- United States

- /

- Media

- /

- NasdaqGS:IAS

Integral Ad Science Holding Corp.'s (NASDAQ:IAS) 26% Jump Shows Its Popularity With Investors

Integral Ad Science Holding Corp. (NASDAQ:IAS) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

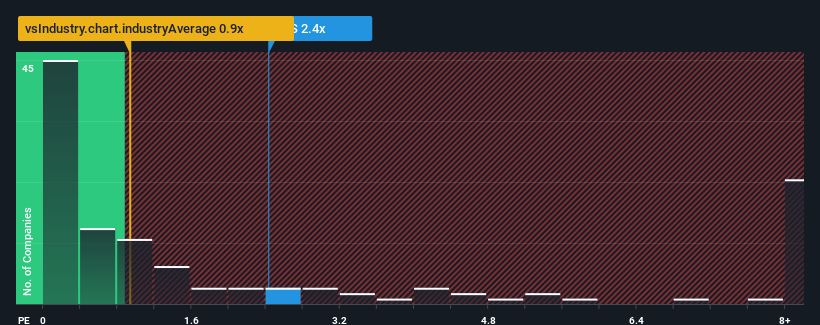

Following the firm bounce in price, you could be forgiven for thinking Integral Ad Science Holding is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in the United States' Media industry have P/S ratios below 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Integral Ad Science Holding

How Has Integral Ad Science Holding Performed Recently?

Integral Ad Science Holding certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Integral Ad Science Holding will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Integral Ad Science Holding?

In order to justify its P/S ratio, Integral Ad Science Holding would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The latest three year period has also seen an excellent 59% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 3.0% per annum growth forecast for the broader industry.

With this information, we can see why Integral Ad Science Holding is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Integral Ad Science Holding's P/S Mean For Investors?

Integral Ad Science Holding's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Integral Ad Science Holding's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Integral Ad Science Holding that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IAS

Integral Ad Science Holding

Operates as a digital advertising verification company in the United States, the United Kingdom, Ireland, France, Germany, Spain, Italy, Singapore, Australia, Japan, India, and the Nordics.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.