- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX) Is Down 11.6% After Surprise Tax Hit and Record Ad Revenue Growth - What's Changed

Reviewed by Sasha Jovanovic

- Netflix recently reported its third-quarter 2025 results, revealing strong revenue growth and record ad-supported sales, but a one-time US$619 million tax charge from a Brazilian dispute led to an earnings miss.

- Despite the setback, Netflix's expanding advertising business, new consumer product partnerships with Mattel and Hasbro, and continued global content momentum signal new pathways for long-term monetization.

- We'll examine how the surprise Brazilian tax expense and rapid growth in ad-supported revenue impact Netflix's updated investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Netflix Investment Narrative Recap

For investors considering Netflix, the core belief centers on its ability to turn global streaming leadership, diversified content, and a fast-growing ad-supported business into sustainable earnings, despite high competition and content spending. The recent Q3 earnings miss, driven by a one-time US$619 million Brazilian tax charge, has little immediate effect on Netflix's key short-term catalyst of scaling ad revenues, but it underscores the principal risk around regulatory unpredictability and evolving global costs.

Of the latest announcements, the buyback update stands out: Netflix repurchased more than 1.5 million shares in the third quarter, totaling over US$19.87 billion since 2021. This continued buyback demonstrates confidence in underlying cash generation and can enhance per-share results, reinforcing the company’s edge as it accelerates ad-supported growth and faces rising content and regulatory costs.

Yet, in contrast, investors should keep a close watch on how unexpected regional costs, like the Brazilian tax dispute, could influence future margin trends and ...

Read the full narrative on Netflix (it's free!)

Netflix's outlook projects $59.4 billion in revenue and $17.7 billion in earnings by 2028. This requires 12.5% annual revenue growth and a $7.5 billion increase in earnings from current earnings of $10.2 billion.

Uncover how Netflix's forecasts yield a $1350 fair value, a 23% upside to its current price.

Exploring Other Perspectives

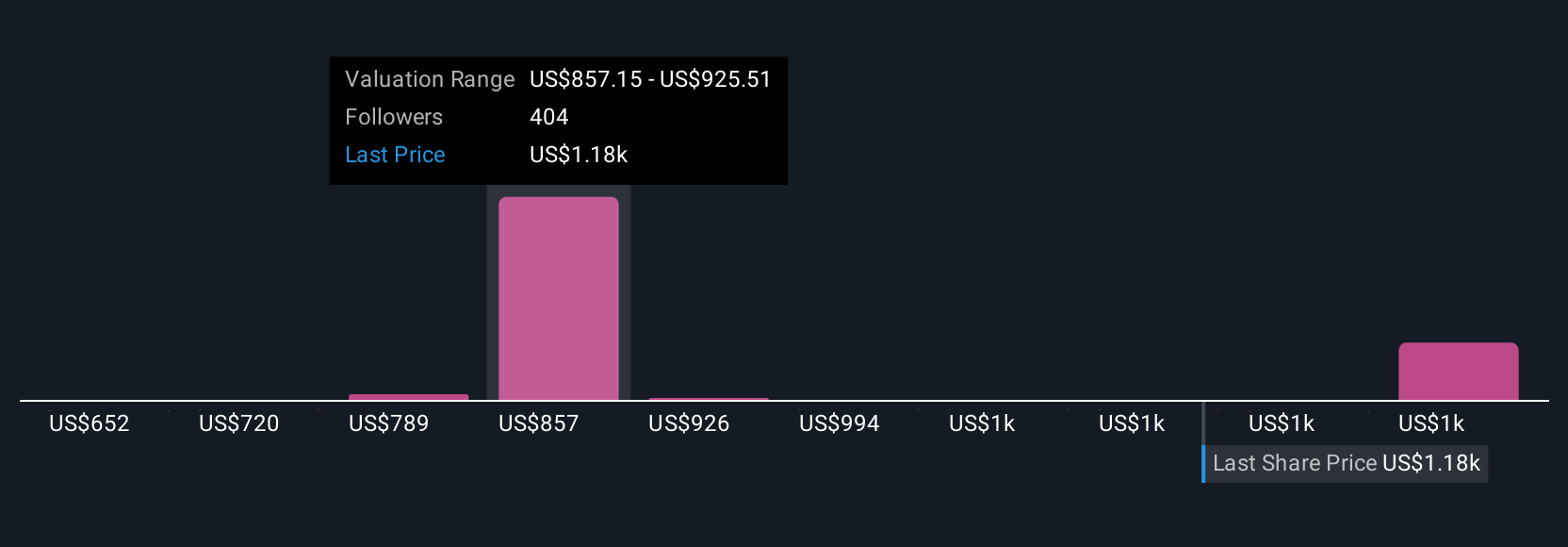

Private fair value estimates from 49 Simply Wall St Community members span from US$797.74 to US$1,825.07 per share. With new regulatory costs surfacing, these varied outlooks show how much investor confidence hinges on Netflix's ability to sustain profit margins amid fast-evolving risks and opportunities.

Explore 49 other fair value estimates on Netflix - why the stock might be worth 27% less than the current price!

Build Your Own Netflix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netflix research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Netflix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netflix's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives