- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms, Inc. (NASDAQ:FB) - Pure Value, but Has a Lot of Work in Order to Retain Users

Meta Platforms, Inc. (NASDAQ:FB), lost about 50% of its market cap highs from September 2021. Investors are wondering if the stock has some solid ground to rebound, or if the business will severely decline in the future. Currently, the market is pricing Meta like a house of cards, and we will attempt to assess if this reflects the intrinsic value of the company.

Using the most recent financial data, we'll take a look at whether the stock is fairly priced by taking the expected future cash flows and discounting them to their present value. One way to achieve this is by employing the Discounted Cash Flow (DCF) model.

Companies can be valued in a lot of ways, so we would point out that a DCF is not perfect for every situation. Anyone interested in learning a bit more about intrinsic value should have a read of the Simply Wall St analysis model.

Meta Valuation Model

First, we need to build the model by estimating the value of future cash flows. We use analyst forecasts and our own calculation to build the cash flows.

Generally we assume that a dollar today is more valuable than a dollar in the future, and so the sum of these future cash flows is then discounted to today's value:

10-year free cash flow (FCF) estimate

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Levered FCF | $26.9b | $36.1b | $45.9b | $55.4b | $72.3b | $84.1b | $94.2b | $102.6b | $109.6b | $115.5b |

| Growth Rate Estimate Source | Analyst x20 | Analyst x20 | Analyst x9 | Analyst x4 | Analyst x3 | Est @ 16.32% | Est @ 12% | Est @ 8.98% | Est @ 6.86% | Est @ 5.38% |

| Present Value ($, Millions) Discounted @ 6.5% | $25.3b | $31.8b | $38b | $43b | $52.6b | $57.5 | $60.4b | $61.8b | $62.0b | $61.3b |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$494b

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage.

Terminal Value (TV)= FCF2031 × (1 + g) ÷ (r – g) = US$116b× (1 + 1.9%) ÷ (6.5%– 1.9%) = US$2.5t

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$2.5t÷ ( 1 + 6.5%)10= US$1.4t

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is US$1.8t.

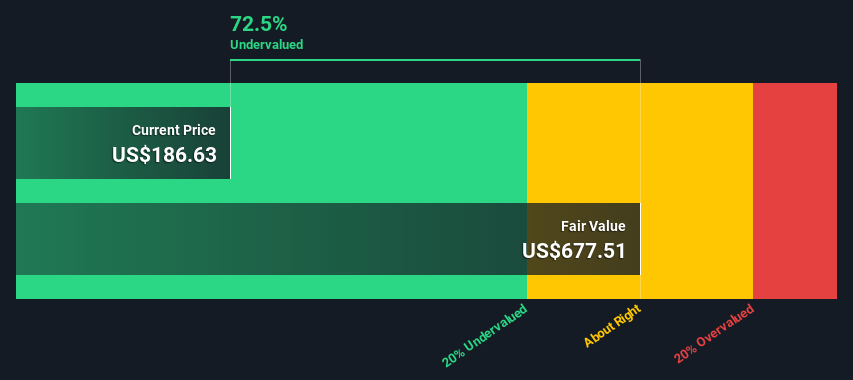

Compared to the current share price of US$187, the company appears potentially underpriced at a discount of over 50%.

This valuation likely reflects the bullish sentiment which some analysts still hold, and investors should consider adjusting down in order to reflect current events.

Alternatively, even if we believe the cash flows will not grow more than inflation, we can use the calculation above and apply a steady state valuation.

In this case, we calculate the intrinsic value as: FCF × (1 + g) ÷ (r – g) = $39.1 * 1.019 / (0.065 - 0.019) = 866.15b, or US$318 per share.

On a fundamental level, we can see that both models show that the company is undervalued. So it might be good to explore where we can expect Facebook to improve.

View our latest analysis for Meta Platforms

Meta's Challenges

Of course, things can go wrong, and the estimates must reflect what the company can realistically produce. While the stock price is based on future cash flows, these in turn are based on the quality of the product.

Until recently, Facebook - enjoyed a dominant position in the world of social media, however, more and more competitors and apps are gaining user attention, which pressures the company's future cash flows. We will attempt to set the table and evaluate the product weaknesses that Meta may decide to address and improve.

First, there need to be a lot of users there - which Facebook clearly has, with 1.929b daily active users.

Then, advertisers need to be able to easily target relevant audiences in order not to waste ad budgets - this is becoming harder because of the iOS changes. Facebook's response to this can be building better algorithms or making it viable for users to self distinguish themselves and their preferences.

Next, they need to be engaged. Scrolling with interest is quite different from scrolling out of boredom. Users must have a pleasant and not addictive experience on the platforms. Engagement has synergistic properties, the more people on the platform that are posting interesting things, the more other users will want to be included and engage. The negative scenario in this case is that people do not engage, and the wall is filled with page and advertising content - which further diminishes the quality of the platform. More is not necessarily better, and FB might experiment with limits for daily ads and page content, while giving users an incentive to stay on the platform.

Quality of the platform - While hard to measure, users need to like being on Facebook. Many of the features that Facebook introduced need a lot of work in order to become attractive again. Think of groups, games, the mobile app, watch, events, etc.

We can clearly see that Meta can do a lot of development within the platform, and not just push new concepts like the metaverse. Unfortunately, we cannot see the enthusiasm within the company and the amount of self-imposed obstacles that keep productivity down.

Conclusion

Meta's cash flows are likely undervalued, even if we assume that organic growth stops today.

The company does have some qualitative risk factors, and needs to also focus on improving core services in order to keep their dominant position. The metaverse may be a great concept, but the company needs to assure investors that their current products are wanted by users.

Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock just search here. For this article, we use Facebook and Meta interchangeably.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026