- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

What Netflix (NFLX)'s FIFA World Cup Deal and Rising Global Revenue Mean for Shareholders

Reviewed by Simply Wall St

- In recent days, Netflix reported an increase in its full-year revenue guidance following strong business performance, healthy member growth, and favorable foreign exchange impacts, while also acquiring exclusive broadcasting rights to the FIFA Women’s World Cup in Canada for 2027 and 2031.

- This expansion into live sports broadcasting and success in international markets, such as an 11% revenue rise in the U.K. during 2024, signals Netflix’s effort to strengthen global reach and diversify its content portfolio.

- We’ll examine how the acquisition of FIFA Women’s World Cup rights could influence Netflix’s long-term investment outlook and growth strategy.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Netflix Investment Narrative Recap

To be a Netflix shareholder, it’s vital to believe in the platform’s ability to grow its global subscriber base, continually expand content offerings, and boost revenue through new channels like advertising and live sports. The recent exclusive Canadian FIFA Women’s World Cup deal and healthy U.K. revenue growth strengthen Netflix’s international presence and content diversity, but these developments do not significantly alter the primary short-term catalyst, ad-supported tier monetization, nor do they diminish the major risk of rising content costs.

The most directly related announcement is Netflix’s raised full-year revenue guidance, underpinned by strong business performance, favorable exchange rates, and robust member growth. This improvement aligns with investor focus on near-term revenue acceleration from expanding ad sales and global subscriber additions, and supports optimism for ongoing monetization gains.

But while topline growth remains strong, investors should be aware that intensifying competition and ever-increasing content investments present a risk to long-term profit margins if subscriber and engagement growth don’t keep pace with spending...

Read the full narrative on Netflix (it's free!)

Netflix's narrative projects $59.4 billion in revenue and $17.7 billion in earnings by 2028. This requires 12.5% yearly revenue growth and a $7.5 billion increase in earnings from the current $10.2 billion.

Uncover how Netflix's forecasts yield a $1350 fair value, a 11% upside to its current price.

Exploring Other Perspectives

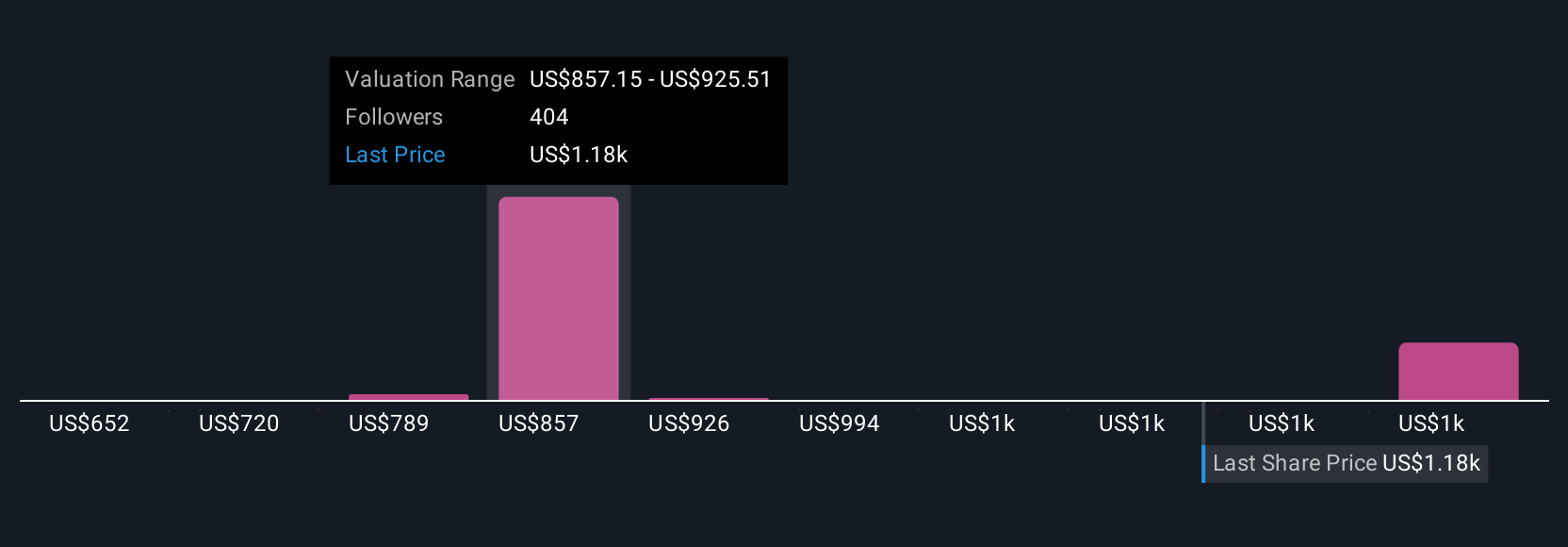

Fair value estimates from 45 Simply Wall St Community members stretch from US$652 to US$1,350, with some seeing Netflix as highly overvalued or undervalued. Members’ views differ as they weigh international expansion and ad-driven growth against concerns over rising content costs and competition.

Explore 45 other fair value estimates on Netflix - why the stock might be worth 46% less than the current price!

Build Your Own Netflix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netflix research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Netflix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netflix's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives