- United States

- /

- Media

- /

- NasdaqGS:MGNI

Can Magnite’s (MGNI) DNPA Collaboration Reveal Its Edge in Audience Targeting Strategies?

Reviewed by Sasha Jovanovic

- Earlier this month, the Digital News Publishers Association (DNPA) announced that several of its members have adopted Magnite Access, enabling publishers to use Magnite's platform for discovering and activating first- and third-party audience segments across premium inventory.

- This initiative also empowers DNPA publishers to create shared data infrastructure and cross-publisher audience packages, providing advertisers with new opportunities for targeted reach and value.

- We'll now explore how the adoption of Magnite Access by DNPA publishers could influence Magnite's broader investment narrative and market position.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Magnite Investment Narrative Recap

To own Magnite, an investor needs to believe in the company’s ability to lead programmatic advertising across digital and connected TV, while expanding publisher partnerships and sustaining margin improvements. The recent uptake of Magnite Access by DNPA members showcases product relevance and execution, though its direct effect on the biggest short-term catalyst, the growth in CTV ad spend, remains limited, while underlying risks like customer concentration among top CTV streamers are still relevant.

Among recent announcements, the rollout of ClearLine stands out for its connection to Magnite Access, since both support better data curation and integration for publishers and advertisers. By enabling unified campaigns across platforms, ClearLine may address agency and publisher needs for transparent, end-to-end programmatic buying, complementing efforts to drive higher-margin digital video and CTV transactions.

On the other hand, investors should stay aware of how concentrated revenue exposure to major CTV partners could impact Magnite if large streamers change their programmatic strategies or relationships…

Read the full narrative on Magnite (it's free!)

Magnite's outlook projects $796.3 million in revenue and $189.5 million in earnings by 2028. This assumes a 5.1% annual revenue growth rate and a $146.4 million increase in earnings from the current $43.1 million.

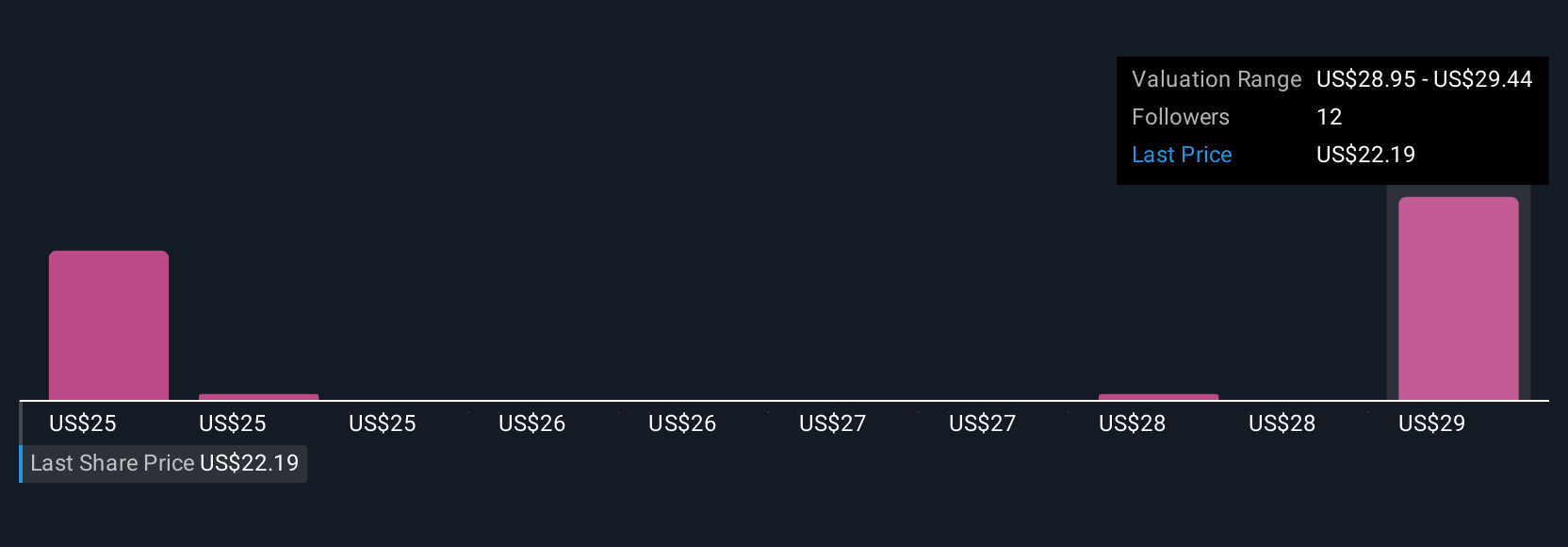

Uncover how Magnite's forecasts yield a $28.19 fair value, a 57% upside to its current price.

Exploring Other Perspectives

Five individual fair value estimates from the Simply Wall St Community range from US$24.70 to US$120.32 per share. While community opinions are wide, keep in mind that Magnite’s future performance could hinge on advertiser demand for truly independent, transparent programmatic solutions, so weigh your viewpoint alongside others.

Explore 5 other fair value estimates on Magnite - why the stock might be worth over 6x more than the current price!

Build Your Own Magnite Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Magnite research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Magnite research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Magnite's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives