- United States

- /

- Media

- /

- NasdaqCM:FLNT

Here's Why Fluent, Inc.'s (NASDAQ:FLNT) CEO Might See A Pay Rise Soon

Shareholders will be pleased by the robust performance of Fluent, Inc. (NASDAQ:FLNT) recently and this will be kept in mind in the upcoming AGM on 02 June 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

See our latest analysis for Fluent

Comparing Fluent, Inc.'s CEO Compensation With the industry

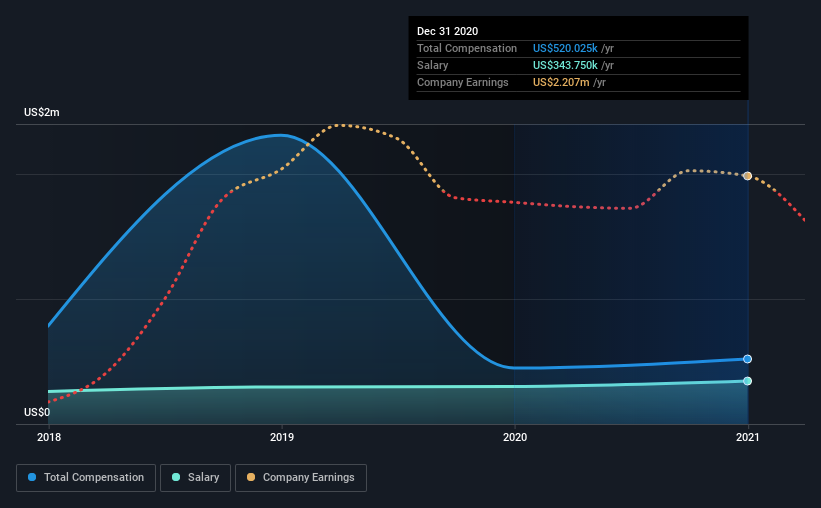

At the time of writing, our data shows that Fluent, Inc. has a market capitalization of US$230m, and reported total annual CEO compensation of US$520k for the year to December 2020. That's a notable increase of 16% on last year. In particular, the salary of US$343.8k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$1.2m. That is to say, Ryan Schulke is paid under the industry median. What's more, Ryan Schulke holds US$22m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$344k | US$300k | 66% |

| Other | US$176k | US$148k | 34% |

| Total Compensation | US$520k | US$448k | 100% |

Speaking on an industry level, nearly 22% of total compensation represents salary, while the remainder of 78% is other remuneration. Fluent is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Fluent, Inc.'s Growth Numbers

Fluent, Inc. has seen its earnings per share (EPS) increase by 75% a year over the past three years. It achieved revenue growth of 2.7% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Fluent, Inc. Been A Good Investment?

Fluent, Inc. has generated a total shareholder return of 5.0% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Fluent that you should be aware of before investing.

Switching gears from Fluent, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Fluent or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:FLNT

Fluent

Provides digital marketing services in the United States and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026