- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX): Taking a Fresh Look at Valuation After Recent Quiet Stock Shift

Reviewed by Kshitija Bhandaru

What’s the Real Story Behind Netflix’s Latest Stock Move?

Netflix (NFLX) has been on investors’ radar after its recent stock movement, one that may have caught the attention of anyone considering what’s next for the streaming giant. The move itself isn’t tied to a specific news flash or earnings surprise, but sometimes, that silence can be just as telling. When a stock like Netflix shifts without a clear cause, it often invites questions about whether the market sees something lurking beneath the surface, perhaps around valuation or broader industry sentiment, that isn’t making headlines just yet.

Looking at the bigger picture, Netflix’s year so far has been anything but dull. The stock has surged nearly 37% since January, with a 71% jump over the past year. This momentum stands out even among tech’s best performers. While recent weeks saw minor pullbacks, the longer-term trend points upward, fueled by double-digit revenue and net income growth. The gains seem to suggest at least some investor confidence that the company’s growth story still has legs.

But with these returns already in the books, is Netflix still a bargain, or is the market already pricing in every ounce of future growth? Let’s dig deeper.

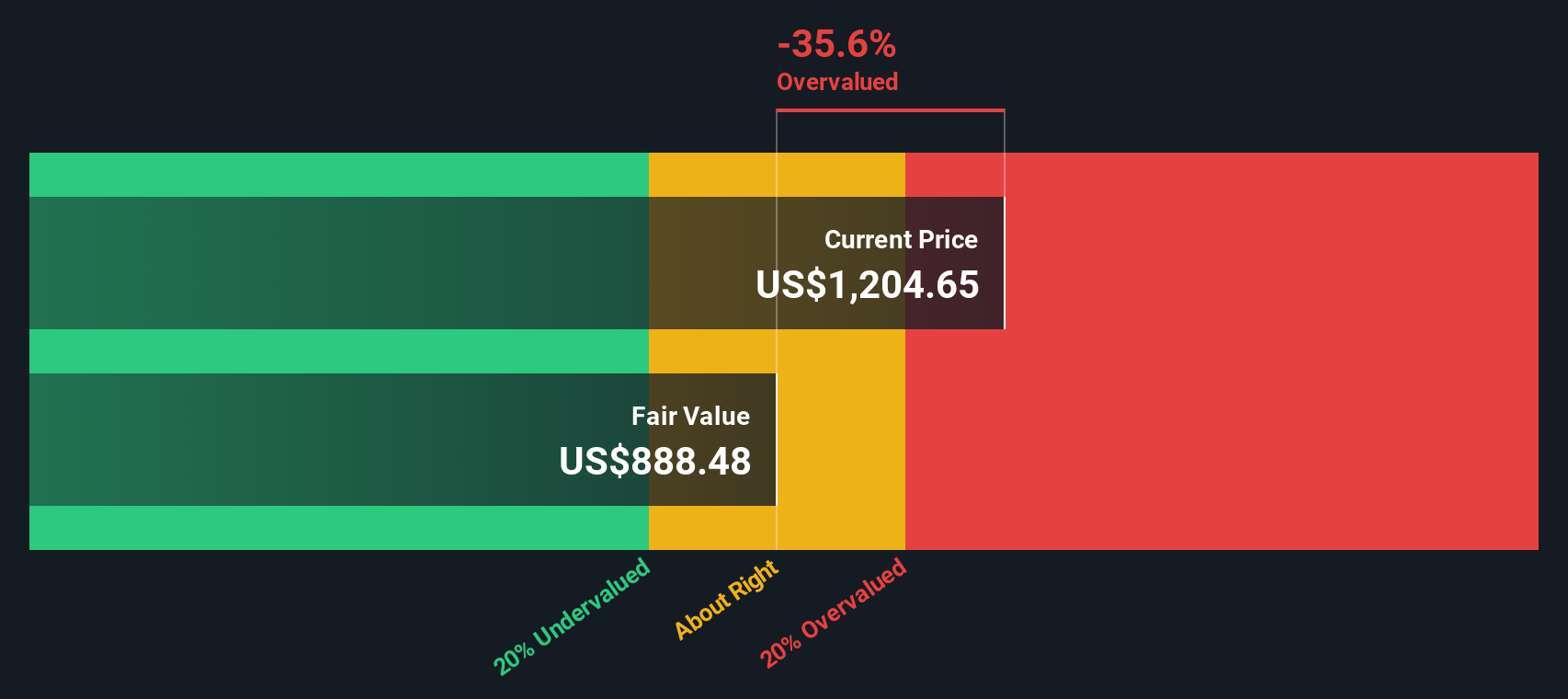

Most Popular Narrative: 51.8% Overvalued

According to MichaelP's narrative, Netflix’s current valuation is seen as significantly above its estimated fair value. The narrative highlights robust recent company performance but suggests the stock price has moved ahead of fundamentals.

I believe there is a greater chance than not, where due to the lack of profitable scale from their DTC offerings, these smaller streaming players may consider re-leasing more of their content library back to the likes of bigger streamers to generate a good return on the content and IP. We are already seeing some of this occur. Smaller streaming platforms will likely realise there is no point in owning great content and IP if you cannot monetise it profitably with your own smaller streaming platforms. So Netflix now holds the leverage over smaller content owners who do not have the same scale.

The narrative teases a deeper story hiding behind Netflix’s lofty share price. What are the critical financial assumptions underpinning this valuation? Which emerging industry trends could redefine Netflix’s bullish outlook, and what surprises may lie in the company’s growth trajectory? Uncover the projected numbers, and see how these bold assumptions add up to a price target that bucks Wall Street’s expectations.

Result: Fair Value of $797 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the narrative could shift quickly if hit shows flop or subscriber growth stalls. Either scenario could pressure valuations and upend bullish expectations.

Find out about the key risks to this Netflix narrative.Another View: SWS DCF Model Weighs In

While the first narrative points to Netflix trading above fair value, our DCF model suggests a similar outcome using projected future cash flows. Both methods seem to agree; however, the question remains whether either captures the full story.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Netflix for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Netflix Narrative

If you have a different perspective or want to dig into the numbers yourself, it only takes a few minutes to create your own narrative. This way, you can test your view. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Netflix.

Looking for more investment ideas?

Give your portfolio the edge it deserves by checking out new themes and sectors thriving right now. Act now and you will stay ahead of the trends others are just waking up to.

- Profit from the AI revolution by scanning for cutting-edge companies in machine learning and smart automation through our selection of AI penny stocks.

- Pursue stable income streams and boost your returns with top picks offering strong yields by browsing dividend stocks with yields > 3%.

- Tap into early-stage potential and high-growth prospects with our handpicked collection of penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026