- United States

- /

- Entertainment

- /

- NasdaqGS:EA

Electronic Arts (NasdaqGS:EA) Unveils Critically Acclaimed Split Fiction Game For US$50

Reviewed by Simply Wall St

Electronic Arts (NasdaqGS:EA) witnessed a price increase of 13% over the last month, largely driven by the successful release of its new multiplayer game, Split Fiction. This collaboration with Hazelight Studios received perfect scores from notable media outlets, boosting investor confidence. While the broader market faced declines, with indices such as the Dow and S&P 500 experiencing one of their worst weeks in two years due to economic uncertainties and tariff concerns, EA's robust product launch helped offset these negative trends. The recent partnership with Flexion to widen mobile game distribution also positioned the company positively in a challenging environment. As major stock indices like the Nasdaq Composite dipped, EA's performance stood out, reflecting the strength of their strategic initiatives compared to market movements where other tech giants saw significant downturns. This resilience highlights EA's firm market presence amidst broader economic apprehensions.

Click here to discover the nuances of Electronic Arts with our detailed analytical report.

Over the last five years, Electronic Arts has generated a total return of 50.21%, combining share price appreciation and dividends. This performance reflects several key developments in product innovation and strategic shifts, positioning EA ahead of broader market challenges. EA has consistently expanded its gaming portfolio with successful launches like "FC 25" and "Dragon Age: The Veilguard" in 2024, both of which were well-received for their advanced features and engaging content.

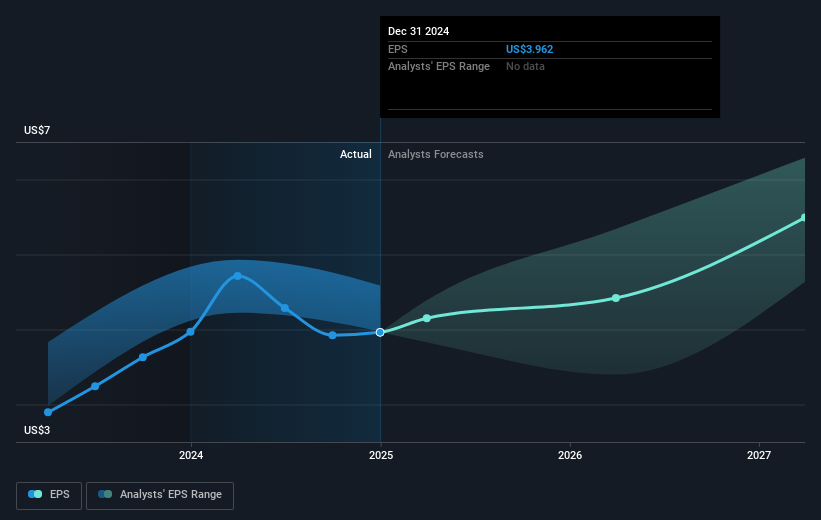

Significant corporate actions supported EA's market performance, including a substantial share buyback program initiated in May 2024. The company repurchased over 6.69 million shares, which may have added to shareholder value. Furthermore, EA's decision to maintain a consistent quarterly dividend of US$0.19 per share reinforced investor confidence. Despite a 2.8% decline in earnings over the past year, EA outperformed the US market and industry peers, underscoring its resilience in a competitive entertainment industry.

- See whether Electronic Arts' current market price aligns with its intrinsic value in our detailed report

- Assess the downside scenarios for Electronic Arts with our risk evaluation.

- Shareholder in Electronic Arts? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electronic Arts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EA

Electronic Arts

Develops, markets, publishes, and delivers games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide.

Excellent balance sheet and slightly overvalued.