- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NasdaqGS:NFLX) Sees 15% Price Move Over Last Quarter Amid Earnings Report

Reviewed by Simply Wall St

Netflix (NasdaqGS:NFLX) recently appointed Rebecca Nadilo as its new Director of Marketing Partnerships Creative for APAC, an event marking the company's strategy to strengthen its market in Asia-Pacific. Over the last quarter, Netflix's share price moved by 15.09%, potentially aided by several factors. The company's solid earnings reports, forecasting a notable year-over-year revenue increase, alongside their updated share repurchase program, potentially added weight to this upward trend. Although market conditions were volatile, with broader technology sell-offs due to U.S.-China trade tensions, Netflix's internal developments likely bolstered investor confidence amid external industry challenges.

We've identified 1 risk for Netflix that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The appointment of Rebecca Nadilo as Netflix's Director of Marketing Partnerships Creative for APAC may bolster the company's emphasis on enhancing its market presence in the Asia-Pacific region, potentially impacting both subscriber growth and revenue. Over the past three years, Netflix has delivered substantial total shareholder returns of 180.05%, showcasing the company's strong performance over the longer term. In comparison, Netflix exceeded the US Entertainment industry over the past year, which returned 30%. This outperformance indicates robust investor confidence in Netflix's strategic directions.

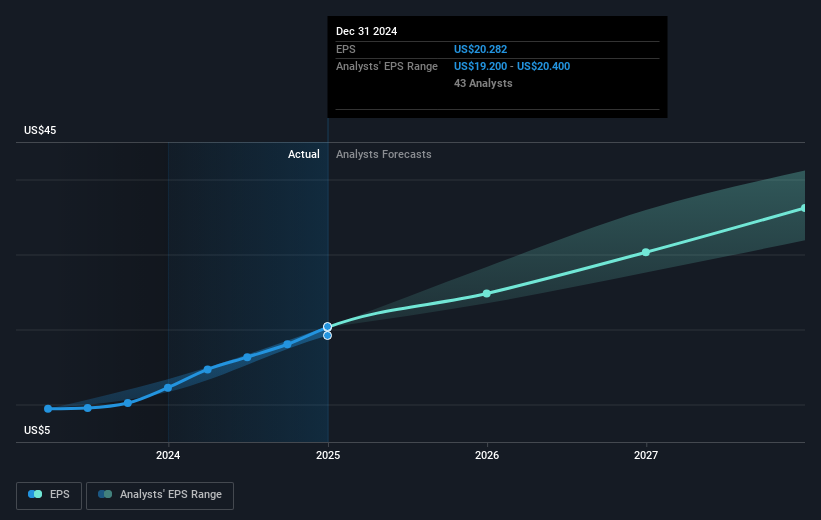

With respect to revenue and earnings forecasts, the focus on global content diversification and investment in ad-tech infrastructure could strengthen audience engagement and enhance financial projections. As Netflix leverages its broad-based content strategy and expands its ad-supported model, these developments might support the anticipated revenue growth of 12.1% annually. Furthermore, the company's recently updated share repurchase program coupled with internal growth initiatives appears aligned with the analyst consensus price target of $1,070.98—a figure 18.7% above the current share price of $870.4. Investors should consider the potential risks and opportunities presented by Netflix's strategic endeavors and emerging challenges in the entertainment industry landscape.

Upon reviewing our latest valuation report, Netflix's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives