- United States

- /

- Entertainment

- /

- NasdaqGS:DOYU

Little Excitement Around DouYu International Holdings Limited's (NASDAQ:DOYU) Revenues

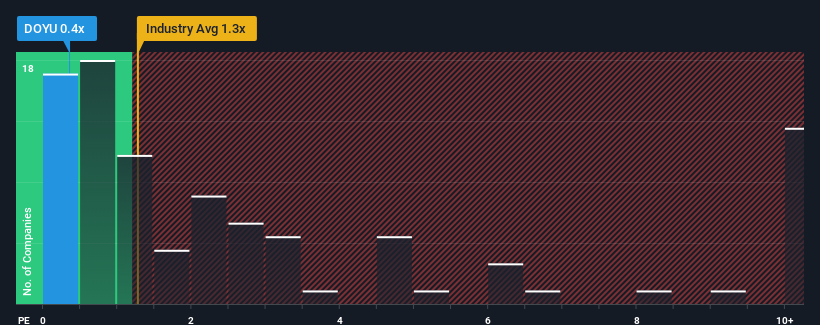

When close to half the companies operating in the Entertainment industry in the United States have price-to-sales ratios (or "P/S") above 1.3x, you may consider DouYu International Holdings Limited (NASDAQ:DOYU) as an attractive investment with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for DouYu International Holdings

How Has DouYu International Holdings Performed Recently?

DouYu International Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on DouYu International Holdings.Is There Any Revenue Growth Forecasted For DouYu International Holdings?

In order to justify its P/S ratio, DouYu International Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. As a result, revenue from three years ago have also fallen 16% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 19% over the next year. Meanwhile, the broader industry is forecast to expand by 11%, which paints a poor picture.

With this in consideration, we find it intriguing that DouYu International Holdings' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that DouYu International Holdings maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with DouYu International Holdings, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DOYU

DouYu International Holdings

Operates a platform on PC and mobile apps that provides interactive games and entertainment live streaming services in the People’s Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives