- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Expands Board, Welcomes Industry Leaders Dina Powell McCormick and Patrick Collison

Reviewed by Simply Wall St

This week, Meta Platforms (NasdaqGS:META) announced the expansion of its Board of Directors, with the addition of two seasoned professionals, Dina Powell McCormick and Patrick Collison. This expansion, coupled with product releases such as the Llama 4 series and substantial investment in a new data center, signifies Meta’s continued focus on strengthening leadership and technological infrastructure. Over the same period, Meta’s stock rose by 7.7%, slightly outperforming the broader market's 5.4% increase. While specific events at Meta may not directly align with its stock movement, these developments provide weight to its upward momentum.

Meta Platforms has 1 weakness we think you should know about.

The recent expansion of Meta Platforms' Board of Directors could bolster its advanced AI initiatives and product innovations, potentially boosting user engagement and reducing costs, aligning with the company's narrative of long-term growth. Over five years, Meta's total returns, including share price and dividends, surged by 204.69%, significantly outpacing its comparable short-term performance, where it exceeded the US market's 3.6% return over one year. This underscores a longer-term trajectory that contrasts with recent, more measured gains.

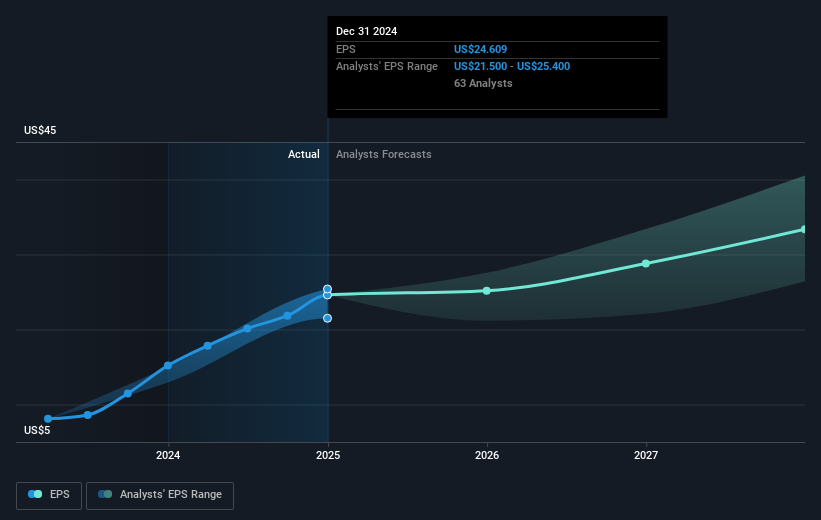

Currently, the focus on AI and product introductions, such as the Llama 4 series, could bolster revenue and earnings forecasts. However, the associated costs of heavy investment in AI pose a risk of straining finances if immediate revenue gains don't materialize. Analysts anticipate Meta's earnings will grow but at a rate lower than the overall market expectation, and they express varied outlooks, contributing to the divergent price target range.

With Meta's current share price trading at $510.45 against a consensus price target of $756.14, there is potential room for upward movement. The market sees a potential undervaluation, reflected in the share price discount to the target, suggesting the company's continued innovations and strategic board appointments might serve as catalysts for future value realization.

Understand Meta Platforms' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Meta Platforms, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives