- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Will a Netflix (NFLX) Bid for Warner Bros. Discovery Change the Streaming Content Landscape?

Reviewed by Sasha Jovanovic

- In early October 2025, reports surfaced that Netflix was preparing a bid for Warner Bros. Discovery, potentially combining major studios, franchises, and popular HBO series under one streaming roof.

- This possible acquisition could reshape streaming content availability and industry power dynamics, especially relating to premium offerings and urban markets worldwide.

- We'll examine how the prospect of Netflix acquiring Warner Bros. Discovery could alter the company's growth trajectory and content strategy.

Find companies with promising cash flow potential yet trading below their fair value.

Netflix Investment Narrative Recap

To be a Netflix shareholder today, you need to believe the company can continue growing engagement and monetization faster than rising content and customer acquisition costs, even as competition and mature market saturation remain hurdles. The rumored Warner Bros. Discovery bid could boost Netflix’s premium content portfolio and urban market appeal, but it does not meaningfully alter the most important short-term catalyst: translating high engagement into stronger ad revenue and margins. The biggest risk, the need to keep content costs and churn in check as competition heats up, remains unchanged by this news.

Among recent announcements, Netflix’s push into major live events, including the upcoming Canelo Alvarez vs. Terence Bud Crawford boxing partnership, stands out. This initiative supports Netflix’s efforts to drive higher user engagement and explore new monetization channels, aligning closely with the current catalyst of maximizing engagement to fuel advertising growth and margin expansion.

However, investors should be aware that if content costs keep climbing faster than subscriber or ad revenue growth, especially as new rivals spend aggressively, the story could take a different turn...

Read the full narrative on Netflix (it's free!)

Netflix's narrative projects $59.4 billion revenue and $17.7 billion earnings by 2028. This requires 12.5% yearly revenue growth and a $7.5 billion earnings increase from $10.2 billion today.

Uncover how Netflix's forecasts yield a $1350 fair value, a 13% upside to its current price.

Exploring Other Perspectives

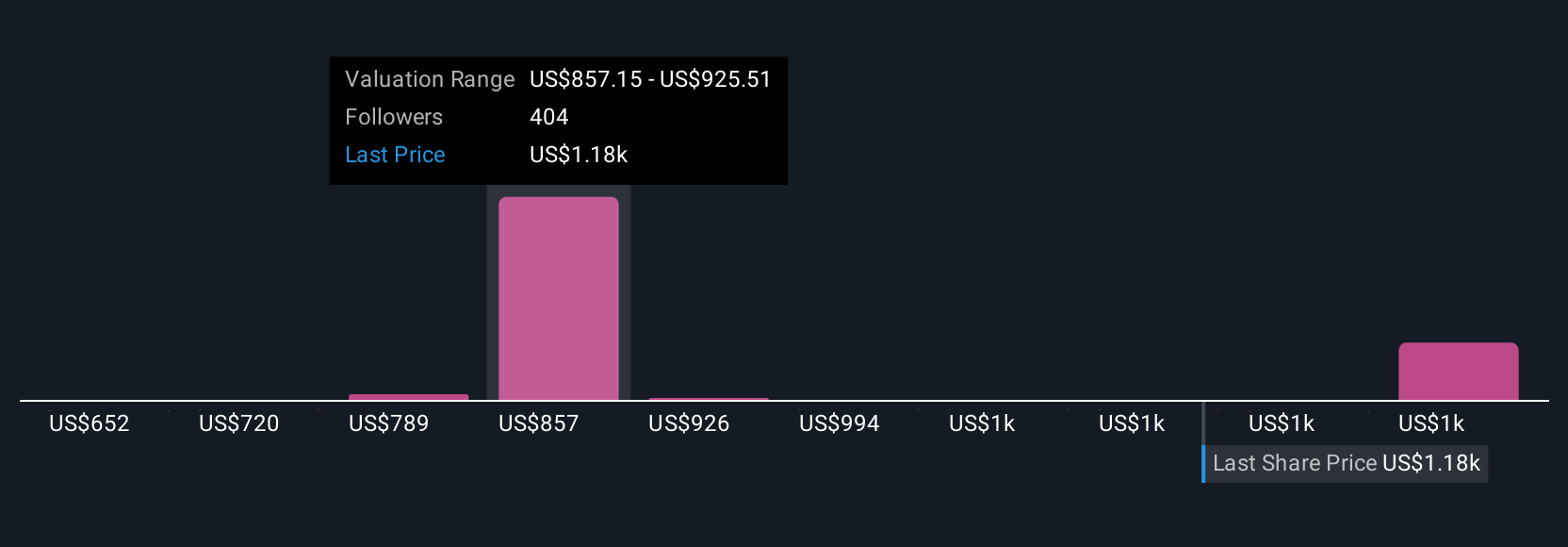

Fifty-seven members of the Simply Wall St Community see Netflix’s fair value anywhere from US$734 to US$1,825 per share. While many are focused on accelerating ad revenues as a catalyst, ongoing competition and the pressure to control soaring content costs could shape future growth and profitability. Compare these viewpoints and see how your perspective matches up.

Explore 57 other fair value estimates on Netflix - why the stock might be worth as much as 52% more than the current price!

Build Your Own Netflix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netflix research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Netflix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netflix's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives