- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX) Is Up 5.8% After Warner Bros. Discovery Bid and Smart TV Gaming Launch - Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this week, reports surfaced that Netflix is preparing a bid for Warner Bros. Discovery, a major Hollywood studio with a vast portfolio including DC movies and HBO series, and is also launching video games on smart TVs using smartphones as controllers.

- This development could significantly reshape Netflix’s entertainment ecosystem, bringing together premium franchises and new gaming offerings on one platform, potentially expanding its global and urban viewer base.

- We’ll explore how bringing video games to TVs, a first for Netflix, could influence its long-term investment story and growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Netflix Investment Narrative Recap

To be a Netflix shareholder today, you need to believe that the company can evolve beyond streaming, scaling diverse content like gaming and blockbuster franchises to fend off deep-pocketed competitors and grow outside saturated core markets. The reported bid for Warner Bros. Discovery, if it materializes, adds content firepower but doesn't alter the near-term focus: strong Q3 earnings and momentum in ad-supported tiers remain the key catalyst, while ballooning content costs are still the most pressing risk to profitability.

Among recent announcements, Netflix’s expansion of live events, most recently broadcasting the Canelo Alvarez vs. Terence Crawford boxing match, is directly tied to efforts to boost engagement and ARPU, reinforcing catalysts that could drive earnings upside if successful. Yet the full impact of such diversification will hinge on Netflix’s ability to efficiently convert viewership into sustained revenue, particularly as competition and expenses climb.

But even as new content and features surface, investors should keep in mind the pressure rising costs put on profit margins in...

Read the full narrative on Netflix (it's free!)

Netflix's outlook anticipates $59.4 billion in revenue and $17.7 billion in earnings by 2028. This would require revenue growth of 12.5% per year and a $7.5 billion increase in earnings from the current $10.2 billion.

Uncover how Netflix's forecasts yield a $1350 fair value, a 11% upside to its current price.

Exploring Other Perspectives

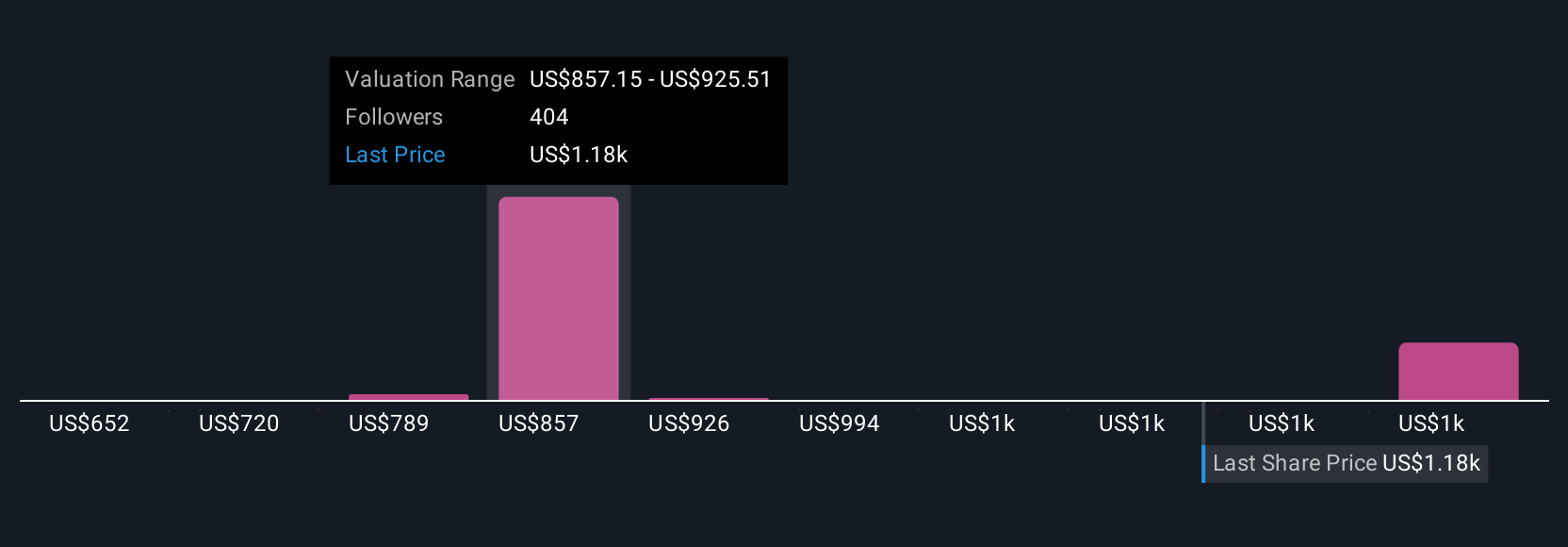

With 55 individual fair value estimates from the Simply Wall St Community ranging from US$734 to US$1,600 per share, viewpoints are far from unified. Many focus on Netflix’s need for high subscriber engagement to offset soaring content expenses, underlining wide implications for future performance and inviting you to compare these varied outlooks yourself.

Explore 55 other fair value estimates on Netflix - why the stock might be worth as much as 31% more than the current price!

Build Your Own Netflix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netflix research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Netflix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netflix's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026