- United States

- /

- Media

- /

- NasdaqCM:FLNT

Fluent (NASDAQ:FLNT) Is Doing The Right Things To Multiply Its Share Price

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So on that note, Fluent (NASDAQ:FLNT) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Fluent, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.015 = US$1.5m ÷ (US$157m - US$54m) (Based on the trailing twelve months to March 2023).

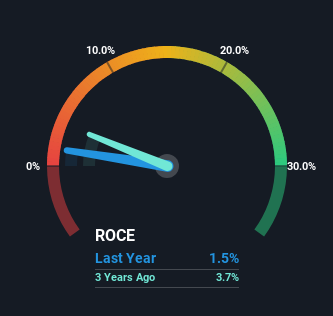

Therefore, Fluent has an ROCE of 1.5%. In absolute terms, that's a low return and it also under-performs the Media industry average of 9.4%.

See our latest analysis for Fluent

Above you can see how the current ROCE for Fluent compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

SWOT Analysis for Fluent

- Debt is well covered by cash flow.

- Interest payments on debt are not well covered.

- Forecast to reduce losses next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio compared to estimated Fair P/S ratio.

- No apparent threats visible for FLNT.

What The Trend Of ROCE Can Tell Us

It's great to see that Fluent has started to generate some pre-tax earnings from prior investments. Historically the company was generating losses but as we can see from the latest figures referenced above, they're now earning 1.5% on their capital employed. In regards to capital employed, Fluent is using 59% less capital than it was five years ago, which on the surface, can indicate that the business has become more efficient at generating these returns. Fluent could be selling under-performing assets since the ROCE is improving.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. Effectively this means that suppliers or short-term creditors are now funding 35% of the business, which is more than it was five years ago. It's worth keeping an eye on this because as the percentage of current liabilities to total assets increases, some aspects of risk also increase.

What We Can Learn From Fluent's ROCE

In a nutshell, we're pleased to see that Fluent has been able to generate higher returns from less capital. Although the company may be facing some issues elsewhere since the stock has plunged 75% in the last five years. Regardless, we think the underlying fundamentals warrant this stock for further investigation.

One more thing to note, we've identified 1 warning sign with Fluent and understanding it should be part of your investment process.

While Fluent isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FLNT

Fluent

Provides digital marketing services in the United States and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026