- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:KRKR

Market Still Lacking Some Conviction On 36Kr Holdings Inc. (NASDAQ:KRKR)

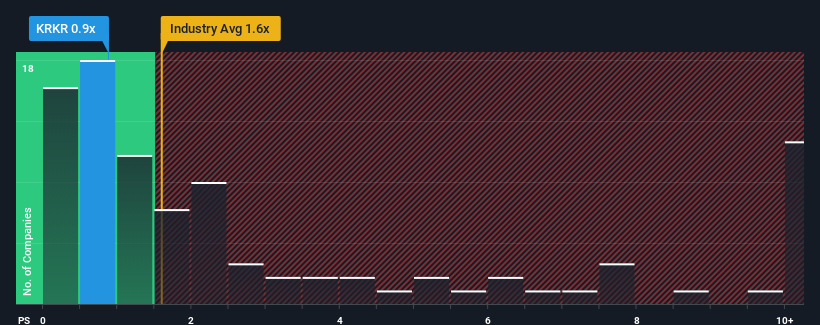

You may think that with a price-to-sales (or "P/S") ratio of 0.9x 36Kr Holdings Inc. (NASDAQ:KRKR) is a stock worth checking out, seeing as almost half of all the Interactive Media and Services companies in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for 36Kr Holdings

How Has 36Kr Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, 36Kr Holdings has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on 36Kr Holdings will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For 36Kr Holdings?

In order to justify its P/S ratio, 36Kr Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 48% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 9.3% growth forecast for the broader industry.

With this in consideration, we find it intriguing that 36Kr Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On 36Kr Holdings' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

36Kr Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for 36Kr Holdings that we have uncovered.

If these risks are making you reconsider your opinion on 36Kr Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if 36Kr Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KRKR

36Kr Holdings

Provides content and business services in the People's Republic of China.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives