- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Evaluating Alphabet After Recent LA28 Olympics Cloud Partnership and Share Price Volatility

Reviewed by Bailey Pemberton

If you’re wondering what to do with Alphabet stock right now, you’re not alone. Investors have been sizing up every move as headlines and market shifts keep the conversation lively. Over the past year, Alphabet’s share price rocket has been hard to ignore: the stock is up a whopping 45.6% over twelve months and more than doubled over five years with a 203.9% gain. That said, the last month has been bumpier, with a modest 1.6% dip, and the past week saw a 3.6% slide, hinting at some nerves about short-term risks and new competitors muscling in on video content.

Recent news highlights two sides of the Alphabet story. On one hand, Google’s cloud division just landed a huge partnership as the official cloud provider for the LA28 Olympics, showing the company’s innovation and global relevance. On the other, regulatory and legal pressure won’t let up. New York City’s lawsuit over social media’s influence on kids and the Supreme Court’s decision not to halt changes to the Play Store both remind us that risk is part of the package.

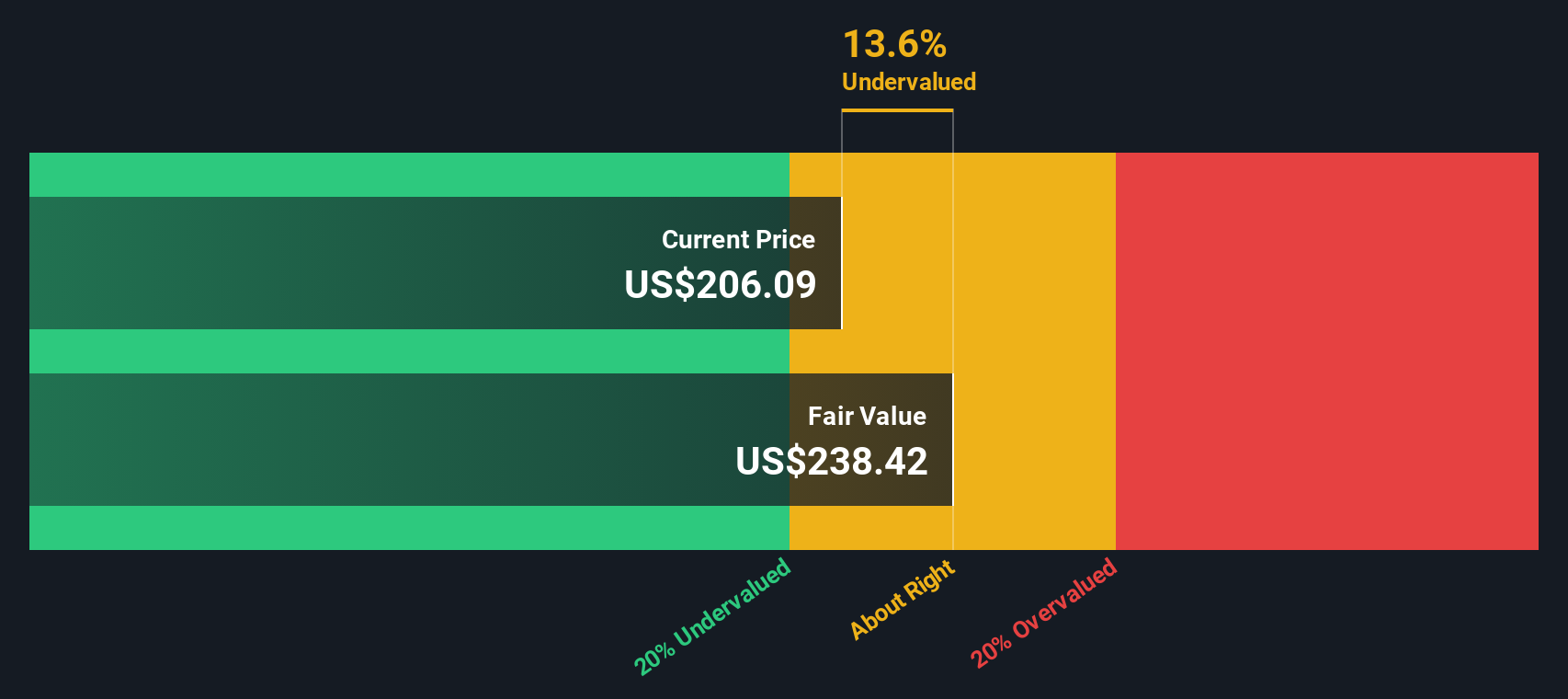

So, with excitement about what’s ahead but also awareness about fresh challenges, is Alphabet a good value today? Our scorecard says the company is undervalued in 3 out of 6 key valuation checks, putting its value score at 3. Next, we’ll dig into each valuation method, but hang tight: I’ll also share my favorite, often-overlooked way to judge stock value later in the article.

Approach 1: Alphabet Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future cash flows and discounting them back to today’s dollars. For Alphabet, the model starts with its latest trailing twelve months’ Free Cash Flow, which stands at $81.4 billion. Analysts provide FCF forecasts for the next five years, expecting cash generation to climb steadily. By 2029, Simply Wall St extends these estimates and projects Alphabet’s FCF could reach $140.7 billion.

DCF models consider not just raw growth but also how future cash is valued less than money in hand now. For Alphabet, this detailed, two-stage DCF approach results in an intrinsic value estimate of $245.99 per share.

Compared to Alphabet’s recent share price, this figure implies that the stock is 3.8% undervalued. That is a small gap and it is well within the typical margin of error for valuation models. In other words, the market’s current pricing is pretty much in line with the underlying cash flow projections.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Alphabet's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Alphabet Price vs Earnings (PE)

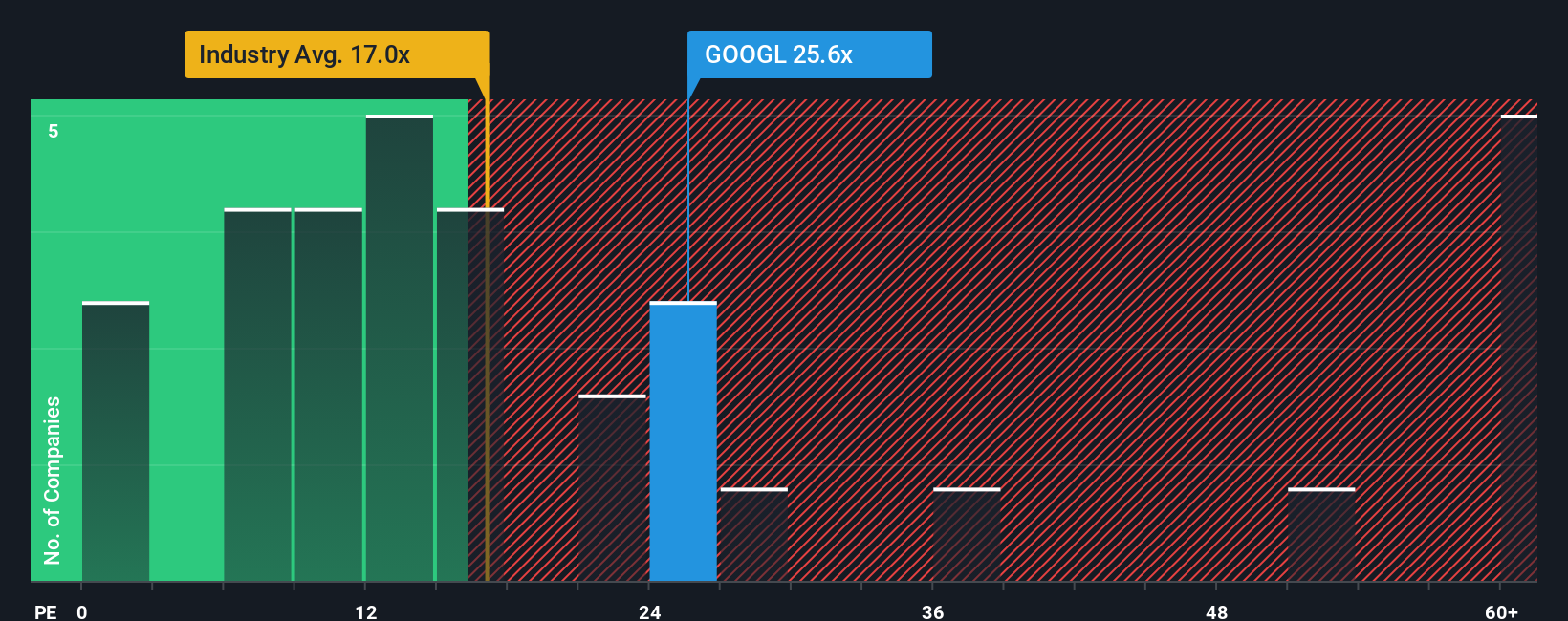

The Price-to-Earnings (PE) ratio is a favored yardstick for valuing consistently profitable companies like Alphabet because it directly links share price with bottom-line results. It is especially useful when assessing mature tech giants with stable earnings streams, letting investors compare how much they are paying for each dollar of profit.

A company’s “normal” or “fair” PE ratio depends on growth expectations and risk. Higher growth firms or those with lower risk profiles usually command loftier PE multiples, while slower-growth or riskier companies typically have lower ratios. So, when benchmarking, it is crucial to weigh Alphabet’s growth outlook and risk against its competition.

Currently, Alphabet trades at a PE ratio of 24.8x. That is well above the Interactive Media and Services industry average of 15.3x, yet dramatically below the peer group average of 54.6x. On the surface, it can seem expensive relative to the industry, but cheap compared to similar tech giants.

To cut through these mixed signals, Simply Wall St’s Fair Ratio comes into play. This proprietary metric calculates a benchmark multiple, in this case 41.3x, based on Alphabet’s earnings growth, profit margins, risks, industry dynamics, and market cap. This tailored analysis is more insightful than simple peer or industry comparisons because it adjusts for company-specific realities instead of relying on potentially misleading averages.

Comparing Alphabet’s actual PE ratio (24.8x) to its Fair Ratio (41.3x), the stock currently trades below our calculated fair value range based on its fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alphabet Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, a smarter, more dynamic approach to investing that goes beyond formulas and ratios. A Narrative is your personal story and perspective on a company, connecting what you believe about its future (such as revenue growth, margins, and risks) directly to a financial forecast and a fair value estimate.

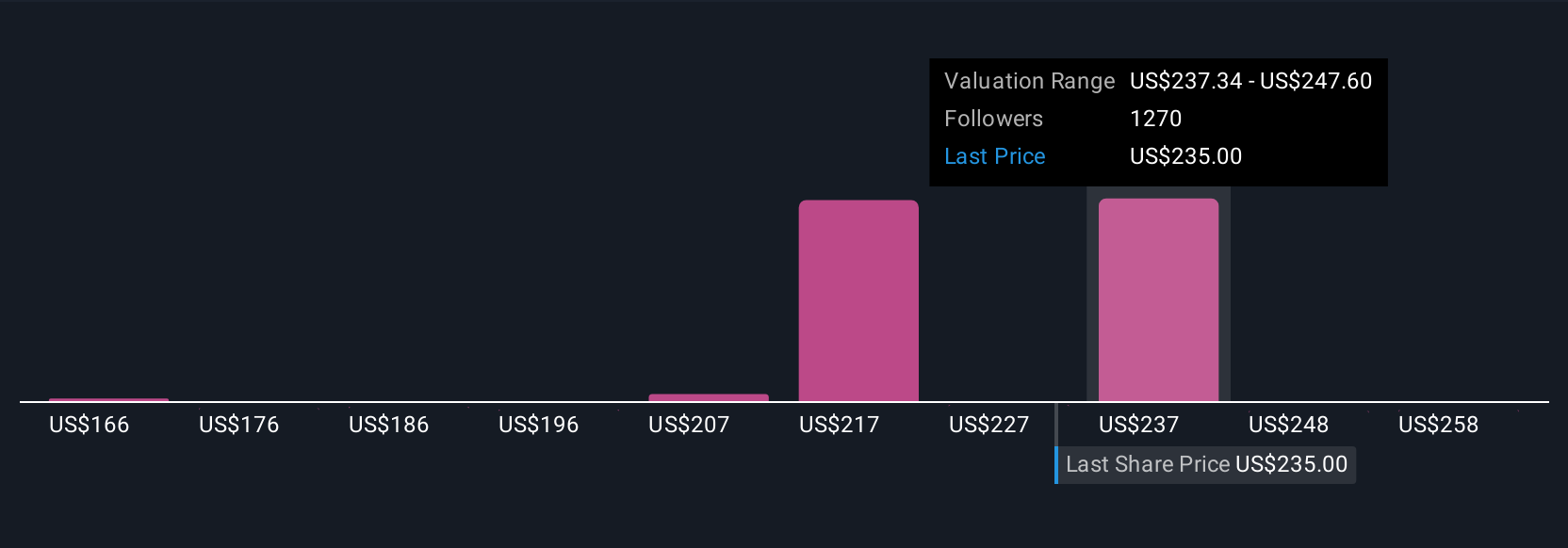

Narratives make the numbers meaningful; they allow investors to map out their assumptions about Alphabet’s business and see how those beliefs translate to target prices and buy/sell decisions. Best of all, Narratives are easy to create and compare on Simply Wall St’s Community page, which is used by millions of investors.

Narratives dynamically update in response to new developments, such as earnings releases or breaking news, so your view can evolve as the facts do. For example, some investors are highly optimistic, seeing Alphabet’s fair value above $260 per share on robust AI and Cloud expansion, while others are more cautious, estimating a value closer to $170 amid competitive and regulatory headwinds. Narratives ensure you’re making decisions with context, not just a spreadsheet number.

For Alphabet, however, we'll make it really easy for you with previews of two leading Alphabet Narratives:

Fair Value: $237.43

Current Price is 0.4% below fair value

Expected Revenue Growth Rate: 18.03%

- Alphabet is viewed as the most undervalued among the "Magnificent 7" tech giants, with strong fundamentals, leading positions in search, advertising, AI, and cloud computing.

- The business demonstrates robust financial strength, significant cash holdings, and ongoing innovation, including heavy investment in AI infrastructure and growing Cloud and YouTube segments.

- Short-term risks such as regulatory challenges and macroeconomic slowdowns are seen as overstated. Long-term growth opportunities include AI integration, cloud expansion, and diversified revenue streams.

Fair Value: $212.34

Current Price is 11.4% above fair value

Expected Revenue Growth Rate: 13.47%

- Google’s leadership in search and digital advertising is expected to fuel continued, but steadier, revenue growth rather than explosive gains. Cloud computing remains a supportive trend.

- The adoption of generative AI will be incremental due to prohibitive costs and a deliberate rollout, with substantial financial impact possibly several years away.

- Risks include high reliance on advertising revenue, potential overregulation of AI technologies, and the threat of competitors gaining market share if Google does not adapt quickly enough to industry shifts.

Do you think there's more to the story for Alphabet? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives