- United States

- /

- Entertainment

- /

- NasdaqGS:FWON.K

Surging F1 Revenues Might Change The Case For Investing In Formula One Group (FWON.K)

Reviewed by Sasha Jovanovic

- Formula One Group recently reported quarterly results that significantly exceeded expectations, with Primary F1 revenues growing 40% year-over-year due to a favorable race calendar and an improved mix of events.

- This performance spotlights the company's ability to monetize global fan engagement and underscores the momentum behind its commercial expansion initiatives.

- We'll explore how Formula One Group's stronger-than-expected quarterly revenue growth supports and challenges the longer-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Formula One Group Investment Narrative Recap

To own Formula One Group stock, you have to believe in the continued global expansion and monetization of its fan base, as well as the brand’s ability to generate higher-margin revenues through new digital platforms and partnerships. The surge in Primary F1 revenues this quarter strengthens short-term optimism, but the premium valuation means any faltering in execution, revenue mix, or cost management could swiftly become a risk; right now, the recent news primarily impacts sentiment rather than changing key catalysts or risks.

One recent announcement closely linked to this positive momentum is the new partnership with Sting Energy, the Official Energy Drink Partner of Formula 1. This deal aims to expand immersive fan experiences at races, supporting Formula One Group’s commercial growth and aligning with the catalyst of monetizing its younger, global audience through innovative sponsorships and on-site activations.

On the other hand, investors should be aware that periods of strong revenue growth aren’t always repeatable, especially if boosted by one-off factors like the recent F1 movie...

Read the full narrative on Formula One Group (it's free!)

Formula One Group's outlook anticipates $5.3 billion in revenue and $758.1 million in earnings by 2028. This reflects an annual revenue growth rate of 11.3% and a $485.1 million increase in earnings from the current $273.0 million.

Uncover how Formula One Group's forecasts yield a $115.87 fair value, a 9% upside to its current price.

Exploring Other Perspectives

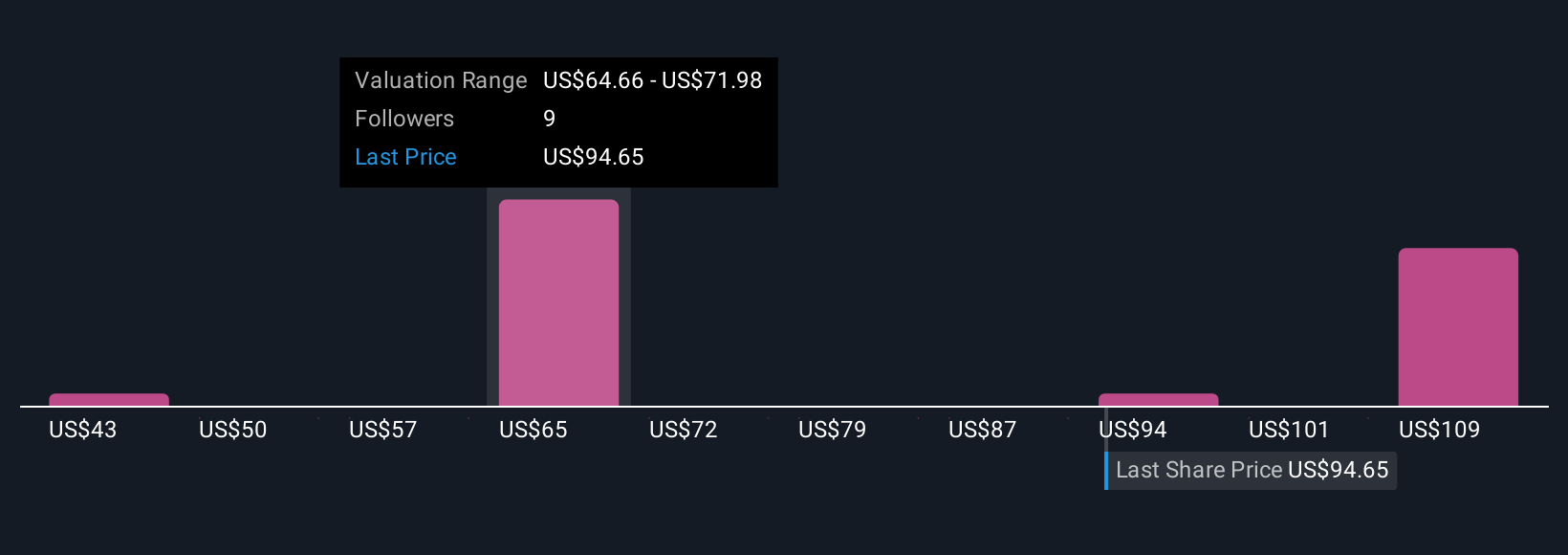

Simply Wall St Community members estimate Formula One Group’s fair value from US$42.72 to US$115.87, spanning 4 unique viewpoints. With such diverse opinions, especially given the company's high price-to-earnings ratio, you can see how forecasts for future profitability may differ widely.

Explore 4 other fair value estimates on Formula One Group - why the stock might be worth as much as 9% more than the current price!

Build Your Own Formula One Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Formula One Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Formula One Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Formula One Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWON.K

Formula One Group

Engages in the motorsports business in the United States and the United Kingdom.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives