- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GTM

Should Investors Rethink ZoomInfo After Shares Drop 8% Despite AI Growth Hopes?

Reviewed by Bailey Pemberton

Wondering whether to hold on to ZoomInfo Technologies, make a move, or simply stay on the sidelines? You are not alone. This stock has been catching the eye of investors trying to decide if its latest moves are signs of a fresh start or a warning sign. After a fairly positive climb of 4.3% over the last 30 days, ZoomInfo’s stock took a modest dip this week, closing at $10.67, down 8.1% in the past seven days. For the year, it is up just 2.0%, though the path here has been anything but smooth. The stock still faces the shadow of a tough three-year stretch, having lost over 75% of its value in that period. That said, its one-year return is a surprising 11.6%, suggesting that some investors see renewed potential even as others remain cautious.

Broader market developments, like the ongoing shifts in technology spending and increased demand for data-driven business tools, have influenced the mood around ZoomInfo but have not been enough to fully reverse its challenging long-term trend. So where does this leave us on value? Using a common checklist approach, ZoomInfo is undervalued in 2 out of 6 key valuation checks, giving it a value score of 2. This might catch the attention of bargain hunters but leaves room for plenty of debate.

If you are curious about what these valuation methods tell us about ZoomInfo Technologies, keep reading. We will break down each approach and, later on, reveal one overlooked way of thinking about whether this stock belongs in your portfolio.

ZoomInfo Technologies scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ZoomInfo Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation approach that estimates a company’s intrinsic value by forecasting its future cash flows and then discounting them back to their present value. The idea is straightforward: if you know what a company might earn in the coming years, you can calculate how much that future stream is worth today.

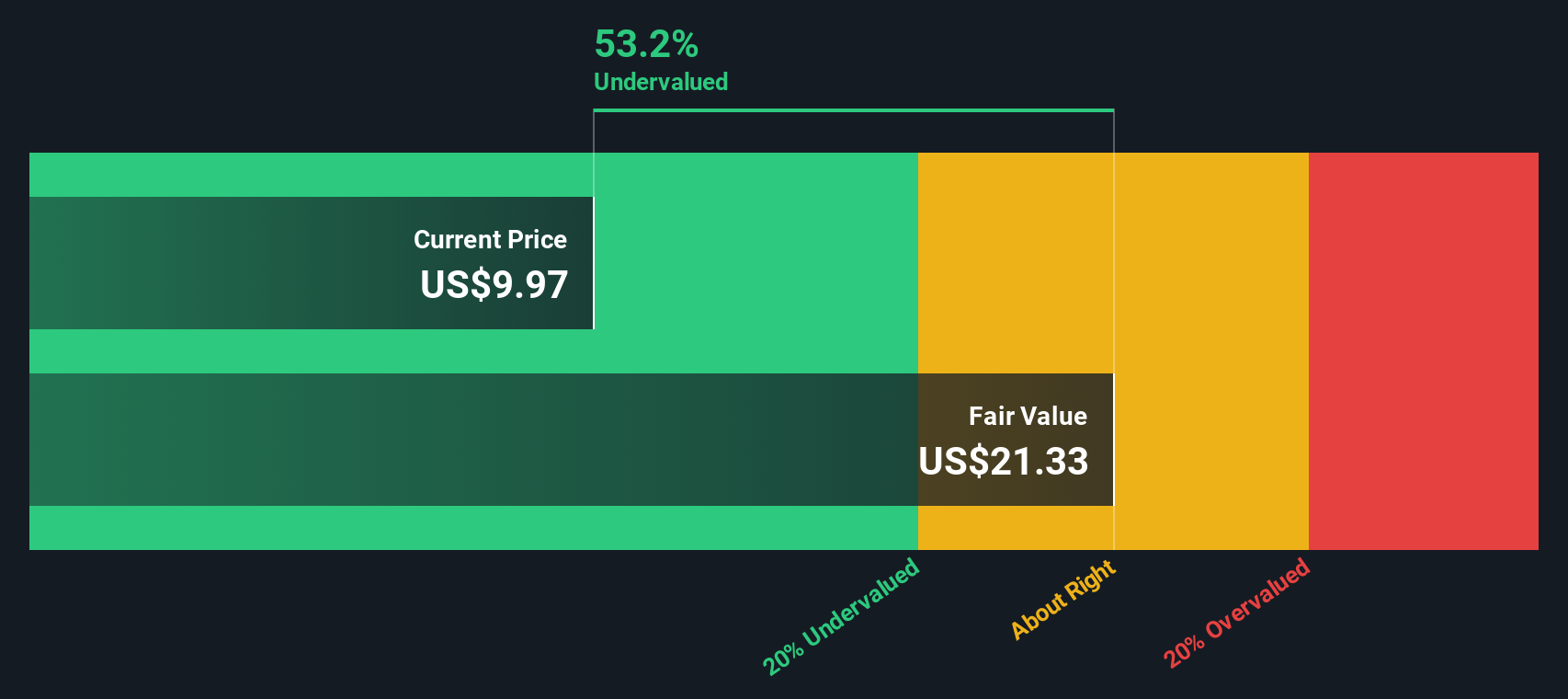

For ZoomInfo Technologies, the DCF uses the 2 Stage Free Cash Flow to Equity model. The company has a current Free Cash Flow (FCF) of $307.6 million. According to analyst estimates and projections, this figure is expected to steadily increase, with FCF reaching $478 million by the end of 2029. Beyond the forecasted years, specialist platforms like Simply Wall St extrapolate additional growth, but for this analysis, most weight is given to the next five years, which show rising FCF with each step.

Based on these assumptions and discounted at appropriate rates, the estimated intrinsic value is $21.36 per share. With shares currently trading at $10.67, the DCF implies the stock is around 50% undervalued compared to its intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ZoomInfo Technologies is undervalued by 50.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: ZoomInfo Technologies Price vs Earnings

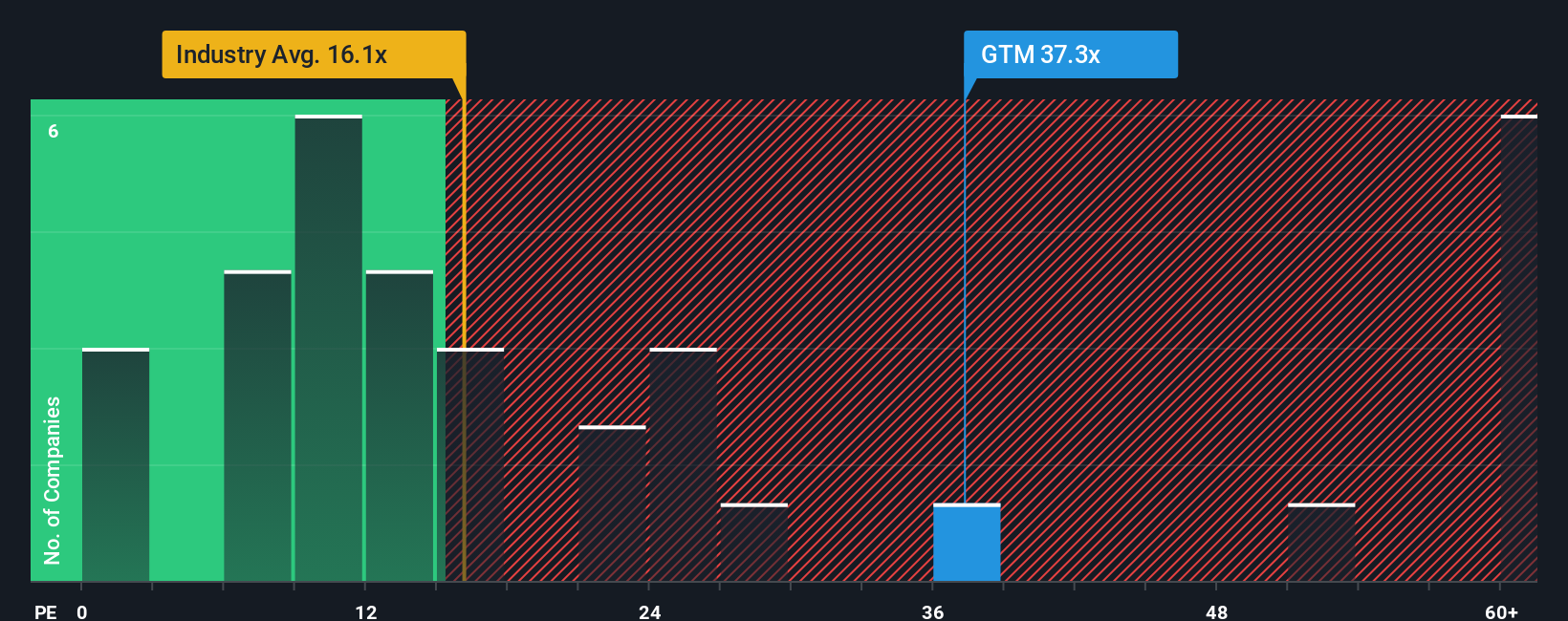

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics, particularly for profitable companies like ZoomInfo Technologies. This financial yardstick helps investors gauge how much they are paying for every dollar of earnings, offering a straightforward snapshot of market expectations.

Growth expectations and risk play a big part in shaping what a fair PE ratio should be. High-growth companies typically command higher PE multiples, while firms with uncertain prospects or greater risk tend to trade at lower multiples. For ZoomInfo, keeping an eye on its earnings trajectory, industry dynamics, and relative risks helps put its current valuation into context.

Right now, ZoomInfo trades at a PE ratio of 38.1x. This is significantly above the industry average PE of 17.1x and higher than the peer average of 10.1x. This reflects the market’s anticipation of above-average growth or profitability. However, numbers alone do not tell the whole story. Simply Wall St’s proprietary “Fair Ratio” is calculated at 23.2x and factors in not just industry or peer benchmarks, but also ZoomInfo’s actual earnings growth, profit margins, size, and risk profile.

Unlike plain industry or peer comparisons, the Fair Ratio provides investors a more tailored benchmark for a company's valuation. It adjusts for the nuances of ZoomInfo’s unique position, growth prospects, and financial health rather than assuming a one-size-fits-all standard.

With ZoomInfo’s actual PE ratio at 38.1x compared to a Fair Ratio of 23.2x, the stock appears to be valued higher than what its fundamentals suggest. The sizable gap points to an overvalued condition on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ZoomInfo Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible framework that lets you connect your unique perspective on a company, considering how you believe its industry, leadership, and market are evolving, with a personalized financial forecast and fair value. Instead of focusing solely on traditional ratios or analyst opinions, Narratives empower you to link the company's story with concrete numbers like future revenue, earnings, and margins, helping you determine what you think the stock should be worth.

Narratives are available to millions of investors on Simply Wall St’s Community page and are designed to be dynamic. They automatically update as new information, such as news or earnings reports, becomes available. By comparing your Narrative’s fair value to the current price, you can make smarter, more informed decisions about when to buy or sell. For example, in the case of ZoomInfo Technologies, some investors see rapid AI adoption and product innovation driving future growth, leading to fair values as high as $15.00. Others are cautious about risks such as client concentration or regulatory changes, estimating a fair value closer to $7.00. Narratives make it easy to see and adjust your own view, so you can act with confidence as market conditions change.

Do you think there's more to the story for ZoomInfo Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZoomInfo Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTM

ZoomInfo Technologies

Provides go-to-market intelligence and engagement platform for sales, marketing, operations, and recruiting professionals in the United States and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives