- United States

- /

- Media

- /

- NasdaqGS:LBRD.K

Why Liberty Broadband (LBRD.K) Is Down 8.0% After CEO Change and Spin-Off Announcement – And What's Next

Reviewed by Simply Wall St

- Earlier this month, Liberty Broadband announced the appointment of Marty E. Patterson as CEO and President in connection with a spin-off, with long-serving executive John C. Malone stepping down from those roles but continuing as Chairman of the Boards of Liberty Broadband and GCI Liberty.

- This leadership transition brings in Patterson's experience from both Liberty Media Corporation and Charter Communications, potentially influencing future company direction and operational priorities.

- We'll explore how the infusion of new executive leadership could shape Liberty Broadband's investment narrative amid ongoing corporate restructuring.

What Is Liberty Broadband's Investment Narrative?

To be a Liberty Broadband shareholder today, you likely need to be comfortable with both the company’s media assets and the ongoing complexity of its merger and spin-off activity, particularly its relationship with Charter Communications. The appointment of Marty E. Patterson as CEO and President marks a significant shift, stepping in as John Malone transitions to a Chairman-only role. This move could affect short-term catalysts around the timing and execution of the GCI business spin-off, which is a critical precursor to Charter’s proposed acquisition of Liberty Broadband. While Patterson’s background brings experience with both Liberty Media and Charter, recent market reaction suggests that investors may not see the leadership change as materially altering the investment case, Liberty's share price moved modestly after the news. However, operational focus and execution through the transition still remain immediate risks worth monitoring. On the other hand, there’s execution risk with the upcoming spin-off that investors should not overlook.

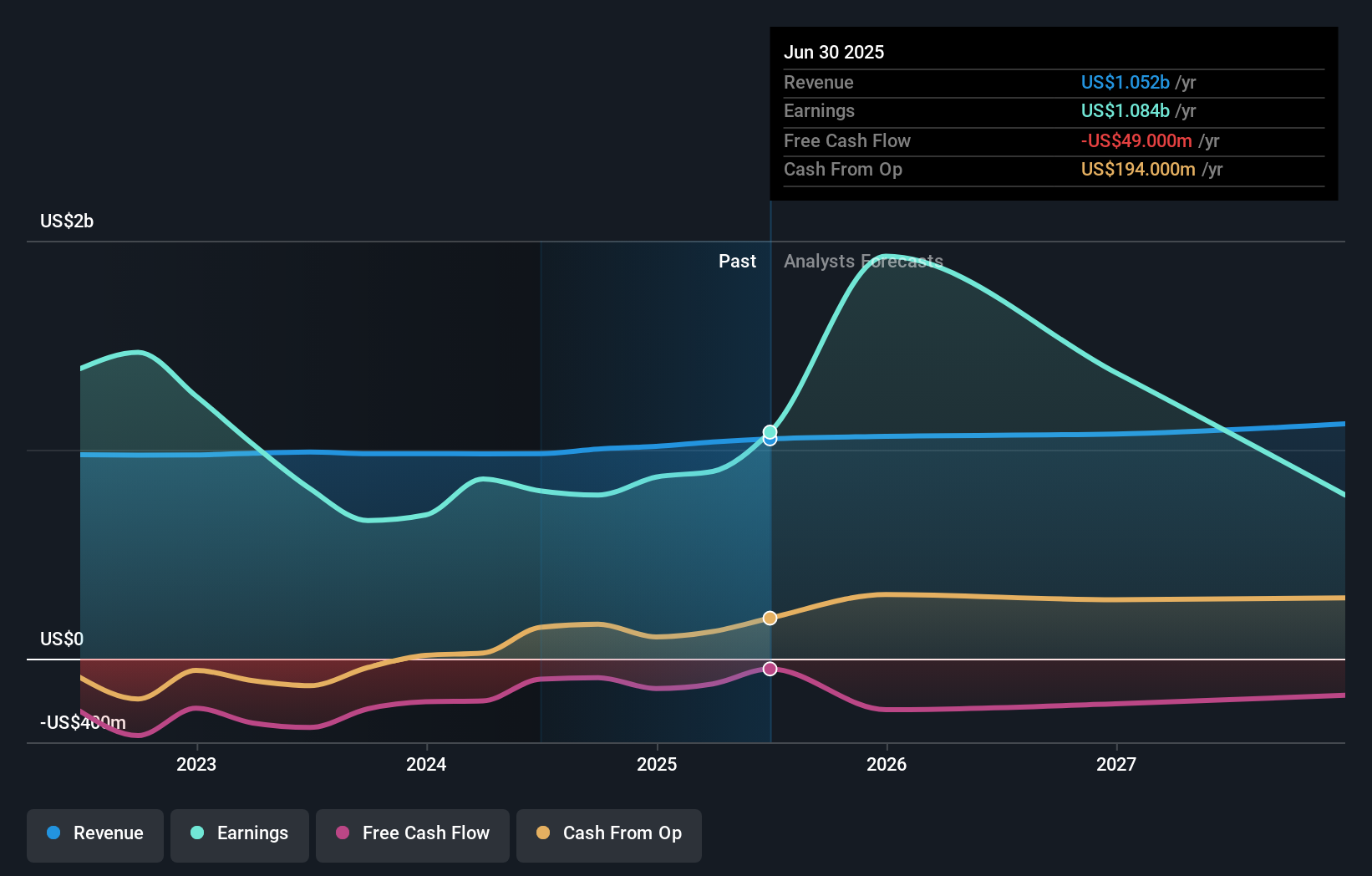

The valuation report we've compiled suggests that Liberty Broadband's current price could be inflated.Exploring Other Perspectives

Build Your Own Liberty Broadband Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liberty Broadband research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Liberty Broadband research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liberty Broadband's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LBRD.K

Liberty Broadband

Engages in a range of communications businesses in the United States.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives