- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix's (NASDAQ:NFLX) Numbers Show the Peaking Streaming Market

Key Takeaways:

- Netflix posted a better result than expected

- The market seems to be discounting the poor Q3 guidance

- Debt doesn't seem to be an issue, but content costs are up

Few large companies experienced a fall from grace with a higher velocity than Netflix, Inc. (NASDAQ:NFLX), as it cratered over 70% year to date. Now, the stock is showing signs of bottoming, supported by the fact that the latest results were not as bad as expected.

The investors' community is arguing about the value (price-to-earnings ratio) vs. growth (subscribers added).

Check out our latest analysis for Netflix

Q2 Earnings Results

- GAAP EPS: US$3.20 (beat by US$0.26)

- Revenue: US$7.97b (miss by US$60m)

- Revenue Growth: +8.6% Y/Y

- Paid Net Additions: - 0.97m (vs. -2m guidance)

Q3 guidance

- Revenue: US$7.84b vs. US$8.1b consensus

- EPS: US$2.14 vs. US$2.76 consensus

For the first time, the company lost subscribers for 2 quarters in a row. It seems that the streaming market has reached its zenith, with the average household signed up to 4.7 services.

Yet, the stock didn't tank after another gloomy guidance. Is it possible that the market dismissed the conservative guidance, hoping for another beat?

Considering that some of the most popular series like Stranger Things and Ozark ended, the company doesn't have standout content coming out to boost the Q3 numbers. Meanwhile, the content cost is up almost 20% Y/Y.

What Is Netflix's Debt?

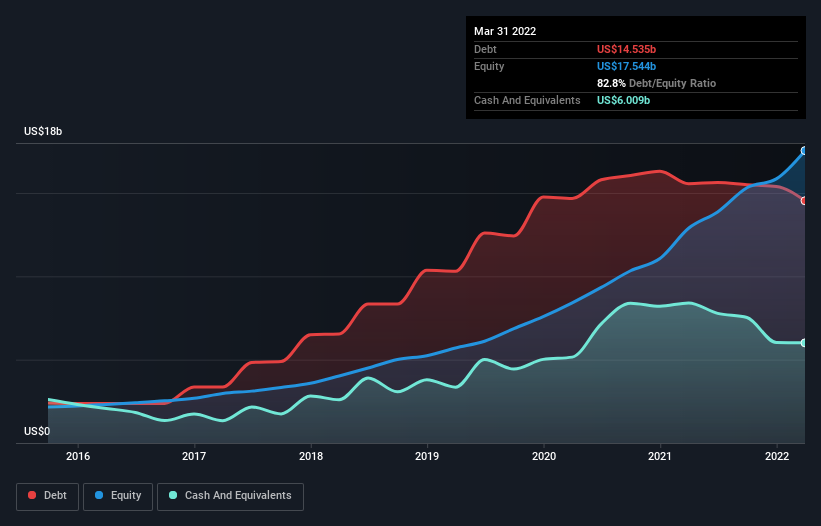

With interest rates rising, it is well-advised to keep track of companies' debts. As you can see below, Netflix had US$14.5b of debt in March 2022, down from US$15.6b a year prior. On the flip side, it has US$6.01b in cash leading to net debt of about US$8.53b.

A Look At Netflix's Liabilities

According to the last reported balance sheet, Netflix had liabilities of US$7.74b due within 12 months and liabilities of US$20.0b due beyond 12 months. On the other hand, it had cash of US$6.01b and US$824.7m worth of receivables due within a year. So it has liabilities totaling US$21.0b more than its cash and near-term receivables combined. This deficit isn't bad because, despite the recent crash, Netflix still has a market capitalization of about US$89b. Thus, it could raise enough capital to shore up its balance sheet if needed.

To size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover).

Netflix has net debt of just 1.3 times EBITDA, indicating that it is undoubtedly not a reckless borrower. And this view is supported by the solid interest coverage, with EBIT coming in at 8.2 times the interest expense over the last year. And we also note that Netflix grew its EBIT by 11% last year, making its debt load easier to handle. Those concerned about profitability can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Netflix recorded negative free cash flow in total. Debt is usually more expensive and almost always riskier in the hands of a company with negative free cash flow.

Our View

The most recent results were not as bad as anticipated. However, they're still not great - the company lost another 1 million subscribers as it looks like the streaming wars have saturated the market. At the moment, it seems like the stock has shaken off Q3 guidance, but the question is whether the market priced in that the management intentionally lowballed the expectations.

Based on what we've seen, Netflix is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. There's no doubt that it has an adequate capacity to cover its interest expense with its EBIT. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep a close watch on its debt levels lest they increase.

However, not all investment risk resides within the balance sheet - far from it. For example - Netflix has 2 warning signs we think you should keep in mind.

Sometimes it's easier to focus on companies that don't need debt. Readers can access a list of growth stocks with zero net debt 100% free right now.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives