- United States

- /

- Media

- /

- NasdaqGS:LBRD.K

While shareholders of Liberty Broadband (NASDAQ:LBRD.K) are in the red over the last three years, underlying earnings have actually grown

While not a mind-blowing move, it is good to see that the Liberty Broadband Corporation (NASDAQ:LBRD.K) share price has gained 21% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 50% in the last three years, significantly under-performing the market.

The recent uptick of 5.7% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Liberty Broadband

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, Liberty Broadband actually saw its earnings per share (EPS) improve by 33% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Revenue is actually up 8.8% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Liberty Broadband further; while we may be missing something on this analysis, there might also be an opportunity.

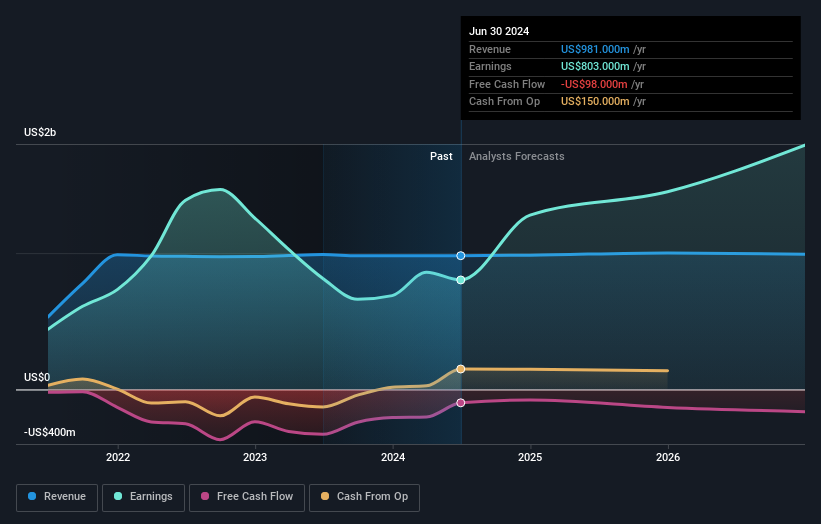

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Liberty Broadband has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Liberty Broadband's financial health with this free report on its balance sheet.

A Different Perspective

Liberty Broadband shareholders are up 1.3% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 6% endured over half a decade. It could well be that the business is stabilizing. Before spending more time on Liberty Broadband it might be wise to click here to see if insiders have been buying or selling shares.

Of course Liberty Broadband may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LBRD.K

Liberty Broadband

Engages in a range of communications businesses in the United States.

Fair value with moderate growth potential.

Market Insights

Community Narratives