- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

How Meta’s AI, Clean-Energy Deals and Smart Glasses Push (META) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, ACES Pest Control announced a company-wide rollout of Meta Smart Glasses for field technicians in New Zealand, while Meta and NextEra Energy Resources reached about 2.5 gigawatts of clean-energy contracts to support Meta’s operations across multiple US power markets.

- Together with Meta’s new dividend, fresh AI product launches, and mounting regulatory and advertising scrutiny, these developments highlight how the company is simultaneously scaling infrastructure, expanding use cases, and grappling with governance and trust risks.

- Against this backdrop, we’ll examine how Meta’s push into monetizable AI models like “Avocado” may reshape its long-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Meta Platforms Investment Narrative Recap

To own Meta today, you need to believe its AI driven advertising and product ecosystem can keep growing engagement and monetization faster than its swelling infrastructure and regulatory costs. The latest smart glasses deployment and clean energy deals are directionally aligned with that thesis, but they do not materially change the near term catalyst of turning heavy AI capex into visible earnings contribution, or the biggest risk of rising regulatory and governance scrutiny around ads and data.

The move toward a closed, monetizable AI model under the “Avocado” codename is the announcement that ties most directly to this story. It sits at the heart of whether Meta’s huge AI infrastructure build and incremental products, from SAM Audio to wearables, can evolve from cost center to revenue engine without amplifying regulatory, trust and content quality risks that could weigh on its core ad business.

Yet even as Meta leans harder into AI, the growing questions around ad quality, scams and regulatory pushback are something investors should be aware of as...

Read the full narrative on Meta Platforms (it's free!)

Meta Platforms' narrative projects $275.9 billion revenue and $92.1 billion earnings by 2028.

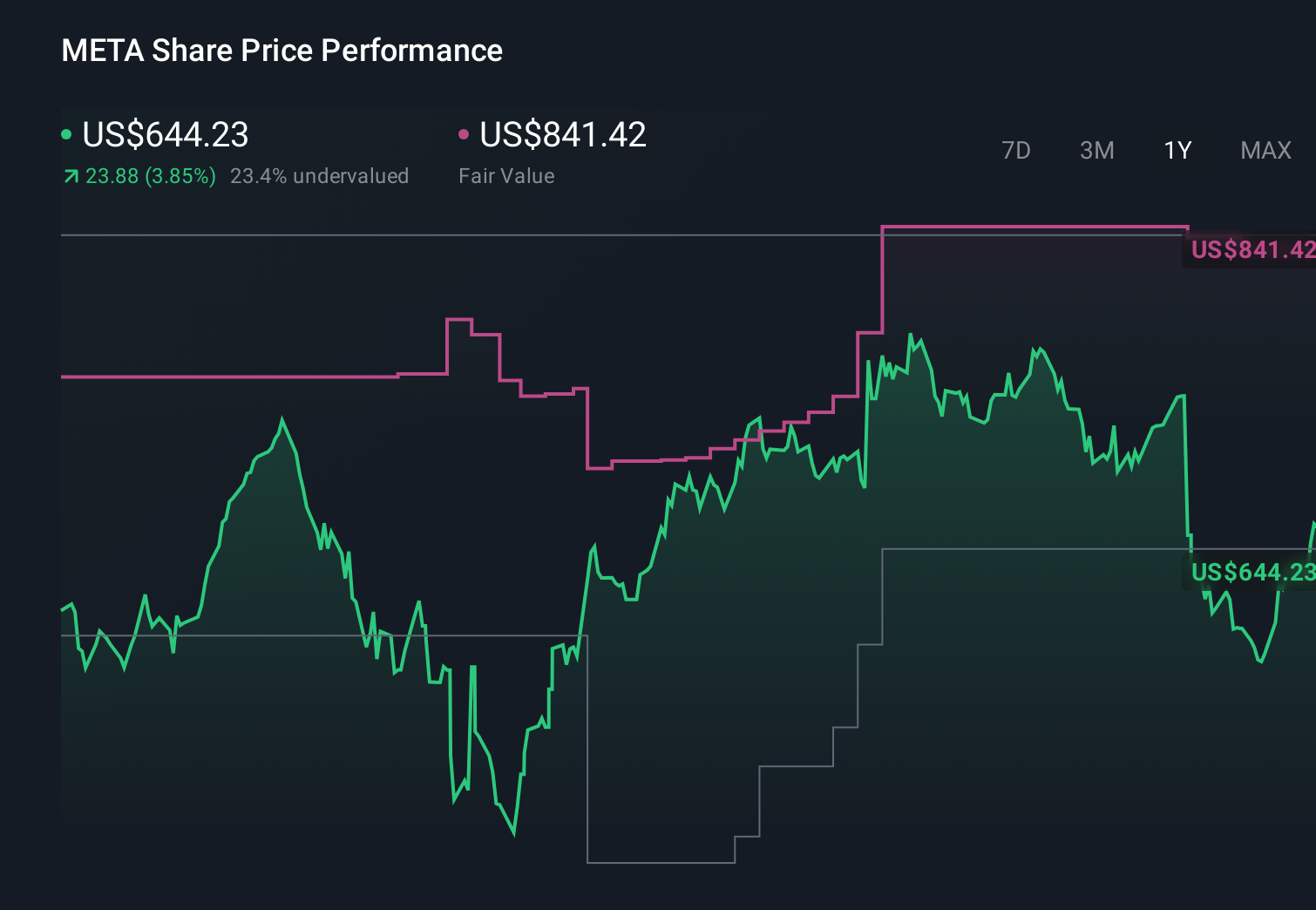

Uncover how Meta Platforms' forecasts yield a $841.42 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Eighty seven members of the Simply Wall St Community currently value Meta between US$538 and US$908 per share, with views spread across this full range. Against that backdrop, the key catalyst many are watching is whether Meta’s large AI infrastructure spend truly converts into sustained revenue growth, or instead pressures margins and future cash returns to shareholders.

Explore 87 other fair value estimates on Meta Platforms - why the stock might be worth 18% less than the current price!

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meta Platforms research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meta Platforms' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)