- United States

- /

- Media

- /

- NasdaqGM:ICLK

The Market Lifts iClick Interactive Asia Group Limited (NASDAQ:ICLK) Shares 154% But It Can Do More

iClick Interactive Asia Group Limited (NASDAQ:ICLK) shareholders have had their patience rewarded with a 154% share price jump in the last month. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

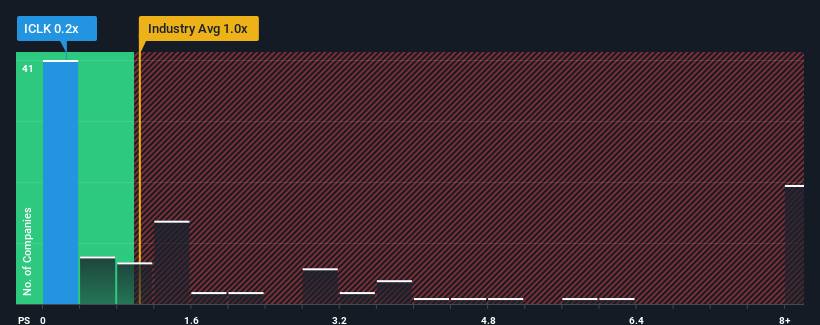

Even after such a large jump in price, iClick Interactive Asia Group's price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Media industry in the United States, where around half of the companies have P/S ratios above 1x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for iClick Interactive Asia Group

What Does iClick Interactive Asia Group's P/S Mean For Shareholders?

iClick Interactive Asia Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think iClick Interactive Asia Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like iClick Interactive Asia Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. As a result, revenue from three years ago have also fallen 48% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 24% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 4.0%, which is noticeably less attractive.

In light of this, it's peculiar that iClick Interactive Asia Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

iClick Interactive Asia Group's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems iClick Interactive Asia Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for iClick Interactive Asia Group (1 can't be ignored!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if iClick Interactive Asia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ICLK

iClick Interactive Asia Group

Provides online marketing services in Mainland China, Hong Kong, and internationally.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives