- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Facebook, Inc.'s (NASDAQ:FB) High ROE is Pushing Up their Value

Most readers would already be aware that Facebook's (NASDAQ:FB) stock increased significantly by 22% over the past three months, and might ask "How much further can it grow?"

Since the market usually pays for a company's long-term fundamentals, we decided to study Facebook's key performance indicators to see if they could be influencing the market. In this article, we decided to focus on Facebook's ROE.

Return on equity or ROE tells investors how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

The reason why ROE can be seen as a good measure of profit efficiency, is because Facebook carries very little long-term debt, meaning that equity is the main source of funding the business.

See our latest analysis for Facebook

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Facebook is:

25% = US$34b ÷ US$134b (Based on the trailing twelve months to March 2021).

The 'return' is the profit over the last twelve months. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.25.

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company's earnings growth potential.

Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Facebook's Earnings Growth And 25% ROE

To begin with, Facebook has a pretty high ROE which is interesting.

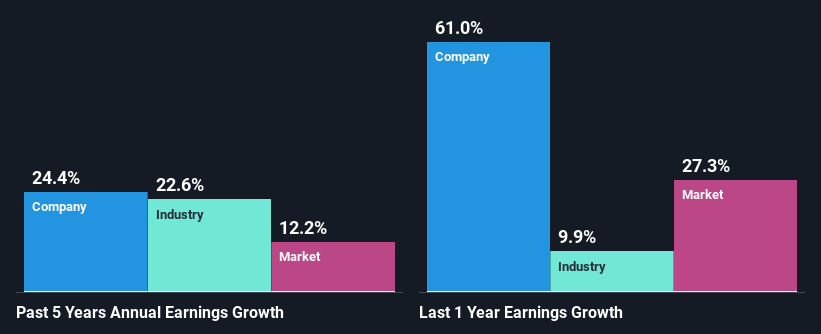

Secondly, even when compared to the industry average of 14%, the company's ROE is quite impressive. Under the circumstances, Facebook's considerable five-year net income growth of 24% was to be expected.

We then performed a comparison between Facebook's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 23% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. For Facebook, we can get a good picture of the expected earnings growth by looking at analyst forecasts and keeping an eye on earnings calls to see if the company is in-line with expectations.

With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Reinvesting Into The Business

Companies reinvest differently during their growth stages, initially focusing on reinvestment in their business model, and then on growth and expansion. The growth and expansion phase is characterized by marketing spending, and later by growth by acquisitions.

Facebook has made some notable acquisitions as a way to grow and reinvest into their business. These acquisitions positioned Facebook as a central figure in communications and social media, and their goal was to be present in multiple aspects of communications.

The more notable acquisitions from Facebook are WhatsApp and Instagram. The company has many much smaller acquisitions, but these two allowed Facebook to be present in the casual sphere of social networks.

The user base of the combined platforms: Facebook, Instagram and WhatsApp, exceeded 3.3 billion in Q1 2021. This means that even though facebook.com user growth is stagnating, the effective combination of the three platforms enabled the company to drive effective communications growth.

Summary

The efficient growth by acquisitions allowed Facebook to have a 25% ROE.

As the market share of Facebook is reaching its limits, the company may shift focus on profitability and maximizing value - which is important for investors.

In total, we are pretty happy with Facebook's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return.

Even though Facebook may seem risky as a mega cap stock that is pushing the limits of user growth, the potential for value maximization and increasing earnings is what is attractive for investors.

To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives