- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (META) Partners With CrowdStrike For AI-Powered Cybersecurity Benchmark Initiative

Reviewed by Simply Wall St

Meta Platforms (META) recorded an 8% price increase over the last quarter, amid significant movements in the broader technology market and company-specific events. The company's collaboration with CrowdStrike to launch CyberSOCEval marks an important step in enhancing AI capabilities in cybersecurity. Additionally, the announcement of a cash dividend and their recent joint venture with Reliance Industries for AI solutions signal continued growth and partnership strategies. Meta's expansion initiatives, including the launch of the Kansas City Data Center, underscore its operational scaling. While market trends, such as record highs in the Nasdaq and S&P 500, provided a positive backdrop, Meta's specific advancements added momentum to its share price movement.

We've discovered 1 weakness for Meta Platforms that you should be aware of before investing here.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent collaboration between Meta Platforms and CrowdStrike for CyberSOCEval, along with the venture with Reliance Industries, could enhance Meta's capabilities in AI-driven cybersecurity and solutions, potentially leading to increased adoption of its platforms. These moves may bolster Meta's foundation in emerging technologies, aligning with its strategy to redefine digital commerce and advertising. Additionally, the launch of the Kansas City Data Center signals further operational scaling, likely supporting expanded data-driven initiatives.

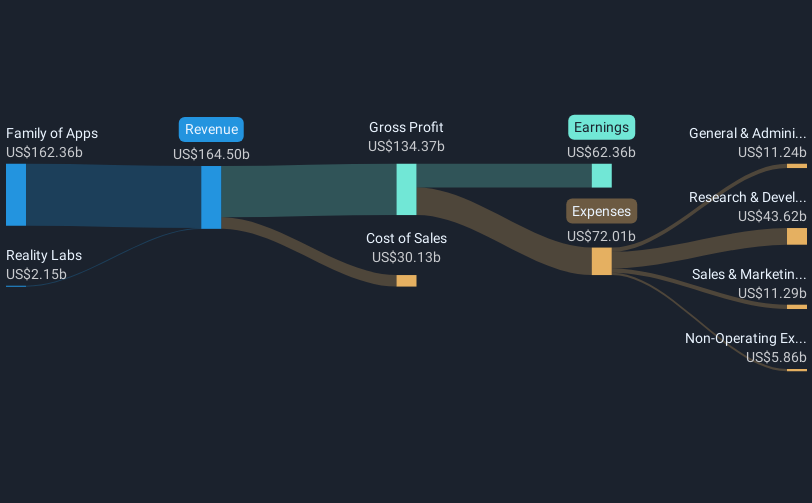

Over the past three years, Meta's total shareholder return, including share price and dividends, was 413.27%, a substantial gain that contrasts with its underperformance relative to the US Interactive Media and Services industry over the past year. While Meta exceeded the broader US Market's annual return of 18.5%, it lagged behind the industry's 48.1% return.

The news regarding AI advancements and expansions could positively impact Meta's revenue and earnings forecasts. Analysts project revenue growth of 13% per year, supported by increased ad performance and diversification across platforms. However, high investment in AI and the metaverse presents potential risks to margins and cash flow. The current share price, at $755.59, remains below the consensus price target of $863.20, indicating a potential 11.3% upside if growth expectations align with analyst projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026