- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Collaborates With Booz Allen To Pioneer AI-Powered Space Tech

Reviewed by Simply Wall St

Meta Platforms (NasdaqGS:META) experienced a notable price move of 9%, significantly outpacing the broader market's 5% gain over the same period. This upward momentum coincides with their collaboration with Booz Allen Hamilton on the Space Llama AI tech stack, an initiative that underscores Meta's capability in advancing AI technology for both space operations and terrestrial industries. The innovative characteristics of Space Llama, especially its application in space missions, may have bolstered investor confidence, adding weight to the broader positive market trends. As the market sees continued recovery, Meta's developments highlight its potential contribution to technological advancements.

Every company has risks, and we've spotted 1 weakness for Meta Platforms you should know about.

The recent collaboration between Meta Platforms and Booz Allen Hamilton on the Space Llama AI tech stack signifies a critical advancement in AI applications, which is pivotal given the company's strategic focus on AI-driven growth. This initiative could potentially enhance Meta's capability to drive long-term user engagement and advertising revenue, aligning with its broader AI investment narrative. Over the past three years, Meta's shares delivered a total return of 174.28%, indicating significant growth and reflecting positively on its capacity to leverage technology for market expansion. In comparison, Meta's shares exceeded the Interactive Media and Services industry, which saw lower growth over the past year.

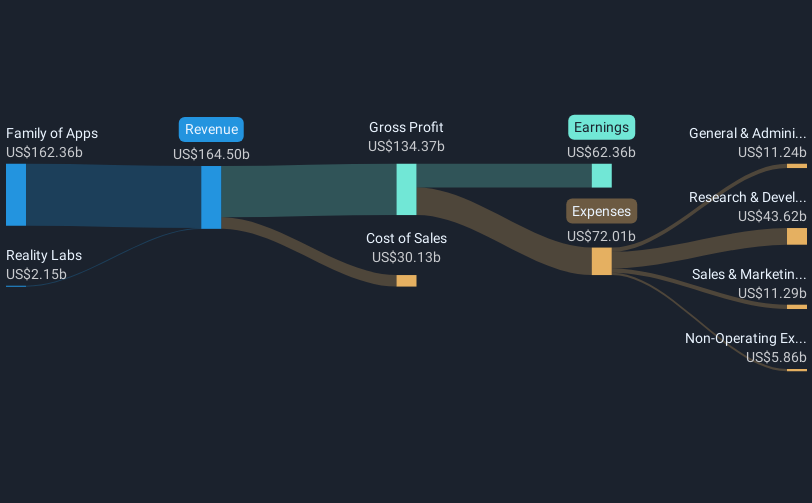

In terms of financial forecasts, the partnership could potentially influence revenue and earnings by introducing new use cases for AI, paving the way for further monetization opportunities. This aligns with analysts' expectations of substantial growth in revenue, anticipating a rise from the current $164.50 billion. While the current share price stands at US$500.28, the consensus analyst price target is US$722.91, suggesting a potential upside of over 30%. The price movement in response to the Space Llama venture may be seen as a positive signal by investors, likely contributing to a stronger outlook on future performance.

Click to explore a detailed breakdown of our findings in Meta Platforms' financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion