- United States

- /

- Media

- /

- NasdaqGM:GAMB

How Strong Earnings Growth at Gambling.com Group (GAMB) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent months, Gambling.com Group reported strong earnings growth attributed to heavy reinvestment in its business, despite a 35% drop in its stock over the preceding three months.

- This financial performance has captured attention, especially as analyst estimates suggest the company’s earnings could continue to gain momentum moving forward.

- We’ll explore how Gambling.com Group’s robust earnings growth, driven by reinvestment, could influence its overall investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Gambling.com Group Investment Narrative Recap

To own shares in Gambling.com Group today, you need to believe that hefty reinvestment and consistent revenue growth can overcome recent share price weakness and margin pressure. The news of strong earnings has not materially altered the key short-term catalyst: continued state-by-state liberalization in US online gambling. However, it does little to diminish the principal risk from declining high-quality search traffic, which could further squeeze profit margins if the shift toward costlier traffic channels continues.

Among recent developments, the company's decision to increase its share buyback program by US$10 million, following this quarter’s results, stands out. This move coincides with a period of steep share price declines and may reflect confidence in the business’s underlying growth prospects, especially as management has maintained guidance for robust top-line expansion, keeping the focus on market-driven catalysts for future performance.

Yet, despite these strengths, investors should be aware that pressure on margins from changes in digital search traffic could weigh on returns if...

Read the full narrative on Gambling.com Group (it's free!)

Gambling.com Group's outlook anticipates $233.8 million in revenue and $63.3 million in earnings by 2028. This scenario assumes 16.5% annual revenue growth and an increase in earnings of $49 million from the current $14.3 million.

Uncover how Gambling.com Group's forecasts yield a $14.14 fair value, a 77% upside to its current price.

Exploring Other Perspectives

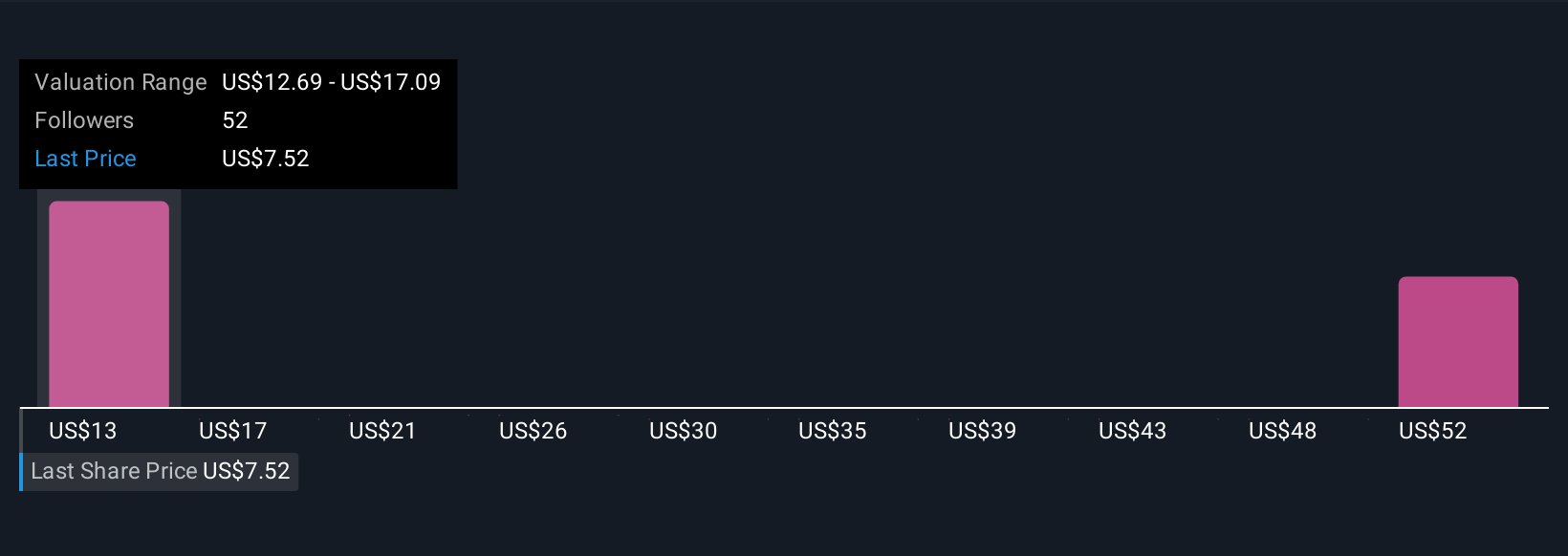

Eleven members of the Simply Wall St Community have estimated Gambling.com Group's fair value between US$12.69 and US$56.61. While many anticipate growth, several highlight the potential risk that ongoing shifts in search engine traffic could impact the company's earnings trajectory. Compare these views to your own outlook before making any decisions.

Explore 11 other fair value estimates on Gambling.com Group - why the stock might be worth over 7x more than the current price!

Build Your Own Gambling.com Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gambling.com Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Gambling.com Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gambling.com Group's overall financial health at a glance.

No Opportunity In Gambling.com Group?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GAMB

Gambling.com Group

Operates as a performance marketing company for the online gambling industry in North America, the United Kingdom, Ireland, rest of Europe, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives