- United States

- /

- Entertainment

- /

- NasdaqGS:FWON.K

Formula One (FWON.K) Valuation After Fresh Buy Ratings, Apple Media Buzz and Liberty Live Split-Off

Reviewed by Simply Wall St

Formula One Group (FWON.K) has been back in focus after a cluster of upbeat analyst calls, fresh buy ratings, and higher outlooks that lean on growing sponsorship demand and potential Apple interest in F1 media rights.

See our latest analysis for Formula One Group.

Those bullish calls have helped the stock regain some traction, with the share price at $96.89 and a modest positive year to date share price return. A robust five year total shareholder return of 140.61 percent shows that long term momentum remains firmly intact even after recent wobbling.

If this kind of media and sports exposure has your attention, it could be a good moment to explore fast growing stocks with high insider ownership as you look for the next potential standout.

With analysts lifting targets roughly 20 percent above today’s price and earnings still growing double digits, investors face a dilemma: is Formula One Group quietly undervalued, or is the market already racing ahead and pricing in years of future growth?

Most Popular Narrative: 17.9% Undervalued

With Formula One Group last closing at $96.89 against a narrative fair value near $118, the current price implies investors are not fully crediting its long range earnings potential.

Ongoing digital transformation evidenced by F1 TV's strong international subscriber growth, premium tier uptake, and a vibrant digital or social content ecosystem enables Formula One to directly monetize its expanding young global audience while improving net margins and earnings stability through higher margin direct to consumer subscription streams.

Curious how a traditional motorsport earns a premium style valuation? The narrative leans on bold revenue compounding, margin expansion, and a punchy future earnings multiple. Want to see the exact assumptions driving that gap between today’s price and its projected worth? Read on and test whether this growth script matches your expectations.

Result: Fair Value of $118.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained cost inflation and heavier leverage from the MotoGP deal could quickly erode margins and undermine the premium valuation that investors are assuming.

Find out about the key risks to this Formula One Group narrative.

Another View: Rich Multiples Raise the Bar

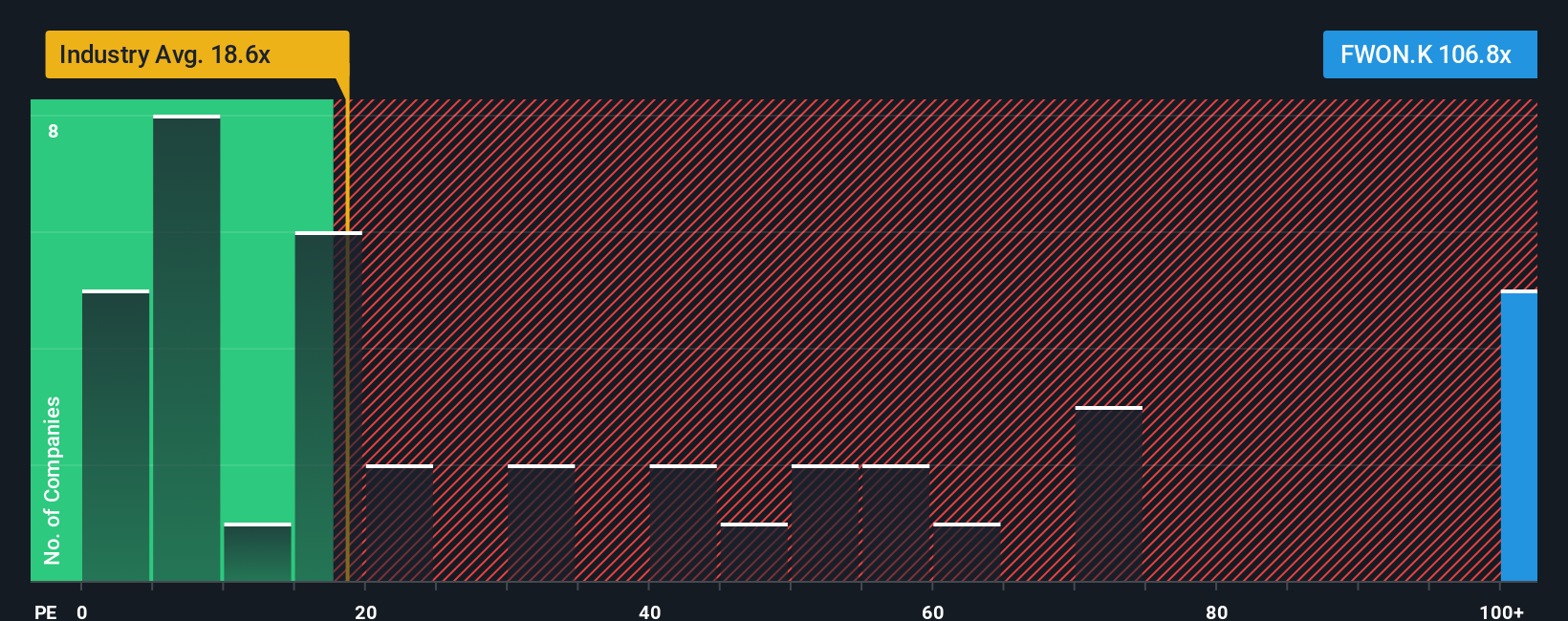

While the narrative fair value suggests upside, the market is already paying a steep price. Formula One Group trades on a P/E of about 109 times, compared with 20 times for the US entertainment sector, 57.7 times for peers, and a fair ratio near 25.7. That kind of gap leaves little room for earnings misfires. The question for investors is which story to put more weight on: the growth runway or the valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Formula One Group Narrative

If this outlook does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom thesis in minutes: Do it your way

A great starting point for your Formula One Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market moves on without you, use the Simply Wall St Screener now to uncover fresh opportunities tailored to how you actually like to invest.

- Capture potential upside early by scanning these 3642 penny stocks with strong financials that balance speculative growth with solid underlying fundamentals.

- Position yourself for potential productivity trends by targeting these 26 AI penny stocks at the forefront of real world artificial intelligence adoption.

- Explore risk and reward setups by focusing on these 912 undervalued stocks based on cash flows where cash flow strength may not yet be fully reflected in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWON.K

Formula One Group

Engages in the motorsports business in the United States and the United Kingdom.

Moderate growth potential with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)