- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:MTCH

AI-Powered Features Might Change The Case For Investing In Match Group (MTCH)

Reviewed by Sasha Jovanovic

- In recent days, Match Group announced a major shift toward AI-powered features designed to improve matching accuracy and boost user satisfaction across its dating platforms, including Tinder.

- This move signals the company’s focus on capturing the interest of younger users and revitalizing engagement amid declining user metrics, while also raising complex questions around privacy and data protection.

- To understand the impact of Match Group’s new AI features on its long-term growth strategy, we’ll explore how this innovation could update the investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Match Group Investment Narrative Recap

To own Match Group, you need to believe that its push toward AI-powered features will reverse user and engagement declines, reignite growth at Tinder, and fend off fierce competition. The recent announcement of AI-driven matching across its portfolio has the potential to serve as a timely short-term catalyst, but questions around data privacy and the adequacy of regulatory safeguards remain the most immediate risk to the business, which could temper any near-term enthusiasm if unresolved.

Among recent developments, the upcoming Q3 results scheduled for November 4, 2025, stand out as particularly relevant. With new AI features rolling out and management emphasizing product innovation as a growth lever, these earnings will offer the first early indicator on whether engagement trends are stabilizing, and whether the company’s tech pivot is starting to generate tangible results.

However, against the optimism of fresh features and new tech, investors should not overlook...

Read the full narrative on Match Group (it's free!)

Match Group's narrative projects $4.0 billion revenue and $811.8 million earnings by 2028. This requires 5.0% yearly revenue growth and a $274 million earnings increase from $537.8 million.

Uncover how Match Group's forecasts yield a $38.47 fair value, a 17% upside to its current price.

Exploring Other Perspectives

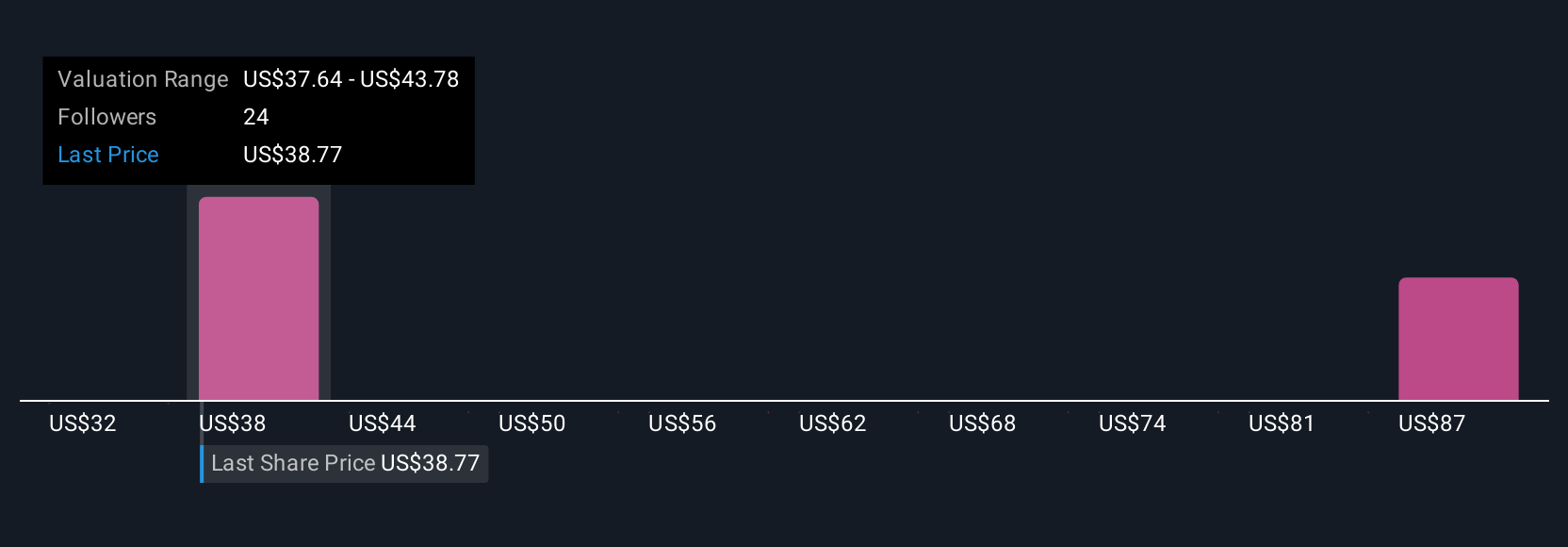

Four estimates from the Simply Wall St Community place fair value for Match Group between US$31.51 and US$91.86. While some see deep undervaluation, many are weighing how regulatory risks tied to AI-driven data use could influence future results; you can review these distinct viewpoints to compare your own expectations.

Explore 4 other fair value estimates on Match Group - why the stock might be worth just $31.51!

Build Your Own Match Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Match Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Match Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Match Group's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MTCH

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026