- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Reports Robust Q1 2025 Earnings Growth

Reviewed by Simply Wall St

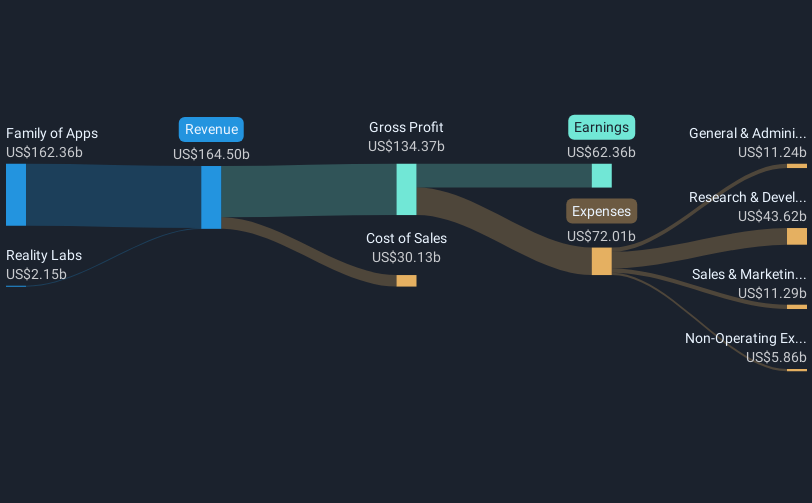

Meta Platforms (NasdaqGS:META) recently unveiled its Q1 2025 earnings, reporting significant increases in sales and net income compared to the previous year, alongside a robust earnings per share improvement. The company also announced a substantial share buyback, with almost 21 million shares repurchased, enhancing shareholder value. Furthermore, Meta introduced new AI products and strengthened partnerships with Groq and Cerebras, aimed at expanding its technological capabilities. These recent developments, highlighting strong financial and strategic positioning, likely informed Meta's notable 21% stock price increase last month, a significant movement compared to the broader market's rise of 4%.

Buy, Hold or Sell Meta Platforms? View our complete analysis and fair value estimate and you decide.

The recent developments at Meta Platforms, including its Q1 2025 earnings results and strategic initiatives in AI and partnerships, have positioned the company for potential revenue growth through enhanced ad targeting and expanded business messaging. The substantial share buyback of approximately 21 million shares reflects a commitment to increasing shareholder value, potentially buoying investor confidence in future earnings growth.

Over the past three years, Meta's total shareholder return was a very large 225.30%, demonstrating strong performance compared to the market return of 11.6% over the past year. This long-term growth highlights Meta's ability to outperform both the broader market and the US Interactive Media and Services industry, which returned 7% in the past year.

These moves may align with analyst expectations of revenue growth to $243.60 billion and earnings to $86 billion by 2028, assuming a price-to-earnings ratio of 24.8x. Despite the current share price of $587.31 being 16.6% below the consensus price target of $705.89, the market's response to recent strategic actions and financial performance could close this gap. Investors might view these developments as catalysts for future performance, potentially influencing Meta's valuation in alignment with analyst forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives