- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

How Netflix’s Q2 Earnings and Sustained Buybacks Could Affect NFLX Investors

Reviewed by Simply Wall St

- On July 17, 2025, Netflix announced its second quarter and half-year results, reporting revenue of US$11.08 billion and net income of US$3.13 billion for the quarter, with continued share repurchases totaling 1.5 million shares in the quarter and over 30.77 million cumulative shares retired under its ongoing buyback program.

- These results reflect stronger earnings alongside a consistent capital return program, highlighting Netflix’s focus on improving performance while reducing its share count through buybacks.

- We’ll examine how Netflix’s ongoing share buybacks, coupled with its robust earnings growth, could influence its future investment outlook.

Netflix Investment Narrative Recap

To be a Netflix shareholder, you need to believe the company can sustain its lead in streaming by growing engagement, monetizing new platforms, and staying ahead of competition. The latest quarterly results, including strong revenue and net income growth, reinforce confidence in Netflix's earnings momentum, though the news does not fundamentally change the current short-term catalyst: execution on ad-supported plans. Biggest risk remains: whether content and tech investments translate to rising margins and market share.

Among recent announcements, the continued buyback program stands out. Netflix repurchased 1.5 million shares last quarter and has now retired over 30.77 million shares under its ongoing plan. This reflects a consistent capital return strategy, supporting the current investment narrative driven by robust earnings.

But keep in mind, even with these strong figures, investors should be aware that competition and content spending pressure could still ...

Read the full narrative on Netflix (it's free!)

Netflix's narrative projects $56.4 billion revenue and $16.1 billion earnings by 2028. This requires 12.0% yearly revenue growth and a $6.8 billion earnings increase from $9.3 billion today.

Uncover how Netflix's forecasts yield a $1096 fair value, a 11% downside to its current price.

Exploring Other Perspectives

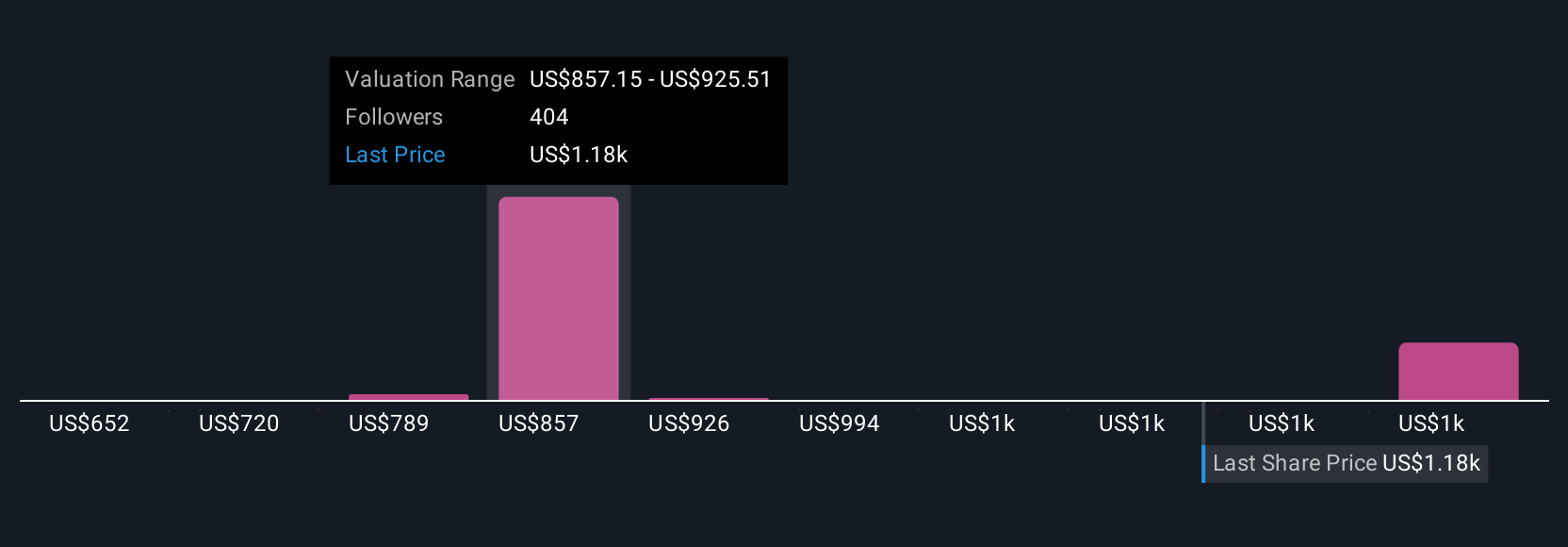

Community fair value estimates for Netflix range from US$652 to US$1,263, with 44 different perspectives from the Simply Wall St Community. Many point to competition and content investment as key issues shaping performance, so consider a range of views before deciding for yourself.

Build Your Own Netflix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netflix research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Netflix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netflix's overall financial health at a glance.

No Opportunity In Netflix?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives