- United States

- /

- Entertainment

- /

- NasdaqGM:GAIA

Health Check: How Prudently Does Gaia (NASDAQ:GAIA) Use Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Gaia, Inc. (NASDAQ:GAIA) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Gaia

What Is Gaia's Net Debt?

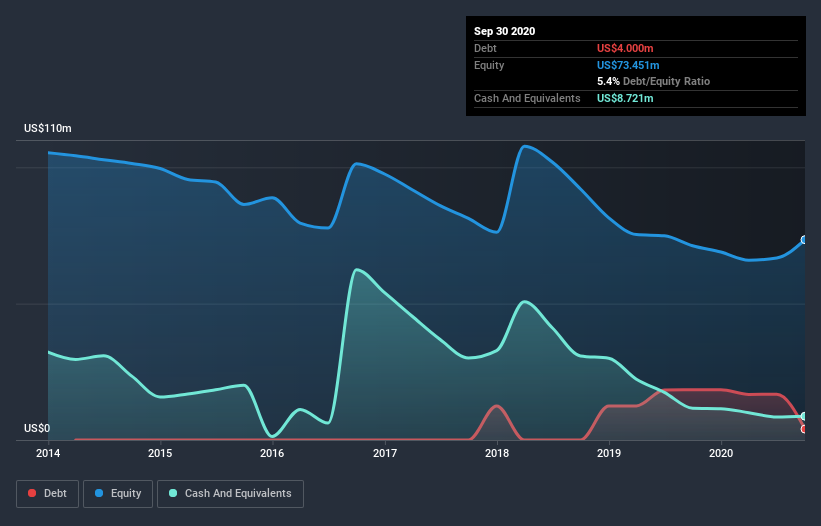

The image below, which you can click on for greater detail, shows that Gaia had debt of US$4.00m at the end of September 2020, a reduction from US$18.4m over a year. However, its balance sheet shows it holds US$8.72m in cash, so it actually has US$4.72m net cash.

How Healthy Is Gaia's Balance Sheet?

According to the last reported balance sheet, Gaia had liabilities of US$20.9m due within 12 months, and liabilities of US$12.4m due beyond 12 months. On the other hand, it had cash of US$8.72m and US$2.36m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$22.3m.

Since publicly traded Gaia shares are worth a total of US$198.7m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Gaia also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Gaia can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Gaia wasn't profitable at an EBIT level, but managed to grow its revenue by 23%, to US$63m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Gaia?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Gaia had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$3.6m and booked a US$2.6m accounting loss. Given it only has net cash of US$4.72m, the company may need to raise more capital if it doesn't reach break-even soon. Gaia's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Gaia (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Gaia or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:GAIA

Gaia

Operates a digital video subscription service and online community for underserved member base in the United States, Canada, Australia, and internationally.

Reasonable growth potential with mediocre balance sheet.