- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (GOOGL) Reports Strong Q2 Earnings With Sales Reaching US$96 Billion

Reviewed by Simply Wall St

Alphabet (GOOGL)'s robust second-quarter results, showcasing a 14% increase in sales and a significant rise in net income, align with a 19% price increase over the last quarter. This surge reflects the company's strong performance, supported by a stock buyback initiative and inclusion in several key indexes. The strategic partnership with OpenAI also bolstered confidence, while the launch of a new product with Dolby Laboratories and Lenovo further highlighted the company's innovation drive. These developments added weight to broader market trends, where the market rose 1.7% in the past week and 18% over the past year.

Buy, Hold or Sell Alphabet? View our complete analysis and fair value estimate and you decide.

The recent developments surrounding Alphabet, including a solid increase in sales and a strategic partnership with OpenAI, could reinforce its growth narrative centered around AI advancements and diversification through Waymo. These initiatives may bolster revenue prospects and operational efficiency, aligning with expectations for significant expansion in subscription services and cloud offerings. Particularly, AI-driven tools are likely to stimulate advertising revenue growth, contributing to a broader financial improvement.

Over a five-year period, Alphabet's total return, including share price and dividends, was a substantial 151.22%. This performance showcases the company's strength and long-term growth potential, providing crucial context relative to the more recent one-year performance, where Alphabet underperformed the broader US market, which returned 17.7%. This contrasts with the short-term share price increase highlighted in the introduction, emphasizing the necessity of assessing Alphabet's long-term trajectory alongside its immediate market reactions.

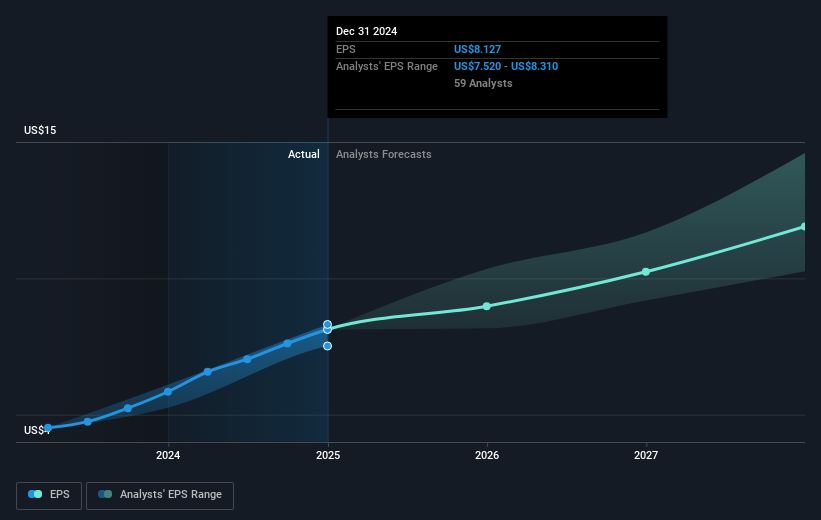

The recent share price movement of Alphabet, reaching US$190.23, is substantial in the context of the consensus price target of approximately US$206.34, indicating a price target discount of 8.5%. This suggests that while the share price has seen a favorable uptick, there remains a moderate gap to the analyst consensus target, reflecting market confidence in the company's growth prospects. Ongoing enhancements in AI and infrastructure, coupled with robust subscriber growth, could further influence future revenue and earnings forecasts, aligning with Alphabet's overall strategy for sustainable financial performance.

Review our historical performance report to gain insights into Alphabet's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives