- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Analyzing Meta's (NASDAQ:FB) Projects - Aiming for a Revitalization of Growth, but Investors Should be Aware of the Risks

After releasing the latest earnings, Meta Platforms, Inc. (NASDAQ:FB) recovered some ground, with shares gaining 9.4% to US$206. The company is now worth US$475b and investors wonder if the price reflects the value of the company. In this article, we will review the company's future projects, and go over the points of concern that may be holding back investors.

Meta Platforms reported US$28b in revenue, roughly in line with analyst forecasts, although statutory earnings per share (EPS) of US$2.72 beat expectations, being 6.9% higher than what the analysts expected.

Highlights:

- Revenue: US$27.9b (up 6.6% from 1Q 2021).

- Net income: US$7.47b (down 21% from 1Q 2021).

- Profit margin: 27% (down from 36% in 1Q 2021). Driven by higher expenses.

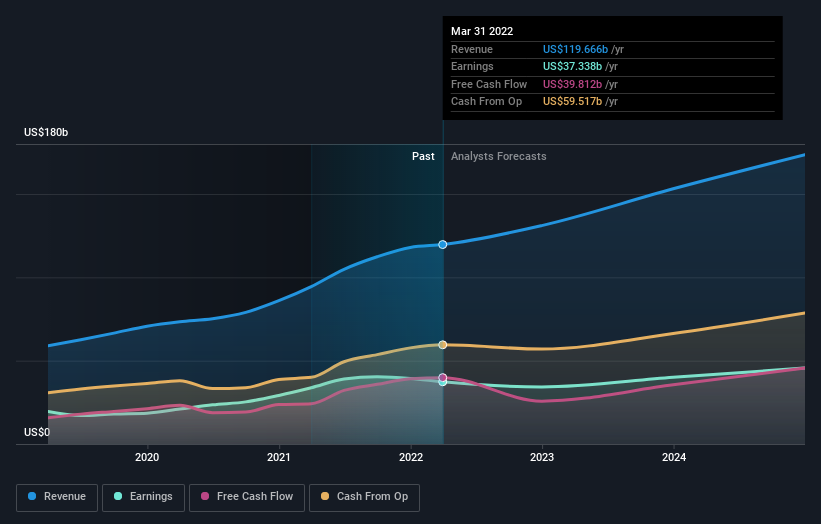

In order to get a clearer picture of the expected future performance, we aggregated the financials along with the expected future forecasts from the 50 analysts covering Meta. Here is where analysts expect FB to be in three years:

Check out our latest analysis for Meta Platforms

Taking into account the latest results, the current consensus from Meta Platforms' 50 analysts is for revenues of US$131.0b in 2022, which would reflect a meaningful 9.5% increase on sales over the past 12 months. Statutory earnings per share are expected to drop 11% to US$12.20 in the same period.

The analysts reconfirmed their price target of US$307, showing that the business is executing well and in line with expectations. Fixating on a single price target may not be the best, and investors are better off looking at the range of estimates.

The most bullish analyst targets a US$466 price and the most bearish a US$195 per share. Note that the wide gap in analyst price targets implies that there is a lot of growth potential as well as a lot of ways things can go wrong.

Quantitative estimates are good, and we will pair these with what management expects to be the basis of Meta's future growth.

Earnings Call Review

Meta held their earnings call this week, and here is our analysis on what management sees the company doing in the future.

Metaverse

FB is building the Metaverse platform, along with a new high-end headset (Cambria). The company is intent on creating both the hardware and software that will replace part of the current PC experience for entertainment, work and gaming.

Meta has already put together teams that are working on products and features that should be available 2-3 years in the future, and management is emphasizing that they are committed to this long-term project that is expected to yield in the next decade.

Reels

In the near-term, Meta sees opportunity in leveraging short-form videos known as Reels. They estimate that 20%+ of the time spent on Instagram is spent on Reels, which signals that users enjoy the feature, and the company is developing approaches to monetize it. The company estimates that Reels will develop similarly as "Stories", which required an adjustment period for users, but was ultimately very successful in driving ads and engagement.

Content Suggestions

Meta is also reworking the suggestion and content algorithms. They are investing in AI and machine learning to improve infrastructure - The way management presents their line of thinking is that in the past, there were a few thousand pieces of content within a circle being ranked in the most interesting order. Now, there are millions of pieces of daily content, and Meta is devising an algorithm that would show global engaging content based on people's interests.

Finally, we must incorporate what can go wrong in our analysis and estimate the risk factors for Meta. When thinking about management's vision, it is worth taking some time to estimate how much of it is realistic and what (if any) are the possible distractions being put forth by management

Risk Factors

Growth Pressures

E-commerce has experienced a slump in growth after the pandemic boost, and advertisers are spending less on marketing. This will affect Meta's growth rate, and is said to be factored in the current outlook - Meaning that part of the stock price decline is justified, and the company will have to make up in the future.

Short-form Video Ads

We noted the expected development of "Reels" as the new short video format which everyone is using and was popularized by TikTok. One advantage which TikTok has over Meta, is that they feel much less constrained by copyright and content moderation, so their platform has more creative possibilities to flourish, while Instagram is still having difficulties making background music available in videos.

The short video format is also being utilized by peers such as YouTube, Reddit, etc. While Meta has an enormous platform, the anonymity available in peers allows people to create content without imposing much social costs offline. While Meta experiments with giving certain features an anonymous option, it is still an identity focused platform.

Currently, the short form videos are in very early stage in the monetization cycle, which means that the platform is optimizing ways in which advertisers can produce successful campaigns. On the other end, advertisers have to tailor their creative to the new format and learn how to use it efficiently. This will take some time and may eat into some of the proven advertising approaches.

Recommendations System

Meta announced changes in their content recommendation algorithm by moving away from content from the circle of likes and friends, to suggestions from global trending content in order to drive engagement.

While this would definitely increase engagement, a concern is that the content will be repetitive, low quality and catered to emotional hooks that draw users to the platform without providing any substantive value - In financial terms, this content suggestion approach is the equivalent to maximizing current profits at the expense of long term cash flows.

Higher perceived engagement on content may lead users to think that the platform is revitalized, while at the same time less of their connections are posting relevant content and results in users feeling more disconnected. There is an argument to be made that this approach worked on Linkedin, however users on that platform are incentivized to interact with posts which are meant to increase their social standing - Facebook may have much less signaling power than needed in order to make this approach work.

Creator Economy

Meta emphasizes that it will make it possible for creators to earn an income from their content. However, this does not hold on its own, as creators (especially on Instagram), need to partner with agencies or push their own products in order to successfully earn an income. The platform has not been able to provide creators with a channel to monetize quality content (like YouTube), and this may contribute to the diminishing quality of what is seen across the family of apps today.

Management emphasizes a stronger creator economy in the metaverse platform, however that is early in the development cycle, and investors may want to focus on the current quality of content.

CapEx Spending

The Metaverse is FB's largest project, with more than US$5 billion spent on capital expenditures in Q1, and an increase in the total employee headcount to 77k.

While companies need to reinvest and develop large projects in order to maintain growth, it seems that this project was born out of a need to deflect from issues with the platform, as well as pressures on the company's financial performance.

The decision seems to have stemmed directly from the CEO's vision, which can be both a strength and a weakness - The absolute executive power that Meta's CEO holds can help with fast-tracking projects like the Metaverse, however no one has nearly enough voting power to challenge such a decision or even to ask for reasonable milestones or KPI's with which the feasibility of the investment can be measured.

It is also apparent that the earnings from safe projects like the current family of apps will subsidize most of the development for the metaverse. Financially, this may mean that management is refusing to appropriately capitalize and instead of returning funds to investors, is using them to fund projects.

Investors bare the risk of Mr. Zuckerberg's vision, which is hard-coded into the majority of voting shares of the company.

Conclusion

Despite the longer discussion of risk factors, Meta has large growth capacity and potential to increase the returns for investors. The company is utilizing its platform properly by experimenting with different approaches in order to produce a better experience for advertisers and users.

The new projects, media focus, and imposed constraints by iOS, will force management to course correct more efficiently and iron-out mistakes in operations and direction.

Meta seems to be entering the next phase of its maturity as a company, and on route to creating a platform that is more custom tailored to different types of consumers, content creators and streamlined options for advertisers.

With that in mind, we wouldn't be too quick to come to a conclusion on Meta Platforms. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Meta Platforms analysts - going out to 2024, and you can see them free on our platform here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives