- United States

- /

- Media

- /

- NasdaqGS:IAS

Integral Ad Science (IAS): Exploring Valuation After Recent 20% Climb in Investor Interest

Reviewed by Kshitija Bhandaru

See our latest analysis for Integral Ad Science Holding.

IAS has steadily built momentum, with the share price showing a nearly 20% gain in the last three months. While short-term share price returns show some choppiness, the stock’s 3-year total shareholder return of 29% points to meaningful long-term value creation and hints at underlying investor confidence in the company’s outlook.

If you’re curious what other media technology stocks are catching investor attention, now is a great time to expand your search and discover fast growing stocks with high insider ownership

With its recent surge, investors are left wondering if Integral Ad Science’s current share price leaves room for upside or if the market is already factoring in the company’s future growth and potential gains.

Most Popular Narrative: 15.9% Undervalued

Integral Ad Science Holding’s most widely followed narrative assigns it a fair value that is notably higher than its latest closing price. This suggests the stock still has undervalued potential that the market may not have fully recognized. It sets the stage for a debate over whether the company’s growth catalysts can drive further upside.

Ongoing product innovation, particularly in AI-driven optimization, contextual targeting, and fraud detection, allows IAS to monetize new service lines and extend premium pricing. This supports top-line revenue growth and improved gross margins. Expanding international market penetration, evidenced by strong adoption rates in EMEA and APAC, as well as strategic initiatives in China, increases IAS's global reach and drives operating leverage. These factors positively impact long-term earnings and profit margins.

Want to see what’s fueling this bullish fair value? The narrative is built on major shifts in profit margins, international expansion, and future growth rates you might not expect. Take a look to find out which bold assumptions are powering this valuation.

Result: Fair Value of $12.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in open web revenue and IAS’s reliance on major platform partnerships could pose challenges to sustaining its growth trajectory.

Find out about the key risks to this Integral Ad Science Holding narrative.

Another View: The Earnings Multiple Perspective

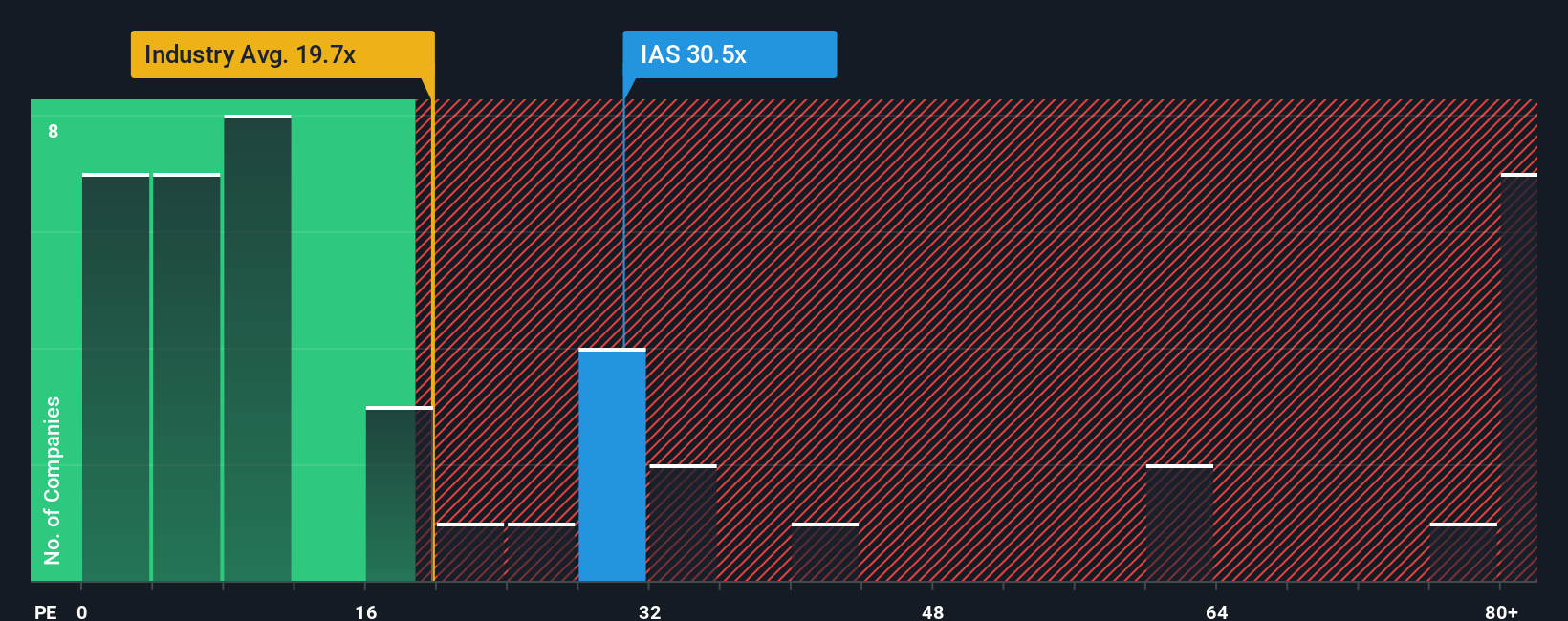

Taking a different angle, IAS is trading at a price-to-earnings ratio of 30.4x, which is much higher than both the US Media industry average of 20.2x and its calculated fair ratio of 20.5x. This suggests investors are pricing in significant future growth, but it also raises questions about potential overvaluation if those expectations are not met. Could this premium signal more risk than opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Integral Ad Science Holding Narrative

If you have a different take on the numbers or want to dive deeper into the details, building your own perspective is quick and simple with Do it your way.

A great starting point for your Integral Ad Science Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Make sure you’re not missing out by checking out powerful new ways to strengthen and future-proof your portfolio right now.

- Amplify your returns with reliable income streams by checking out these 19 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Spot tomorrow’s rapid movers by jumping into these 3563 penny stocks with strong financials offering unique growth advantages and early-stage innovation potential.

- Capitalize on trends shaping the next decade and see how these 31 healthcare AI stocks are harnessing the power of intelligent tech in medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAS

Integral Ad Science Holding

Operates as a digital advertising verification company in the United States, the United Kingdom, Ireland, France, Germany, Spain, Italy, Singapore, Australia, Japan, India, and the Nordics.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives