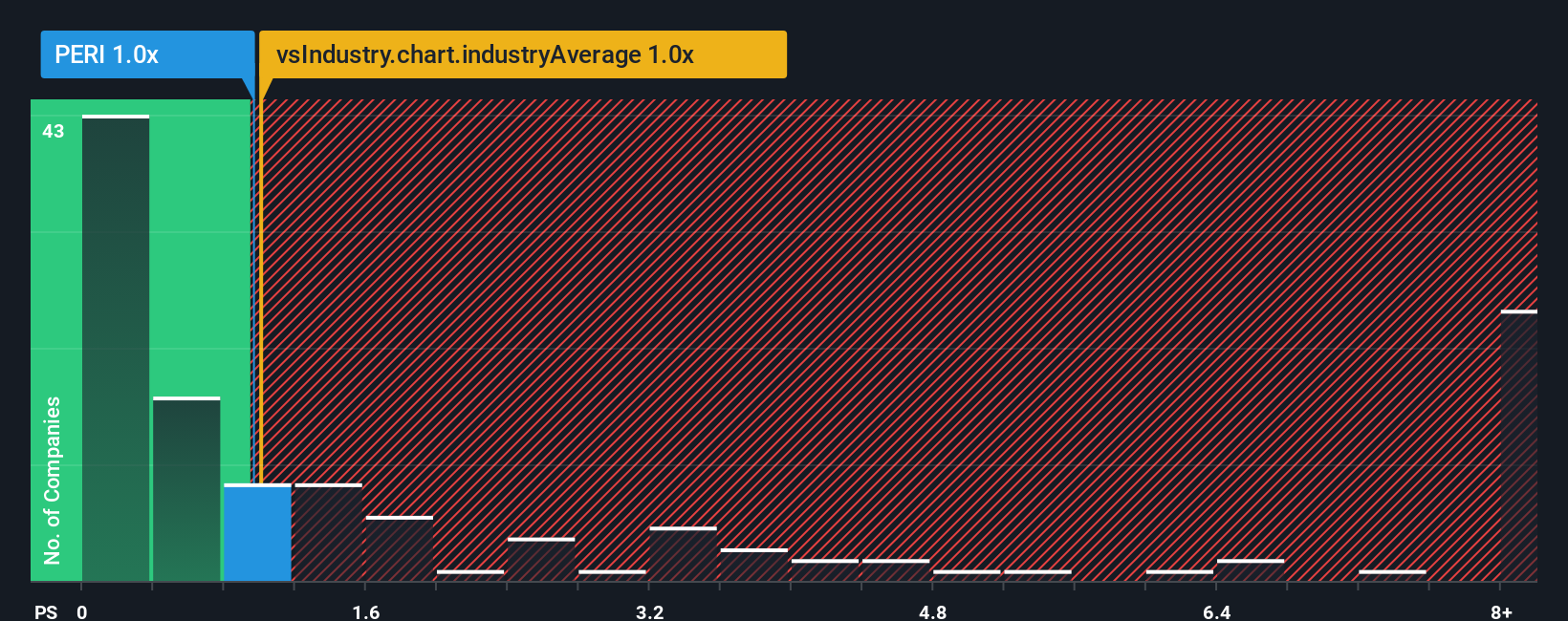

With a median price-to-sales (or "P/S") ratio of close to 1x in the Media industry in the United States, you could be forgiven for feeling indifferent about Perion Network Ltd.'s (NASDAQ:PERI) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Perion Network

What Does Perion Network's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Perion Network's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Perion Network will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Perion Network?

Perion Network's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 43%. The last three years don't look nice either as the company has shrunk revenue by 16% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.5% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 2.4%, which is noticeably less attractive.

With this information, we find it interesting that Perion Network is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Perion Network currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Perion Network with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Perion Network, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PERI

Perion Network

Provides digital advertising solutions to brands, agencies, and retailers in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives