- United States

- /

- Media

- /

- NasdaqGS:MGNI

Magnite (MGNI): Evaluating Valuation After Legal Challenge to Google in Ad Tech Industry

Reviewed by Kshitija Bhandaru

Magnite (MGNI) is making headlines this week after filing a lawsuit against Google, alleging anticompetitive behavior in the ad tech market. This is not just another legal squabble; it is a direct challenge to industry norms at a time when regulators and competitors are closely watching how dominant tech companies operate. With Magnite seeking damages and structural changes, the outcome could reshape the landscape for independent ad tech firms and alter where value accrues in the sector.

The news comes on the heels of robust quarterly results for Magnite. The company saw net revenue climb 10% year-over-year and expanded its reach through new data partnerships and office growth. After a slow start to the year, the stock has surged 61% year to date and nearly quadrupled over three years. This momentum has caught the attention of both growth seekers and those reassessing risk. The dramatic move in the past three months suggests markets are recalibrating how they value Magnite’s potential, especially given its aggressive stance in the courts.

Now the big question for investors is whether the market is still underestimating Magnite’s upside or if the current stock price already reflects the possibility of significant changes ahead.

Most Popular Narrative: 8.1% Undervalued

The prevailing narrative suggests that Magnite is undervalued by 8.1%, based on forward-looking assumptions about its growth in connected TV and digital advertising.

Magnite is positioned to benefit from the accelerating shift of ad spend from traditional TV to digital and connected TV (CTV) platforms. This is evidenced by deepened partnerships with top streamers including Roku, Netflix, LG, Warner Bros. Discovery, and Paramount, as well as expanding SMB participation in CTV. These factors are expected to drive sustained revenue growth and a higher-margin business mix.

Want to discover what drives an ambitious valuation for Magnite? The secret sauce blends aggressive margin expansion and a bullish outlook on digital ad growth. Curious which financial forecasts convinced analysts to set the bar so high for profit and value? Dig into the full narrative to see the quantitative levers behind this compelling price target.

Result: Fair Value of $28.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if Magnite loses a major streaming partner or if antitrust lawsuits do not lead to significant changes in the market, these risks could limit future upside.

Find out about the key risks to this Magnite narrative.Another View: Are Shares Actually Expensive?

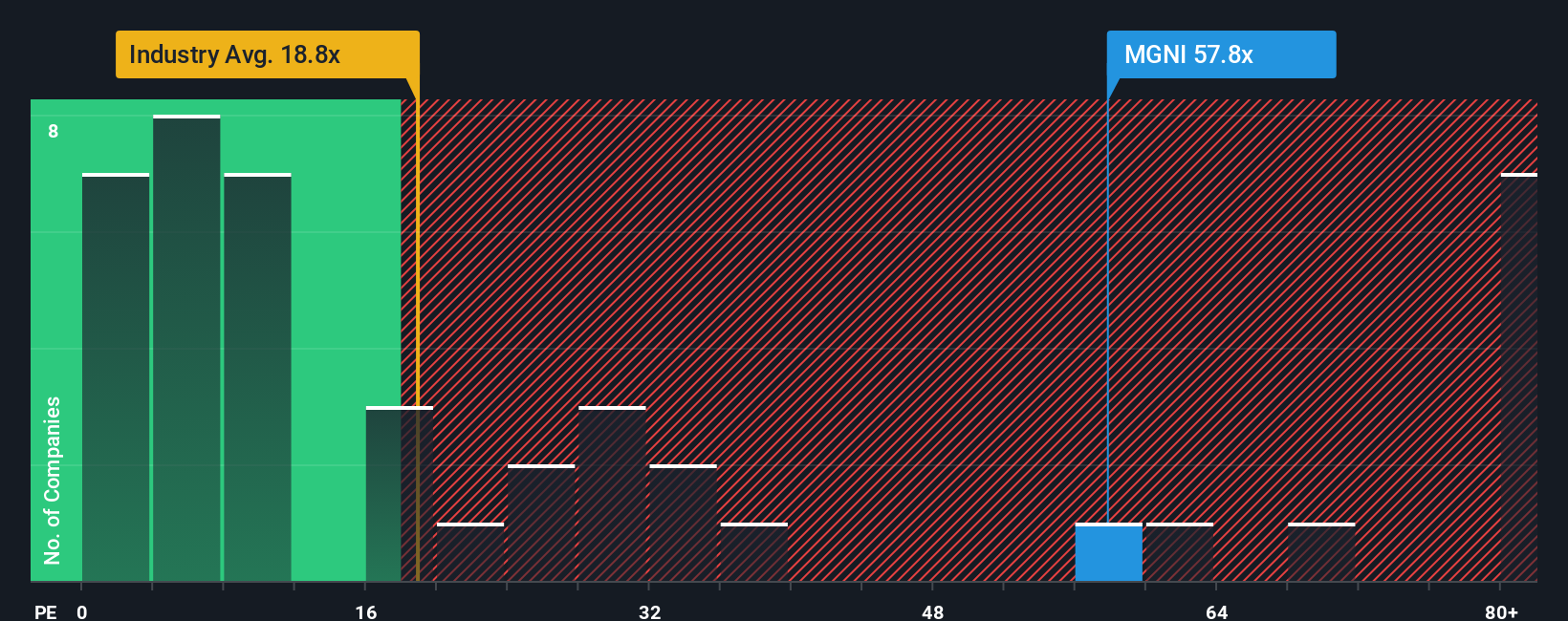

Looking at things from a different angle, a comparison to the US Media industry average shows Magnite trading at a far higher price-to-earnings ratio than its peers. Does this challenge the optimism in the forecast?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Magnite Narrative

For those who want to challenge the consensus or dig deeper into Magnite’s fundamentals, you can shape your own perspective in just a few minutes by using Do it your way.

A great starting point for your Magnite research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let great opportunities pass you by. The Simply Wall Street Screener puts unique stocks within your reach, whatever your style or ambitions.

- Supercharge your portfolio by targeting assets with high yield potential, and tap into the market's best dividend stocks with yields > 3%.

- Ride the momentum behind the next wave of artificial intelligence breakthroughs by checking out the leaders in AI penny stocks.

- Get ahead of the crowd by zeroing in on shares the market may be mispricing thanks to our exclusive list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives