- United States

- /

- Media

- /

- NasdaqGS:FOXA

Fox FOXA Margin Compression Challenges Long Term Bullish Earnings Narrative After Q2 2026 Results

How Fox (FOXA) Has Been Performing Heading Into Q2 2026

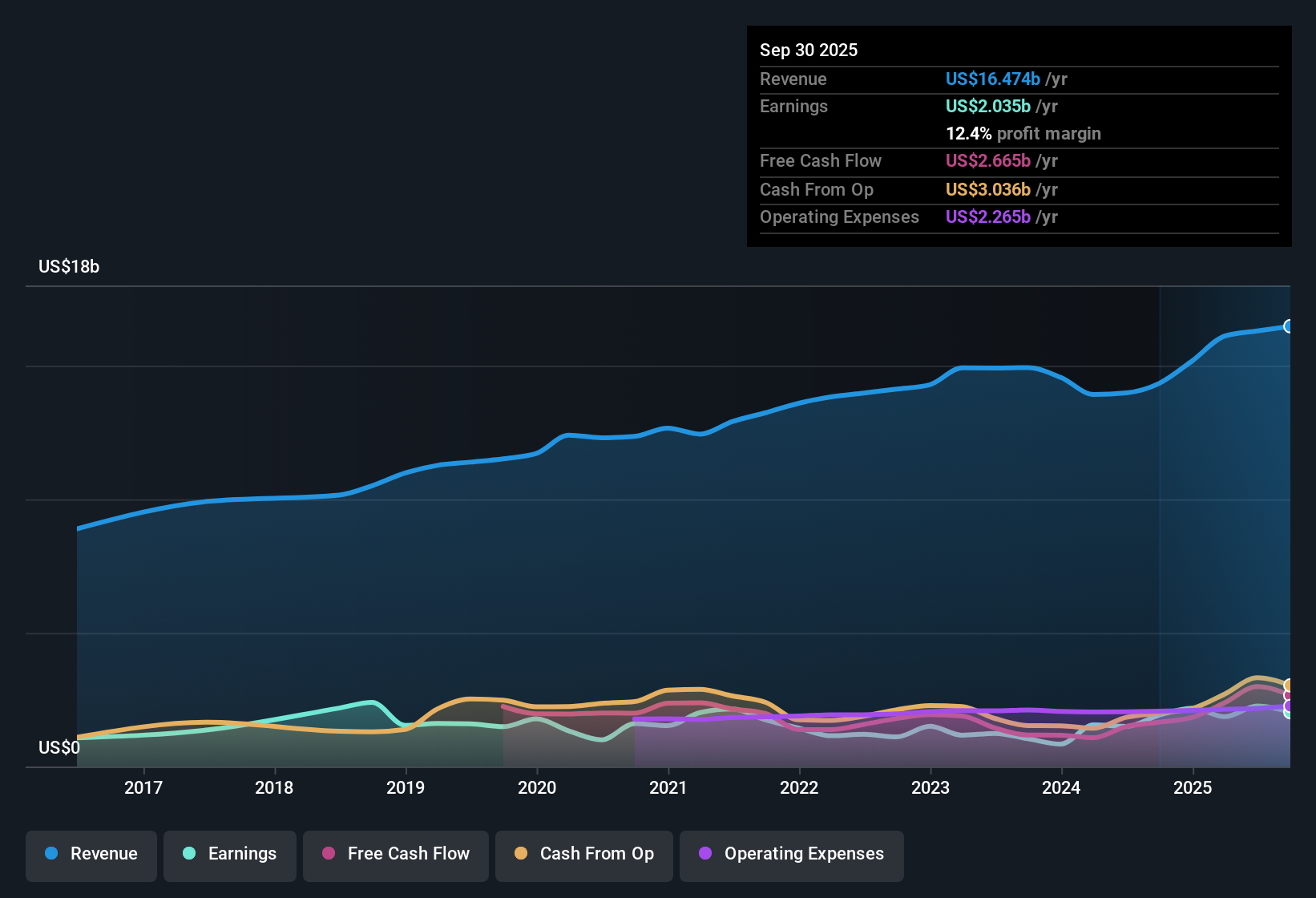

Fox (FOXA) just posted Q2 2026 revenue of US$5.2b with basic EPS of US$0.53, putting fresh numbers on the board for investors watching its media earnings story. The company has seen quarterly revenue move from US$5.1b in Q2 2025 to US$5.2b this quarter, while EPS shifted from US$0.82 to US$0.53 over the same period. On a trailing twelve month basis, EPS sits at US$4.24 on revenue of US$16.6b. With net profit margin over the last year at 11.4% compared to 14.4% previously, the latest results keep the focus squarely on how efficiently Fox is turning its top line into profit.

See our full analysis for Fox.With the latest quarter in hand, the next step is to set these numbers against the most common stories about Fox to see which narratives match the data and which ones the results start to challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM EPS Slips From US$4.97 To US$4.24

- On a trailing twelve month basis, basic EPS is US$4.24, compared with US$4.97 at Q4 2025 and US$4.51 at Q1 2026, even though trailing revenue has moved from US$16.3b to US$16.6b across those same snapshots.

- What stands out for a bullish view that focuses on multi year earnings growth around 4.9% and forecast growth of about 5.3% per year is that the latest trailing EPS of US$4.24 and trailing net income of US$1.9b sit below the earlier US$2.3b level, which means:

- Supporters can still point to positive five year growth and mid single digit forecasts, but the recent EPS drift and lower trailing profit show that the growth path has not been perfectly smooth.

- At the same time, the company is still earning well over US$1b in profit on about US$16.6b of revenue, so the bullish story about an established earnings base with room for further compounding is grounded in real cash generating capacity rather than just theory.

Investors who want to see how this earnings trend fits into a broader long term story can step back and read the full narrative around growth, risks, and valuation in one place with 📊 Read the full Fox Consensus Narrative.

Margins Ease To 11.4% On Lower Trailing Profit

- Net profit margin over the last year is 11.4% compared to 14.4% previously, with trailing net income at US$1.9b on US$16.6b of revenue versus the earlier US$2.3b on US$16.3b, so profitability on each dollar of sales has been thinner than before.

- Critics highlight margin pressure as a key bearish angle, and the data backs that concern because:

- The move from a 14.4% margin to 11.4% translates to several hundred million dollars less profit on a revenue base that is a little higher, so the margin effect matters more than the top line change.

- With earnings growth over the past year described as negative and trailing EPS dropping from US$4.97 to US$4.24, bears can reasonably argue that recent profitability trends do not yet match the longer term growth story.

P/E Of 14.8x And DCF Gap Send Mixed Valuation Signal

- At a share price of US$65.92, Fox trades on a trailing P/E of 14.8x, above the 11x peer average and in line with the US media industry, while also sitting about 13% below a DCF fair value of roughly US$75.75.

- What is interesting for a bearish narrative that focuses on valuation and balance sheet risk is how the numbers pull in different directions:

- On the cautionary side, a 14.8x P/E that is higher than peers and a high level of debt suggest investors are paying more than similar companies while also accepting higher financial leverage.

- Set against that, the indicated 13% gap between the current share price and the DCF fair value means valuation models still see room between price and estimated worth, which softens the case that the stock is outright expensive based only on the P/E comparison.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Fox's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Fox is still generating solid revenue, but softer margins, lower trailing EPS and a relatively high P/E all point to pressure on value and profitability.

If those pressures make you want a stronger margin of safety, check out our 55 high quality undervalued stocks to quickly zero in on companies where the price tag looks more forgiving.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion