- United States

- /

- Media

- /

- NasdaqGS:IAS

Integral Ad Science (IAS): Revisiting Valuation After a 17.9% 90-Day Share Price Rebound

Reviewed by Simply Wall St

Integral Ad Science Holding (IAS) has been quietly grinding higher this past quarter, and that steady climb is catching more investor attention. With solid double digit revenue and earnings growth, the stock’s recent move invites a fresh look.

See our latest analysis for Integral Ad Science Holding.

Over the past year, Integral Ad Science Holding’s share price has been choppy, but a 17.9% 90 day share price return from a recent low suggests momentum is rebuilding as investors warm to its growth profile and improving profitability.

If this kind of steady re rating interests you, it is worth scanning fast growing stocks with high insider ownership to spot other fast moving companies where insiders have real skin in the game.

With shares still trading below some valuation estimates but not dramatically under Wall Street targets, the key question now is simple: is Integral Ad Science Holding genuinely undervalued, or is future growth already priced in?

Most Popular Narrative: 2.9% Undervalued

With Integral Ad Science Holding last closing at $10.28 against a narrative fair value near $10.59, the story leans modestly in favor of upside, setting the stage for one core growth driver.

The continued shift of ad budgets from traditional to digital channels, along with growing complexity in digital ad environments such as Connected TV (CTV), social media, and mobile apps, is driving sustained demand for IAS's cross platform verification and optimization solutions supporting long term revenue and customer base growth.

Want to see what this demand story looks like in numbers? Behind this fair value sits a powerful mix of rising margins, accelerating earnings, and a future profit multiple that assumes IAS keeps earning premium status in the ad tech stack. Curious which specific growth and profitability targets have to land for that price to hold up? Dive in to see the full narrative and the projections it is built on.

Result: Fair Value of $10.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view could unravel if key platform partners internalize verification tools, or if tighter privacy rules blunt IAS’s measurement and targeting advantages.

Find out about the key risks to this Integral Ad Science Holding narrative.

Another View on Value

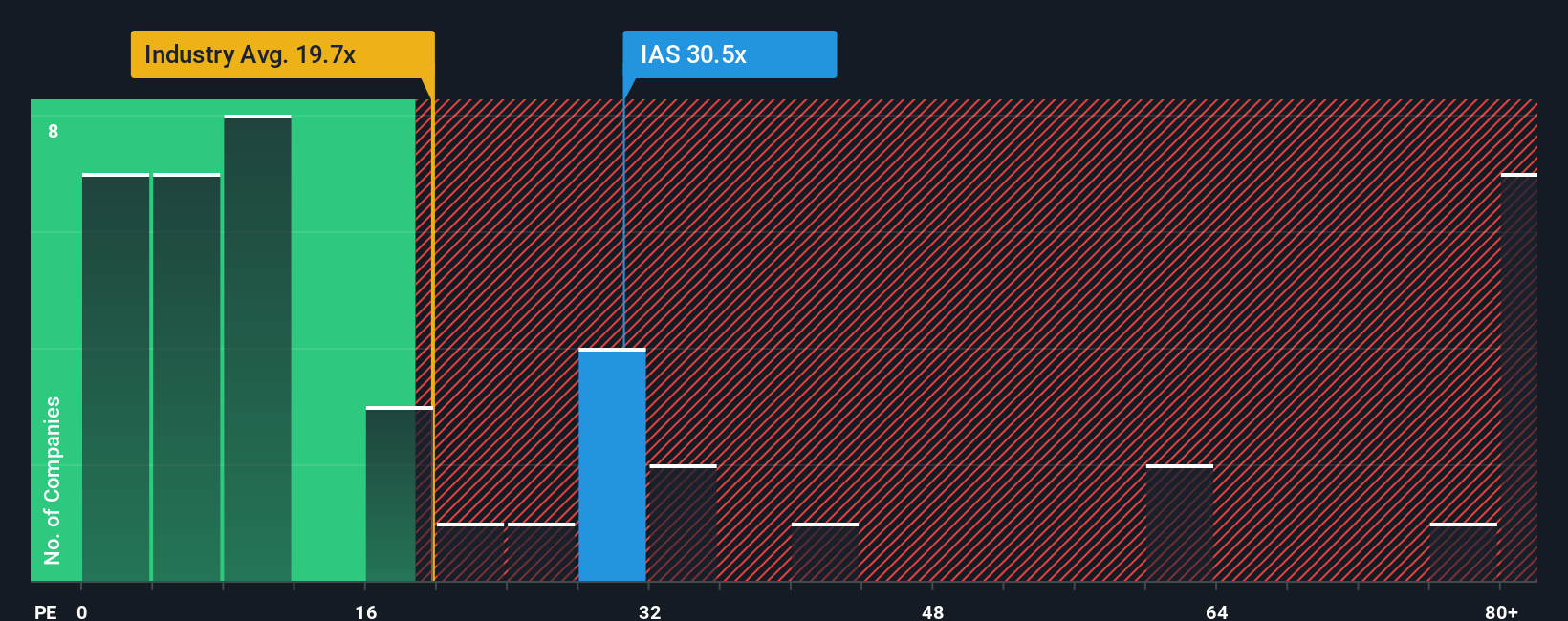

On earnings, IAS looks far less forgiving. The stock trades on a 36.9x price to earnings ratio, well above both the US Media industry at 15.4x and a 20.5x fair ratio, implying investors already pay up for growth. If the deal falters, does that premium still hold?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Integral Ad Science Holding Narrative

If you see the story differently or want to stress test the numbers yourself, you can spin up a fresh narrative in minutes: Do it your way.

A great starting point for your Integral Ad Science Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next opportunity by scanning targeted stock lists on Simply Wall Street’s Screener, so you are not leaving potential gains on the table.

- Capture early stage momentum by reviewing these 3576 penny stocks with strong financials that already show improving fundamentals and room for a serious re rating.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks at the crossroads of medical innovation and intelligent software.

- Strengthen your income stream by filtering for these 15 dividend stocks with yields > 3% that can help support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAS

Integral Ad Science Holding

Operates as a digital advertising verification company in the United States, the United Kingdom, Ireland, France, Germany, Spain, Italy, Singapore, Australia, Japan, India, and the Nordics.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026