- United States

- /

- Entertainment

- /

- NasdaqGS:FWON.K

How Investors May Respond To Formula One Group (FWON.K) Leadership Transition as Bennett Replaces Malone

Reviewed by Sasha Jovanovic

- Liberty Media Corporation has announced that effective January 1, 2026, long-standing Chairman John C. Malone will step down from the board and transition to Chairman Emeritus, with Vice Chairman Robert R. Bennett set to become Chairman of the Board.

- This leadership transition involves one of Liberty's most influential figures and may prompt investors to reconsider Formula One Group's strategic direction as Bennett takes the helm.

- We'll explore how the upcoming change in board leadership could influence Formula One Group’s growth and expansion outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Formula One Group Investment Narrative Recap

At its core, holding Formula One Group stock means believing in the global expansion of the F1 brand, growing fan engagement, and the business’s ability to monetize these trends through new races and digital initiatives. The upcoming transition to Robert R. Bennett as Chairman, while significant given John Malone’s stature, is not expected to have an immediate material impact on the main short-term catalyst, ongoing monetization of fan growth, especially in the U.S., or fundamentally change the biggest immediate risk, which is the reliance on one-off revenue sources that could make year-over-year comparisons volatile. Among recent developments, the partnership with Sting Energy is particularly relevant as it strengthens F1’s focus on immersive fan experiences and commercial partnerships, supporting the near-term catalyst of higher sponsorship and hospitality revenue. This aligns closely with the company’s strategy to widen its revenue base beyond core race income and tap into global consumer brands. However, despite these efforts, the risk of cost pressures outpacing top-line growth as operations expand is something investors should watch out for given...

Read the full narrative on Formula One Group (it's free!)

Formula One Group's narrative projects $5.3 billion in revenue and $758.1 million in earnings by 2028. This requires 11.3% yearly revenue growth and a $485.1 million earnings increase from current earnings of $273.0 million.

Uncover how Formula One Group's forecasts yield a $115.87 fair value, a 21% upside to its current price.

Exploring Other Perspectives

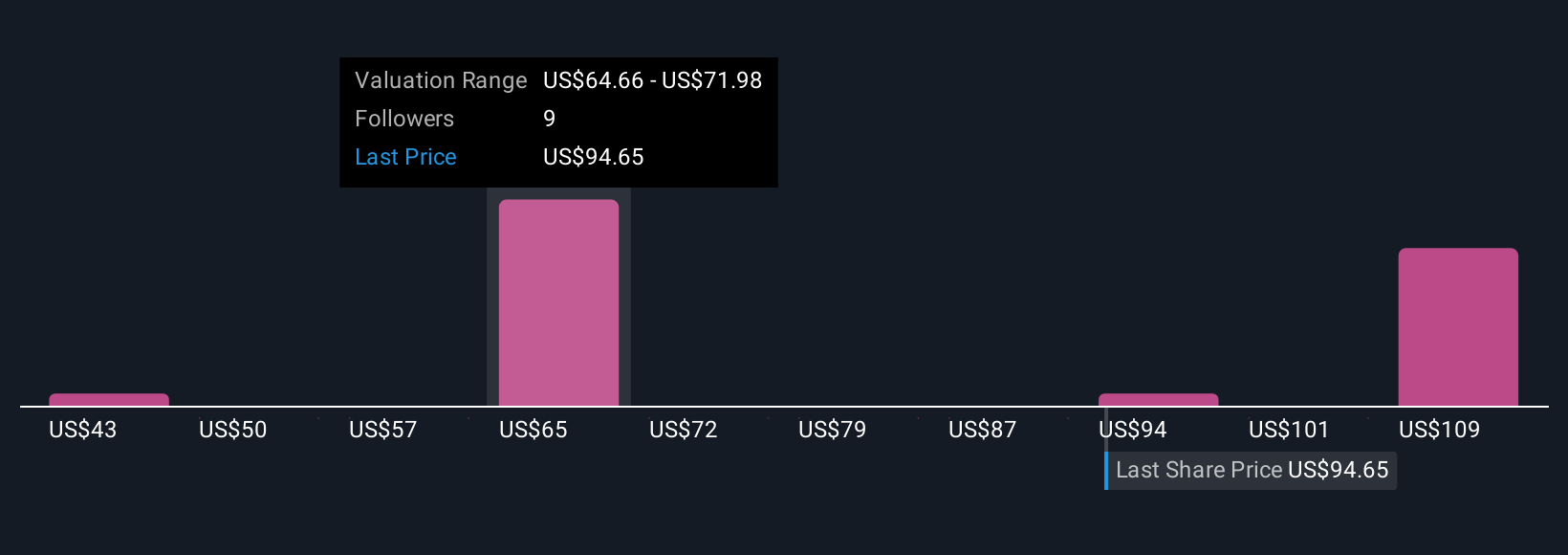

Four fair value estimates from the Simply Wall St Community range from US$42.72 to US$115.87 per share, covering a broad spectrum of outlooks. While some expect significant upside, many remain mindful of the company’s dependence on non-recurring revenue and how this could affect future performance.

Explore 4 other fair value estimates on Formula One Group - why the stock might be worth as much as 21% more than the current price!

Build Your Own Formula One Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Formula One Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Formula One Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Formula One Group's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWON.K

Formula One Group

Engages in the motorsports business in the United States and the United Kingdom.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives